Answered step by step

Verified Expert Solution

Question

1 Approved Answer

expected savings per week with the new variable hiring policy? -75 Budgeting: comprehensive problem Judd's Reproductions makes reproductions of antique tables and chairs and sells

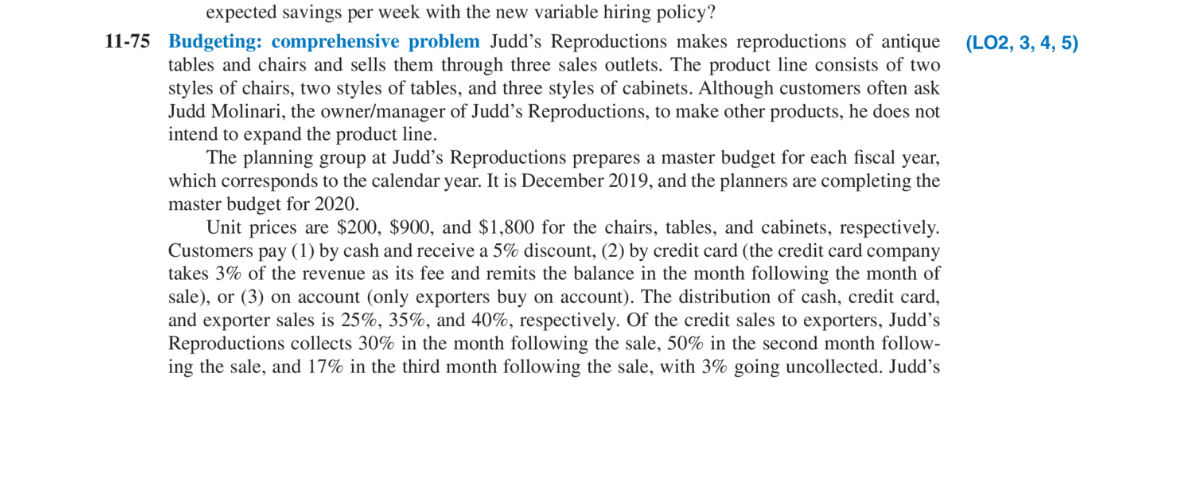

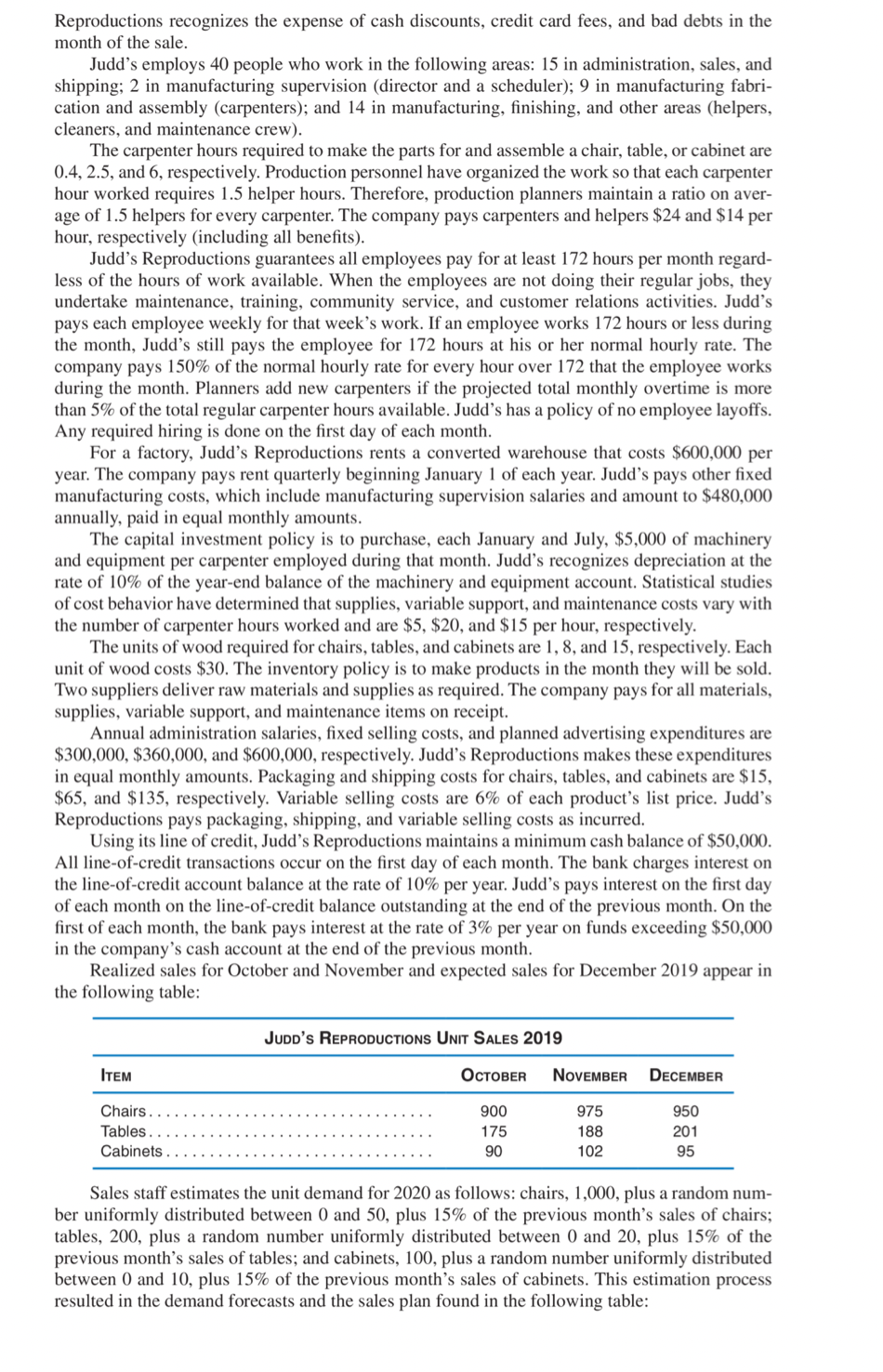

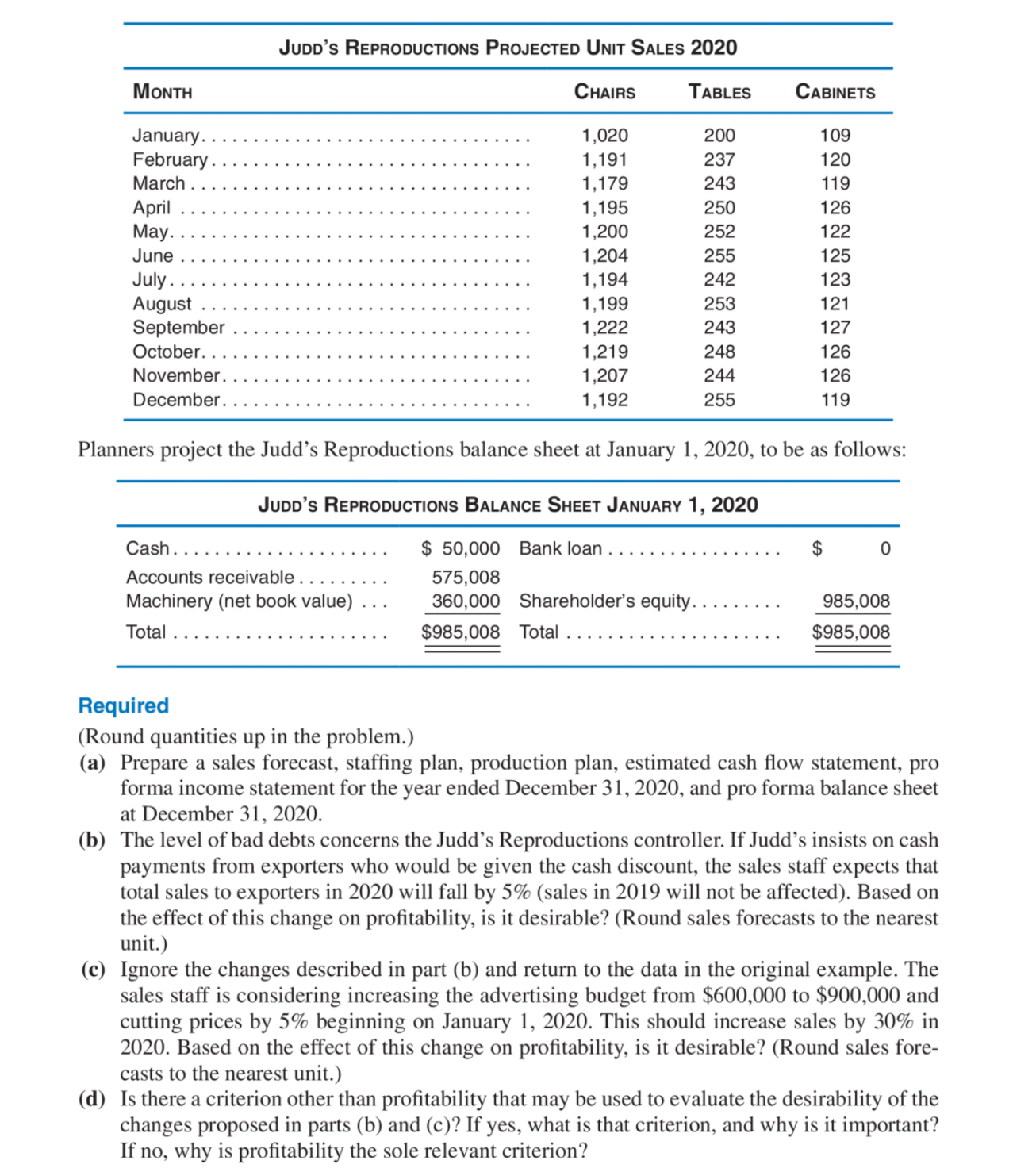

expected savings per week with the new variable hiring policy? -75 Budgeting: comprehensive problem Judd's Reproductions makes reproductions of antique tables and chairs and sells them through three sales outlets. The product line consists of two styles of chairs, two styles of tables, and three styles of cabinets. Although customers often ask Judd Molinari, the owner/manager of Judd's Reproductions, to make other products, he does not intend to expand the product line. The planning group at Judd's Reproductions prepares a master budget for each fiscal year, which corresponds to the calendar year. It is December 2019, and the planners are completing the master budget for 2020 . Unit prices are $200,$900, and $1,800 for the chairs, tables, and cabinets, respectively. Customers pay (1) by cash and receive a 5\% discount, (2) by credit card (the credit card company takes 3% of the revenue as its fee and remits the balance in the month following the month of sale), or (3) on account (only exporters buy on account). The distribution of cash, credit card, and exporter sales is 25%,35%, and 40%, respectively. Of the credit sales to exporters, Judd's Reproductions collects 30% in the month following the sale, 50% in the second month following the sale, and 17% in the third month following the sale, with 3% going uncollected. Judd's Reproductions recognizes the expense of cash discounts, credit card fees, and bad debts in the month of the sale. Judd's employs 40 people who work in the following areas: 15 in administration, sales, and shipping; 2 in manufacturing supervision (director and a scheduler); 9 in manufacturing fabrication and assembly (carpenters); and 14 in manufacturing, finishing, and other areas (helpers, cleaners, and maintenance crew). The carpenter hours required to make the parts for and assemble a chair, table, or cabinet are 0.4,2.5, and 6 , respectively. Production personnel have organized the work so that each carpenter hour worked requires 1.5 helper hours. Therefore, production planners maintain a ratio on average of 1.5 helpers for every carpenter. The company pays carpenters and helpers $24 and $14 per hour, respectively (including all benefits). Judd's Reproductions guarantees all employees pay for at least 172 hours per month regardless of the hours of work available. When the employees are not doing their regular jobs, they undertake maintenance, training, community service, and customer relations activities. Judd's pays each employee weekly for that week's work. If an employee works 172 hours or less during the month, Judd's still pays the employee for 172 hours at his or her normal hourly rate. The company pays 150% of the normal hourly rate for every hour over 172 that the employee works during the month. Planners add new carpenters if the projected total monthly overtime is more than 5% of the total regular carpenter hours available. Judd's has a policy of no employee layoffs. Any required hiring is done on the first day of each month. For a factory, Judd's Reproductions rents a converted warehouse that costs $600,000 per year. The company pays rent quarterly beginning January 1 of each year. Judd's pays other fixed manufacturing costs, which include manufacturing supervision salaries and amount to $480,000 annually, paid in equal monthly amounts. The capital investment policy is to purchase, each January and July, $5,000 of machinery and equipment per carpenter employed during that month. Judd's recognizes depreciation at the rate of 10% of the year-end balance of the machinery and equipment account. Statistical studies of cost behavior have determined that supplies, variable support, and maintenance costs vary with the number of carpenter hours worked and are $5,$20, and $15 per hour, respectively. The units of wood required for chairs, tables, and cabinets are 1,8, and 15, respectively. Each unit of wood costs $30. The inventory policy is to make products in the month they will be sold. Two suppliers deliver raw materials and supplies as required. The company pays for all materials, supplies, variable support, and maintenance items on receipt. Annual administration salaries, fixed selling costs, and planned advertising expenditures are $300,000,$360,000, and $600,000, respectively. Judd's Reproductions makes these expenditures in equal monthly amounts. Packaging and shipping costs for chairs, tables, and cabinets are $15, $65, and $135, respectively. Variable selling costs are 6% of each product's list price. Judd's Reproductions pays packaging, shipping, and variable selling costs as incurred. Using its line of credit, Judd's Reproductions maintains a minimum cash balance of $50,000. All line-of-credit transactions occur on the first day of each month. The bank charges interest on the line-of-credit account balance at the rate of 10% per year. Judd's pays interest on the first day of each month on the line-of-credit balance outstanding at the end of the previous month. On the first of each month, the bank pays interest at the rate of 3% per year on funds exceeding $50,000 in the company's cash account at the end of the previous month. Realized sales for October and November and expected sales for December 2019 appear in the following table: Sales staff estimates the unit demand for 2020 as follows: chairs, 1,000, plus a random number uniformly distributed between 0 and 50 , plus 15% of the previous month's sales of chairs; tables, 200, plus a random number uniformly distributed between 0 and 20 , plus 15% of the previous month's sales of tables; and cabinets, 100, plus a random number uniformly distributed between 0 and 10, plus 15% of the previous month's sales of cabinets. This estimation process resulted in the demand forecasts and the sales plan found in the following table: Planners project the Judd's Reproductions balance sheet at January 1, 2020, to be as follows: Required (Round quantities up in the problem.) (a) Prepare a sales forecast, staffing plan, production plan, estimated cash flow statement, pro forma income statement for the year ended December 31,2020, and pro forma balance sheet at December 31, 2020. (b) The level of bad debts concerns the Judd's Reproductions controller. If Judd's insists on cash payments from exporters who would be given the cash discount, the sales staff expects that total sales to exporters in 2020 will fall by 5% (sales in 2019 will not be affected). Based on the effect of this change on profitability, is it desirable? (Round sales forecasts to the nearest unit.) (c) Ignore the changes described in part (b) and return to the data in the original example. The sales staff is considering increasing the advertising budget from $600,000 to $900,000 and cutting prices by 5% beginning on January 1, 2020. This should increase sales by 30% in 2020. Based on the effect of this change on profitability, is it desirable? (Round sales forecasts to the nearest unit.) (d) Is there a criterion other than profitability that may be used to evaluate the desirability of the changes proposed in parts (b) and (c)? If yes, what is that criterion, and why is it important? If no, why is profitability the sole relevant criterion? expected savings per week with the new variable hiring policy? -75 Budgeting: comprehensive problem Judd's Reproductions makes reproductions of antique tables and chairs and sells them through three sales outlets. The product line consists of two styles of chairs, two styles of tables, and three styles of cabinets. Although customers often ask Judd Molinari, the owner/manager of Judd's Reproductions, to make other products, he does not intend to expand the product line. The planning group at Judd's Reproductions prepares a master budget for each fiscal year, which corresponds to the calendar year. It is December 2019, and the planners are completing the master budget for 2020 . Unit prices are $200,$900, and $1,800 for the chairs, tables, and cabinets, respectively. Customers pay (1) by cash and receive a 5\% discount, (2) by credit card (the credit card company takes 3% of the revenue as its fee and remits the balance in the month following the month of sale), or (3) on account (only exporters buy on account). The distribution of cash, credit card, and exporter sales is 25%,35%, and 40%, respectively. Of the credit sales to exporters, Judd's Reproductions collects 30% in the month following the sale, 50% in the second month following the sale, and 17% in the third month following the sale, with 3% going uncollected. Judd's Reproductions recognizes the expense of cash discounts, credit card fees, and bad debts in the month of the sale. Judd's employs 40 people who work in the following areas: 15 in administration, sales, and shipping; 2 in manufacturing supervision (director and a scheduler); 9 in manufacturing fabrication and assembly (carpenters); and 14 in manufacturing, finishing, and other areas (helpers, cleaners, and maintenance crew). The carpenter hours required to make the parts for and assemble a chair, table, or cabinet are 0.4,2.5, and 6 , respectively. Production personnel have organized the work so that each carpenter hour worked requires 1.5 helper hours. Therefore, production planners maintain a ratio on average of 1.5 helpers for every carpenter. The company pays carpenters and helpers $24 and $14 per hour, respectively (including all benefits). Judd's Reproductions guarantees all employees pay for at least 172 hours per month regardless of the hours of work available. When the employees are not doing their regular jobs, they undertake maintenance, training, community service, and customer relations activities. Judd's pays each employee weekly for that week's work. If an employee works 172 hours or less during the month, Judd's still pays the employee for 172 hours at his or her normal hourly rate. The company pays 150% of the normal hourly rate for every hour over 172 that the employee works during the month. Planners add new carpenters if the projected total monthly overtime is more than 5% of the total regular carpenter hours available. Judd's has a policy of no employee layoffs. Any required hiring is done on the first day of each month. For a factory, Judd's Reproductions rents a converted warehouse that costs $600,000 per year. The company pays rent quarterly beginning January 1 of each year. Judd's pays other fixed manufacturing costs, which include manufacturing supervision salaries and amount to $480,000 annually, paid in equal monthly amounts. The capital investment policy is to purchase, each January and July, $5,000 of machinery and equipment per carpenter employed during that month. Judd's recognizes depreciation at the rate of 10% of the year-end balance of the machinery and equipment account. Statistical studies of cost behavior have determined that supplies, variable support, and maintenance costs vary with the number of carpenter hours worked and are $5,$20, and $15 per hour, respectively. The units of wood required for chairs, tables, and cabinets are 1,8, and 15, respectively. Each unit of wood costs $30. The inventory policy is to make products in the month they will be sold. Two suppliers deliver raw materials and supplies as required. The company pays for all materials, supplies, variable support, and maintenance items on receipt. Annual administration salaries, fixed selling costs, and planned advertising expenditures are $300,000,$360,000, and $600,000, respectively. Judd's Reproductions makes these expenditures in equal monthly amounts. Packaging and shipping costs for chairs, tables, and cabinets are $15, $65, and $135, respectively. Variable selling costs are 6% of each product's list price. Judd's Reproductions pays packaging, shipping, and variable selling costs as incurred. Using its line of credit, Judd's Reproductions maintains a minimum cash balance of $50,000. All line-of-credit transactions occur on the first day of each month. The bank charges interest on the line-of-credit account balance at the rate of 10% per year. Judd's pays interest on the first day of each month on the line-of-credit balance outstanding at the end of the previous month. On the first of each month, the bank pays interest at the rate of 3% per year on funds exceeding $50,000 in the company's cash account at the end of the previous month. Realized sales for October and November and expected sales for December 2019 appear in the following table: Sales staff estimates the unit demand for 2020 as follows: chairs, 1,000, plus a random number uniformly distributed between 0 and 50 , plus 15% of the previous month's sales of chairs; tables, 200, plus a random number uniformly distributed between 0 and 20 , plus 15% of the previous month's sales of tables; and cabinets, 100, plus a random number uniformly distributed between 0 and 10, plus 15% of the previous month's sales of cabinets. This estimation process resulted in the demand forecasts and the sales plan found in the following table: Planners project the Judd's Reproductions balance sheet at January 1, 2020, to be as follows: Required (Round quantities up in the problem.) (a) Prepare a sales forecast, staffing plan, production plan, estimated cash flow statement, pro forma income statement for the year ended December 31,2020, and pro forma balance sheet at December 31, 2020. (b) The level of bad debts concerns the Judd's Reproductions controller. If Judd's insists on cash payments from exporters who would be given the cash discount, the sales staff expects that total sales to exporters in 2020 will fall by 5% (sales in 2019 will not be affected). Based on the effect of this change on profitability, is it desirable? (Round sales forecasts to the nearest unit.) (c) Ignore the changes described in part (b) and return to the data in the original example. The sales staff is considering increasing the advertising budget from $600,000 to $900,000 and cutting prices by 5% beginning on January 1, 2020. This should increase sales by 30% in 2020. Based on the effect of this change on profitability, is it desirable? (Round sales forecasts to the nearest unit.) (d) Is there a criterion other than profitability that may be used to evaluate the desirability of the changes proposed in parts (b) and (c)? If yes, what is that criterion, and why is it important? If no, why is profitability the sole relevant criterion

expected savings per week with the new variable hiring policy? -75 Budgeting: comprehensive problem Judd's Reproductions makes reproductions of antique tables and chairs and sells them through three sales outlets. The product line consists of two styles of chairs, two styles of tables, and three styles of cabinets. Although customers often ask Judd Molinari, the owner/manager of Judd's Reproductions, to make other products, he does not intend to expand the product line. The planning group at Judd's Reproductions prepares a master budget for each fiscal year, which corresponds to the calendar year. It is December 2019, and the planners are completing the master budget for 2020 . Unit prices are $200,$900, and $1,800 for the chairs, tables, and cabinets, respectively. Customers pay (1) by cash and receive a 5\% discount, (2) by credit card (the credit card company takes 3% of the revenue as its fee and remits the balance in the month following the month of sale), or (3) on account (only exporters buy on account). The distribution of cash, credit card, and exporter sales is 25%,35%, and 40%, respectively. Of the credit sales to exporters, Judd's Reproductions collects 30% in the month following the sale, 50% in the second month following the sale, and 17% in the third month following the sale, with 3% going uncollected. Judd's Reproductions recognizes the expense of cash discounts, credit card fees, and bad debts in the month of the sale. Judd's employs 40 people who work in the following areas: 15 in administration, sales, and shipping; 2 in manufacturing supervision (director and a scheduler); 9 in manufacturing fabrication and assembly (carpenters); and 14 in manufacturing, finishing, and other areas (helpers, cleaners, and maintenance crew). The carpenter hours required to make the parts for and assemble a chair, table, or cabinet are 0.4,2.5, and 6 , respectively. Production personnel have organized the work so that each carpenter hour worked requires 1.5 helper hours. Therefore, production planners maintain a ratio on average of 1.5 helpers for every carpenter. The company pays carpenters and helpers $24 and $14 per hour, respectively (including all benefits). Judd's Reproductions guarantees all employees pay for at least 172 hours per month regardless of the hours of work available. When the employees are not doing their regular jobs, they undertake maintenance, training, community service, and customer relations activities. Judd's pays each employee weekly for that week's work. If an employee works 172 hours or less during the month, Judd's still pays the employee for 172 hours at his or her normal hourly rate. The company pays 150% of the normal hourly rate for every hour over 172 that the employee works during the month. Planners add new carpenters if the projected total monthly overtime is more than 5% of the total regular carpenter hours available. Judd's has a policy of no employee layoffs. Any required hiring is done on the first day of each month. For a factory, Judd's Reproductions rents a converted warehouse that costs $600,000 per year. The company pays rent quarterly beginning January 1 of each year. Judd's pays other fixed manufacturing costs, which include manufacturing supervision salaries and amount to $480,000 annually, paid in equal monthly amounts. The capital investment policy is to purchase, each January and July, $5,000 of machinery and equipment per carpenter employed during that month. Judd's recognizes depreciation at the rate of 10% of the year-end balance of the machinery and equipment account. Statistical studies of cost behavior have determined that supplies, variable support, and maintenance costs vary with the number of carpenter hours worked and are $5,$20, and $15 per hour, respectively. The units of wood required for chairs, tables, and cabinets are 1,8, and 15, respectively. Each unit of wood costs $30. The inventory policy is to make products in the month they will be sold. Two suppliers deliver raw materials and supplies as required. The company pays for all materials, supplies, variable support, and maintenance items on receipt. Annual administration salaries, fixed selling costs, and planned advertising expenditures are $300,000,$360,000, and $600,000, respectively. Judd's Reproductions makes these expenditures in equal monthly amounts. Packaging and shipping costs for chairs, tables, and cabinets are $15, $65, and $135, respectively. Variable selling costs are 6% of each product's list price. Judd's Reproductions pays packaging, shipping, and variable selling costs as incurred. Using its line of credit, Judd's Reproductions maintains a minimum cash balance of $50,000. All line-of-credit transactions occur on the first day of each month. The bank charges interest on the line-of-credit account balance at the rate of 10% per year. Judd's pays interest on the first day of each month on the line-of-credit balance outstanding at the end of the previous month. On the first of each month, the bank pays interest at the rate of 3% per year on funds exceeding $50,000 in the company's cash account at the end of the previous month. Realized sales for October and November and expected sales for December 2019 appear in the following table: Sales staff estimates the unit demand for 2020 as follows: chairs, 1,000, plus a random number uniformly distributed between 0 and 50 , plus 15% of the previous month's sales of chairs; tables, 200, plus a random number uniformly distributed between 0 and 20 , plus 15% of the previous month's sales of tables; and cabinets, 100, plus a random number uniformly distributed between 0 and 10, plus 15% of the previous month's sales of cabinets. This estimation process resulted in the demand forecasts and the sales plan found in the following table: Planners project the Judd's Reproductions balance sheet at January 1, 2020, to be as follows: Required (Round quantities up in the problem.) (a) Prepare a sales forecast, staffing plan, production plan, estimated cash flow statement, pro forma income statement for the year ended December 31,2020, and pro forma balance sheet at December 31, 2020. (b) The level of bad debts concerns the Judd's Reproductions controller. If Judd's insists on cash payments from exporters who would be given the cash discount, the sales staff expects that total sales to exporters in 2020 will fall by 5% (sales in 2019 will not be affected). Based on the effect of this change on profitability, is it desirable? (Round sales forecasts to the nearest unit.) (c) Ignore the changes described in part (b) and return to the data in the original example. The sales staff is considering increasing the advertising budget from $600,000 to $900,000 and cutting prices by 5% beginning on January 1, 2020. This should increase sales by 30% in 2020. Based on the effect of this change on profitability, is it desirable? (Round sales forecasts to the nearest unit.) (d) Is there a criterion other than profitability that may be used to evaluate the desirability of the changes proposed in parts (b) and (c)? If yes, what is that criterion, and why is it important? If no, why is profitability the sole relevant criterion? expected savings per week with the new variable hiring policy? -75 Budgeting: comprehensive problem Judd's Reproductions makes reproductions of antique tables and chairs and sells them through three sales outlets. The product line consists of two styles of chairs, two styles of tables, and three styles of cabinets. Although customers often ask Judd Molinari, the owner/manager of Judd's Reproductions, to make other products, he does not intend to expand the product line. The planning group at Judd's Reproductions prepares a master budget for each fiscal year, which corresponds to the calendar year. It is December 2019, and the planners are completing the master budget for 2020 . Unit prices are $200,$900, and $1,800 for the chairs, tables, and cabinets, respectively. Customers pay (1) by cash and receive a 5\% discount, (2) by credit card (the credit card company takes 3% of the revenue as its fee and remits the balance in the month following the month of sale), or (3) on account (only exporters buy on account). The distribution of cash, credit card, and exporter sales is 25%,35%, and 40%, respectively. Of the credit sales to exporters, Judd's Reproductions collects 30% in the month following the sale, 50% in the second month following the sale, and 17% in the third month following the sale, with 3% going uncollected. Judd's Reproductions recognizes the expense of cash discounts, credit card fees, and bad debts in the month of the sale. Judd's employs 40 people who work in the following areas: 15 in administration, sales, and shipping; 2 in manufacturing supervision (director and a scheduler); 9 in manufacturing fabrication and assembly (carpenters); and 14 in manufacturing, finishing, and other areas (helpers, cleaners, and maintenance crew). The carpenter hours required to make the parts for and assemble a chair, table, or cabinet are 0.4,2.5, and 6 , respectively. Production personnel have organized the work so that each carpenter hour worked requires 1.5 helper hours. Therefore, production planners maintain a ratio on average of 1.5 helpers for every carpenter. The company pays carpenters and helpers $24 and $14 per hour, respectively (including all benefits). Judd's Reproductions guarantees all employees pay for at least 172 hours per month regardless of the hours of work available. When the employees are not doing their regular jobs, they undertake maintenance, training, community service, and customer relations activities. Judd's pays each employee weekly for that week's work. If an employee works 172 hours or less during the month, Judd's still pays the employee for 172 hours at his or her normal hourly rate. The company pays 150% of the normal hourly rate for every hour over 172 that the employee works during the month. Planners add new carpenters if the projected total monthly overtime is more than 5% of the total regular carpenter hours available. Judd's has a policy of no employee layoffs. Any required hiring is done on the first day of each month. For a factory, Judd's Reproductions rents a converted warehouse that costs $600,000 per year. The company pays rent quarterly beginning January 1 of each year. Judd's pays other fixed manufacturing costs, which include manufacturing supervision salaries and amount to $480,000 annually, paid in equal monthly amounts. The capital investment policy is to purchase, each January and July, $5,000 of machinery and equipment per carpenter employed during that month. Judd's recognizes depreciation at the rate of 10% of the year-end balance of the machinery and equipment account. Statistical studies of cost behavior have determined that supplies, variable support, and maintenance costs vary with the number of carpenter hours worked and are $5,$20, and $15 per hour, respectively. The units of wood required for chairs, tables, and cabinets are 1,8, and 15, respectively. Each unit of wood costs $30. The inventory policy is to make products in the month they will be sold. Two suppliers deliver raw materials and supplies as required. The company pays for all materials, supplies, variable support, and maintenance items on receipt. Annual administration salaries, fixed selling costs, and planned advertising expenditures are $300,000,$360,000, and $600,000, respectively. Judd's Reproductions makes these expenditures in equal monthly amounts. Packaging and shipping costs for chairs, tables, and cabinets are $15, $65, and $135, respectively. Variable selling costs are 6% of each product's list price. Judd's Reproductions pays packaging, shipping, and variable selling costs as incurred. Using its line of credit, Judd's Reproductions maintains a minimum cash balance of $50,000. All line-of-credit transactions occur on the first day of each month. The bank charges interest on the line-of-credit account balance at the rate of 10% per year. Judd's pays interest on the first day of each month on the line-of-credit balance outstanding at the end of the previous month. On the first of each month, the bank pays interest at the rate of 3% per year on funds exceeding $50,000 in the company's cash account at the end of the previous month. Realized sales for October and November and expected sales for December 2019 appear in the following table: Sales staff estimates the unit demand for 2020 as follows: chairs, 1,000, plus a random number uniformly distributed between 0 and 50 , plus 15% of the previous month's sales of chairs; tables, 200, plus a random number uniformly distributed between 0 and 20 , plus 15% of the previous month's sales of tables; and cabinets, 100, plus a random number uniformly distributed between 0 and 10, plus 15% of the previous month's sales of cabinets. This estimation process resulted in the demand forecasts and the sales plan found in the following table: Planners project the Judd's Reproductions balance sheet at January 1, 2020, to be as follows: Required (Round quantities up in the problem.) (a) Prepare a sales forecast, staffing plan, production plan, estimated cash flow statement, pro forma income statement for the year ended December 31,2020, and pro forma balance sheet at December 31, 2020. (b) The level of bad debts concerns the Judd's Reproductions controller. If Judd's insists on cash payments from exporters who would be given the cash discount, the sales staff expects that total sales to exporters in 2020 will fall by 5% (sales in 2019 will not be affected). Based on the effect of this change on profitability, is it desirable? (Round sales forecasts to the nearest unit.) (c) Ignore the changes described in part (b) and return to the data in the original example. The sales staff is considering increasing the advertising budget from $600,000 to $900,000 and cutting prices by 5% beginning on January 1, 2020. This should increase sales by 30% in 2020. Based on the effect of this change on profitability, is it desirable? (Round sales forecasts to the nearest unit.) (d) Is there a criterion other than profitability that may be used to evaluate the desirability of the changes proposed in parts (b) and (c)? If yes, what is that criterion, and why is it important? If no, why is profitability the sole relevant criterion Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started