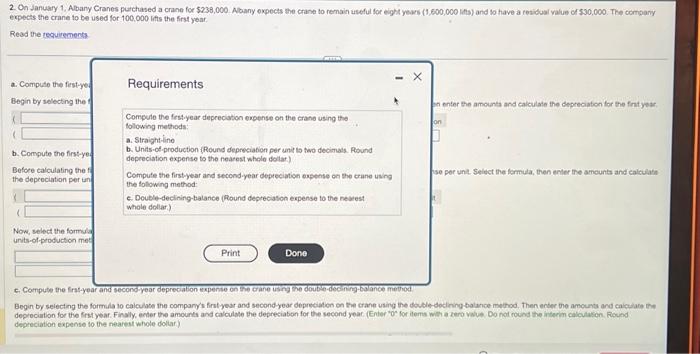

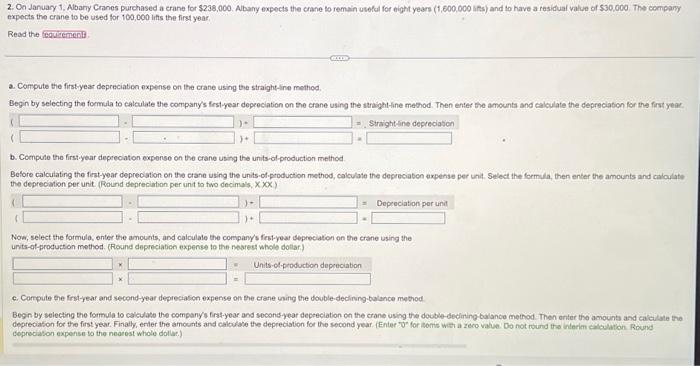

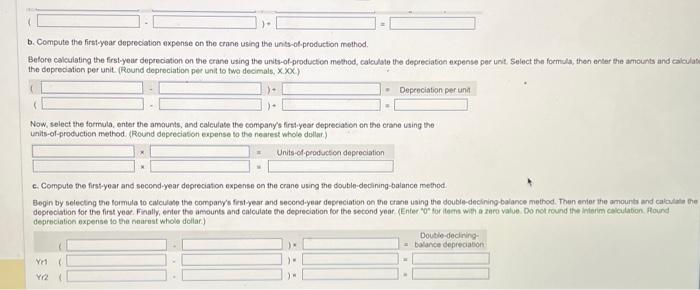

expects the crane to be used for 100,000 ifts the first yoar. Read the tequirements 2. On January 1, Abary Cranes purchased a crane for $238,000. Abany expects the crane to remain useful for eight years (1,600,000 ifs) and to have a residual value of $30,000. The company expects the crane to be used for 100,000 lifts the first year. Read the a. Compute the first-year depreciation expense on the crane using the straight-line method, Begin by selecting the formula to calculate the company's frstyear depececiation on Be crane using the straight-line method. Then enter the amounts and calculate the depreciation for the first year. f b. Compule the firstyear depreolation expense on the crane using the units-of-production method. Before calculating the fist-year depreciation on the crane using the units-of production method, colculate the depreciabon expense per unit. Select the formula, then enter the amounts and caloulate the deprecation per unit, (Round depreciation per unt ta tivo decimals, x ) Now, select the formula, enter the amounts, and calculate the companys frstyear sepreciation on the crane using the units-of-production method. (Round depreciation expense to the neares whole dotlar.) c. Corrpute the frst-year and second-year depreciation expense on the crane using the double-declining-balance method Begin by selecting the formula to calculate the companys frat-year and socond-year depeeciation on the crane using the double-decining-balance method. Then enter the amount and calcilate the cepreciaton expense to the nearest whole dollac.) b. Compute the first-year depreciation expense on the crane using the units-of-production method. Before calculating the first-year depreciation on the crane using the unis-of-producton method, calculate the depreciaton expense per unit, Select the formula, then enter the amounts and calculas the doprecation per unit. (Round depreciation per unit to two decmals, .0 ) Now, select the formula, enter the amounts, and calculate the company's firstyear depreciation on the crane using the units-of-production method. (Round depreciason eupense to the noarest whole dollar.) c. Compute the first-year and socond-year depreciaton expense on the crane using the double-declining-balance method. Begin by selecting the formula to caculate the comparys fisst-yesr and second-year depreciation on the crane using the double-decining-balance method. Then enter the amounts and catalata the depreciation expense to the nearsat whole dollar.)