Answered step by step

Verified Expert Solution

Question

1 Approved Answer

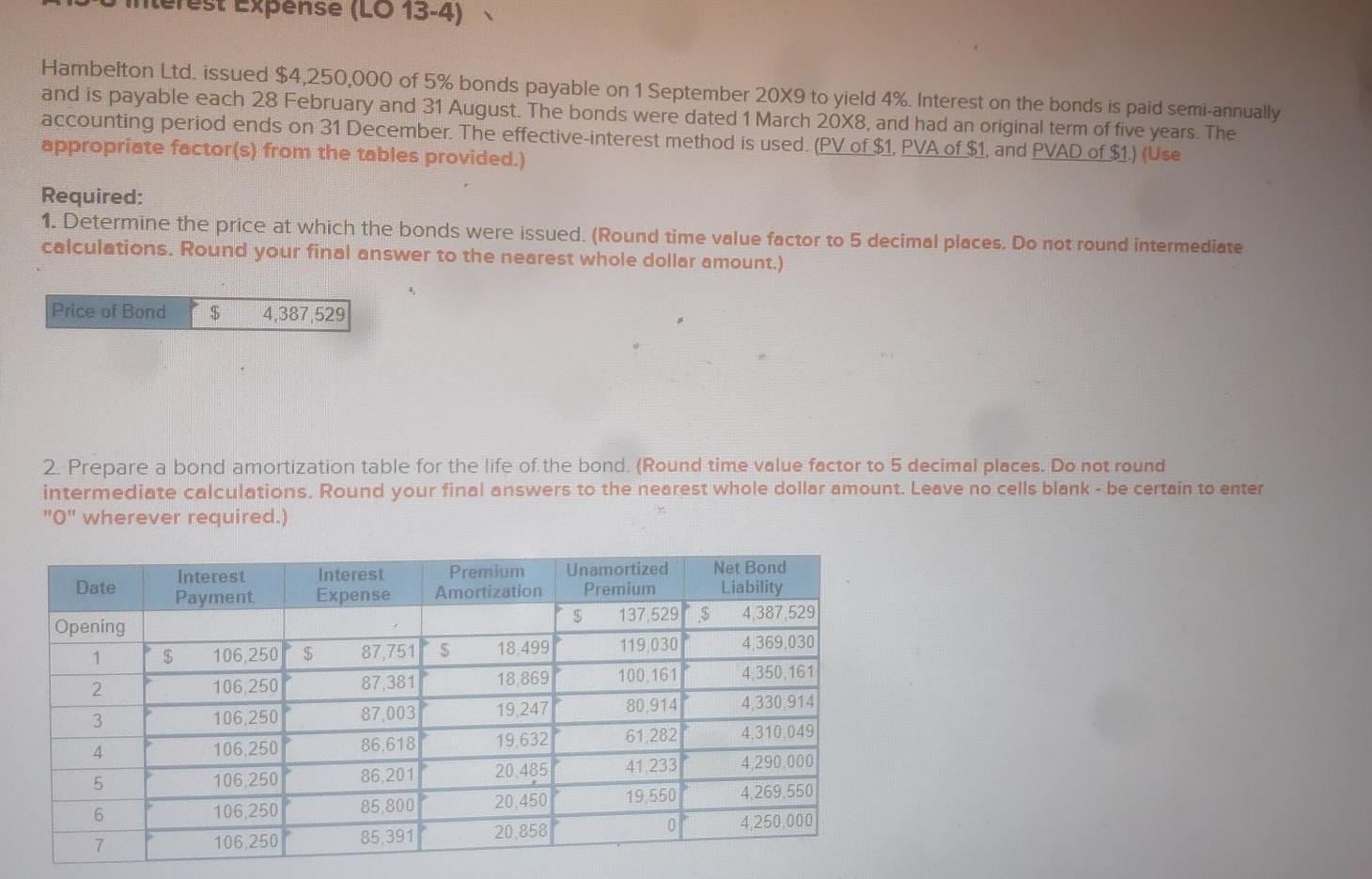

Expense (LO 13-4) Hambelton Ltd. issued $4,250,000 of 5% bonds payable on 1 September 20X9 to yield 4%. Interest on the bonds is paid semi-annually

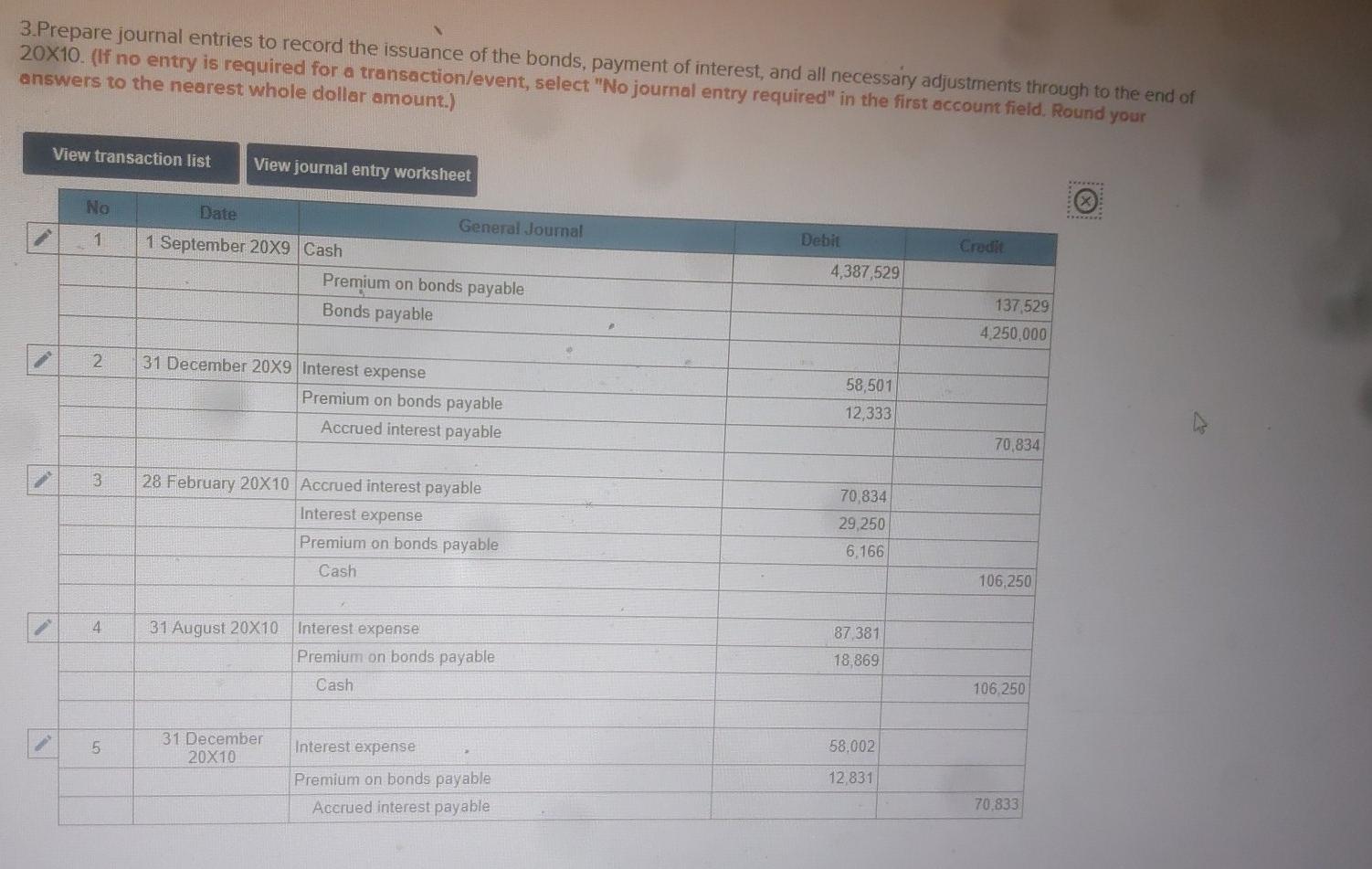

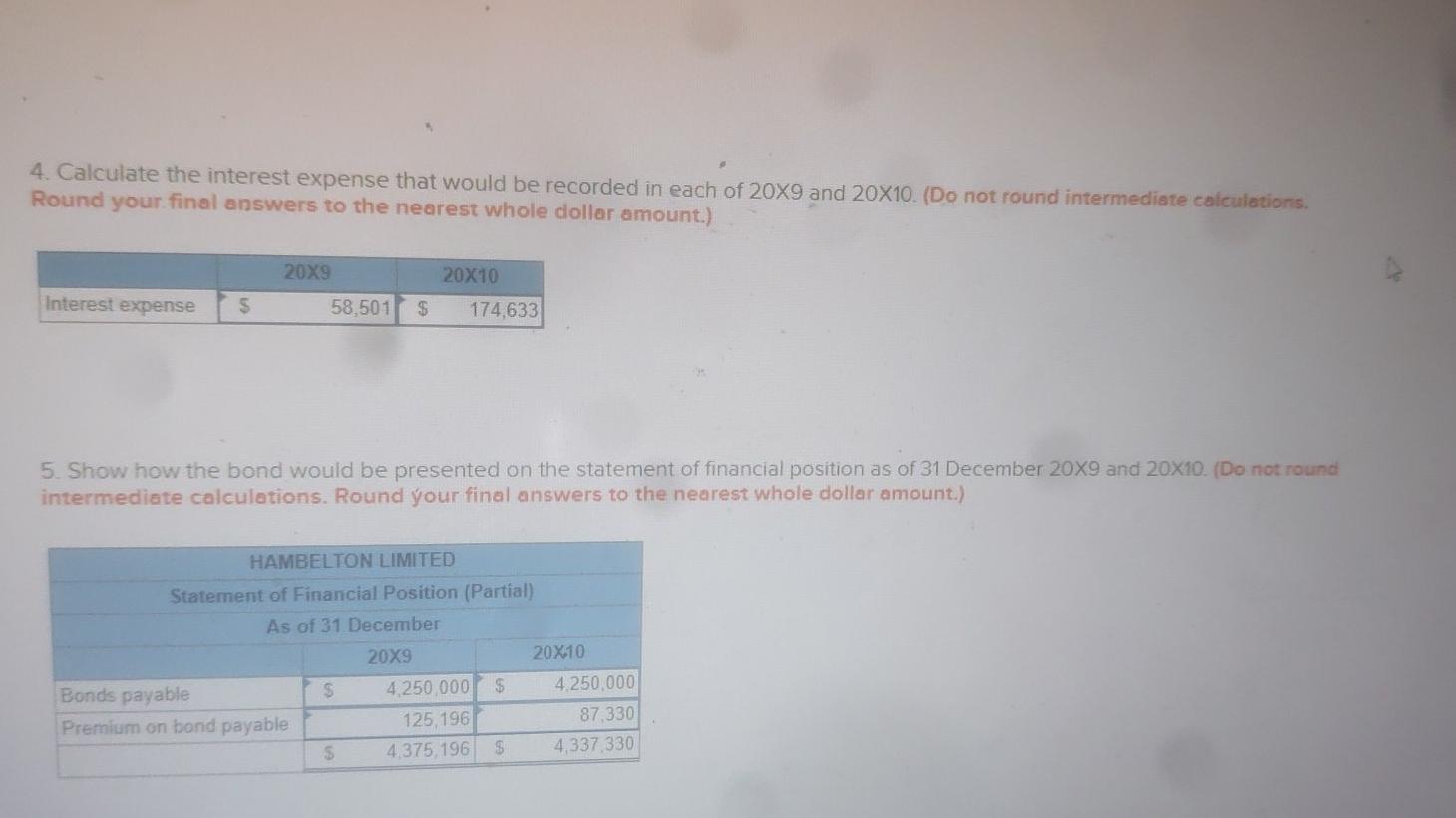

Expense (LO 13-4) Hambelton Ltd. issued $4,250,000 of 5% bonds payable on 1 September 20X9 to yield 4%. Interest on the bonds is paid semi-annually and is payable each 28 February and 31 August. The bonds were dated 1 March 20X8, and had an original term of five years. The accounting period ends on 31 December. The effective-interest method is used. (PV of $1. PVA of $1, and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. Determine the price at which the bonds were issued. (Round time value factor to 5 decimal places. Do not round intermediate calculations. Round your final answer to the nearest whole dollar amount.) Price of Bond $ 4,387 529 2. Prepare a bond amortization table for the life of the bond (Round time value factor to 5 decimal places. Do not round intermediate calculations. Round your final answers to the nearest whole dollar amount. Leave no cells blank - be certain to enter "O" wherever required.) Date Interest Payment Interest Expense Premium Amortization Opening 1 2 3 106,250 $ 106 250 106.250 106,250 106.250 106,250 106,250 Unamortized Net Bond Premium Liability $ 137 529 $ 4,387 529 119,030 4,369,030 100 161 4.350.161 80 914 4330 914 61.282 4.310.049 41 233 4.290.000 19 550 4.269.550 0 4.250.000 18.499 18.869 19,247 19.632 20.485 20.450 20 858 87,751 $ 87 381 87 003 86,618 86,201 85,800 85 391 4 5 6 7 3. Prepare journal entries to record the issuance of the bonds, payment of interest, and all necessary adjustments through to the end of 20X10. (If no entry is required for a transaction/event, select "No journal entry required in the first account field. Round your answers to the nearest whole dollar amount.) View transaction list View journal entry worksheet ***** No 1 Debit Credit Date General Journal 1 September 2009 Cash Premium on bonds payable Bonds payable 4,387,529 137 529 4,250,000 2 31 December 20X9 Interest expense Premium on bonds payable Accrued interest payable 58,501 12,333 70,834 3 28 February 20X10 Accrued interest payable Interest expense Premium on bonds payable Cash 70.834 29,250 6.166 106,250 4 31 August 20X10 Interest expense Premium on bonds payable Cash 87 381 18,869 106,250 5 31 December 20X10 Interest expense 58,002 12831 Premium on bonds payable Accrued interest payable 70.833 4. Calculate the interest expense that would be recorded in each of 20x9 and 20X10. (Do not round intermediate calculations. Round your final answers to the nearest whole dollar amount.) 20X10 20x9 58,501 Interest expense $ $ 174,633 5. Show how the bond would be presented on the statement of financial position as of 31 December 20X9 and 20x10. (Do not found intermediate calculations. Round your final answers to the nearest whole dollar amount.) HAMBELTON LIMITED Statement of Financial Position (Partial) As of 31 December 20X9 20X10 Bonds payable $ 4.250 000 $ 4.250,000 Premium on bond payable 125 196 87.330 $ 4.375 196 $ 4,337,330

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started