Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Expenses and Deductions Salaries and wages-officers: Salaries and wages-employees: $ 150,000 Office rent: 32) Part IV (Total 20 points) Using the below Income Statement

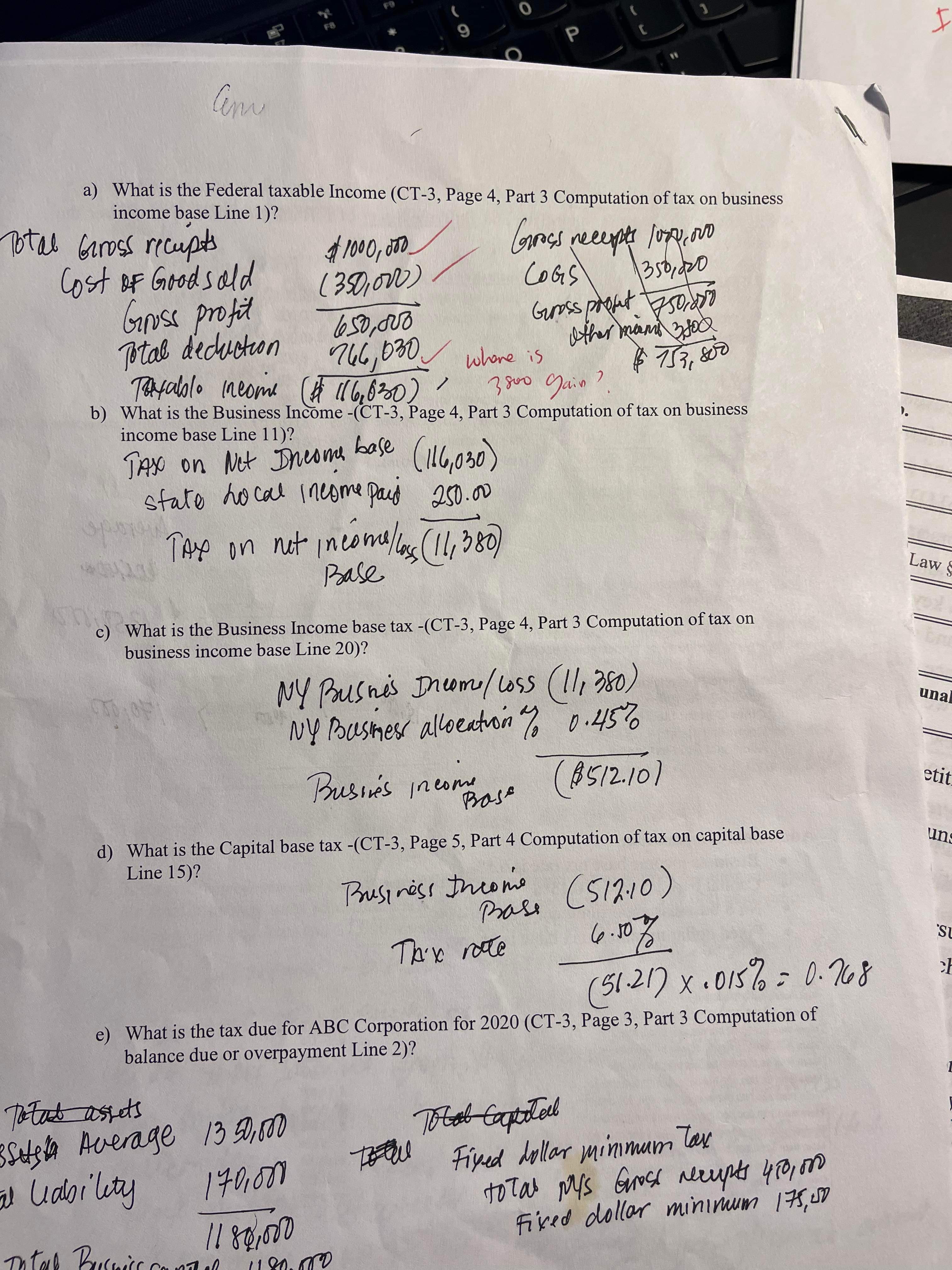

Expenses and Deductions Salaries and wages-officers: Salaries and wages-employees: $ 150,000 Office rent: 32) Part IV (Total 20 points) Using the below Income Statement and Balance Sheet of I Think Corporation to answer the questions: Income: Gross receipts-NYS $ 450,000 Gross receipts-NJ $ 400,000 Gross receipts-CT $ 220,000 $ 300,000 $ 40,000 $ 1,000,000 Advertisement: $ 8,000 Cost of goods sold: $ (350,000) State/local income tax paid: $ 250 Gross profit: $ 650,000 Payroll tax-employer portion: $ 39,780 Other Income: Capital gain $ 3,800 Federal depreciation expense: Other deductions: $ 8,000 (note NYS allowable depreciation expense is $12,000) Total Income: $ 653,800 Total expenses/deductions: $ 150,000 $ 766.030 Balance Sheet: Assets: Cash Other Investment Other Assets (* Other investment and other assets are not related to any real property or marketable securities) Liability and Shareholder's Equity: Accounts Payable Other Current Liability. Common Stock Additional Paid-in Capital Beginning of Tax Year End of Tax Year Average $ 650,000 $ 600,000 125,400 $ 200,000 $ 250,000 $ 350,000 $ 650,000 $ 1,200,000 $ 1,500,000 1350,000 100,000 $. 190000 50,000 $ 800,000 $ $150,0000 $ $ $ 150,000 40,000/ 800,000 510,000 250,000 $ 1,200,000 $ 1,500,000 170,000 Additional information: Business income base tax rate is 6.5%. Capital base tax rate is 0.15%. NYS business apportionment factor is 45%. Fixed dollar minimum tax table is below: Not more than $100,000: More than $100,000 but not over $250,000: More than $250,000 but not over $500,000: More than $500,000 but not over $1,000,000: More than $1,000,000 but not over $5,000,000: More than $5,000,000 but not over $25,000,000: More than $25,000,000 but not over $50,000,000: More than $50,000,000 but not over $100,000,000: More than $100,000,000 but not over $250,000,000: More than $250,000,000 but not over $500,000,000: More than $500,000,000 but not over $1,000,000,000: Over $1,000,000,000 but 25 75 $ 175 $ 500 $ 1,500 $ 3,500 $ 5,000 $ 10,000 $ 20,000 $ 50,000 $ 100,000 $ 200,000 01.02 P Am O 9 O P t J I a) What is the Federal taxable Income (CT-3, Page 4, Part 3 Computation of tax on business income base Line 1)? Total Gross recupts Cost of Goods ald $1000,000. (350,000) Gruss profit 650,000 Total deduction 746,030 Gross recepts love, 00 COGS 350,000 Gross profit 750,000 where is $753,800 3800 Main? Taxable income ($116,630) other man 3800 b) What is the Business Income -(CT-3, Page 4, Part 3 Computation of tax on business income base Line 11)? TAX on Net Income base (146,030) state Local income paid 250.00 TAX on not income/lass (11,380) Base c) What is the Business Income base tax -(CT-3, Page 4, Part 3 Computation of tax on business income base Line 20)? NY Busnes Income/Loss (11,380) y NY Business allocation % 0.45% Busines Income Base (8512.101 d) What is the Capital base tax -(CT-3, Page 5, Part 4 Computation of tax on capital base Line 15)? Business Income Base (512.10) 6.107 Thix rate (51.21) x .015% = 0.768 e) What is the tax due for ABC Corporation for 2020 (CT-3, Page 3, Part 3 Computation of balance due or overpayment Line 2)? 1. Law unal etit. uns Su ch 1 Total assets Best Average 1350,000 Total Capital al Liability 170,000 Totu In task Bussics cont 1180,000 Fixed dollar minimum Tax total pys Gross recupts 450,000 Fixed dollar minimum 175,50 1180.000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started