Question

Expenses (Excluding VAT) Purchase of hardware Purchase of software Purchase of diesel Purchase of Royalty Air ticket to Singapore Expenses (Including VAT) Telephone, rent,

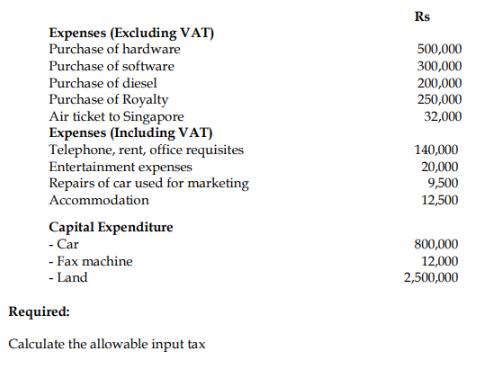

Expenses (Excluding VAT) Purchase of hardware Purchase of software Purchase of diesel Purchase of Royalty Air ticket to Singapore Expenses (Including VAT) Telephone, rent, office requisites Entertainment expenses Repairs of car used for marketing Accommodation Capital Expenditure - Car - Fax machine - Land Required: Calculate the allowable input tax Rs 500,000 300,000 200,000 250,000 32,000 140,000 20,000 9,500 12,500 800,000 12,000 2,500,000

Step by Step Solution

3.48 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

Calculate the allowable input tax In this case well assume a hypothetical VAT rate ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Advanced Accounting

Authors: Gail Fayerman

1st Canadian Edition

9781118774113, 1118774116, 111803791X, 978-1118037911

Students also viewed these Law questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App