Answered step by step

Verified Expert Solution

Question

1 Approved Answer

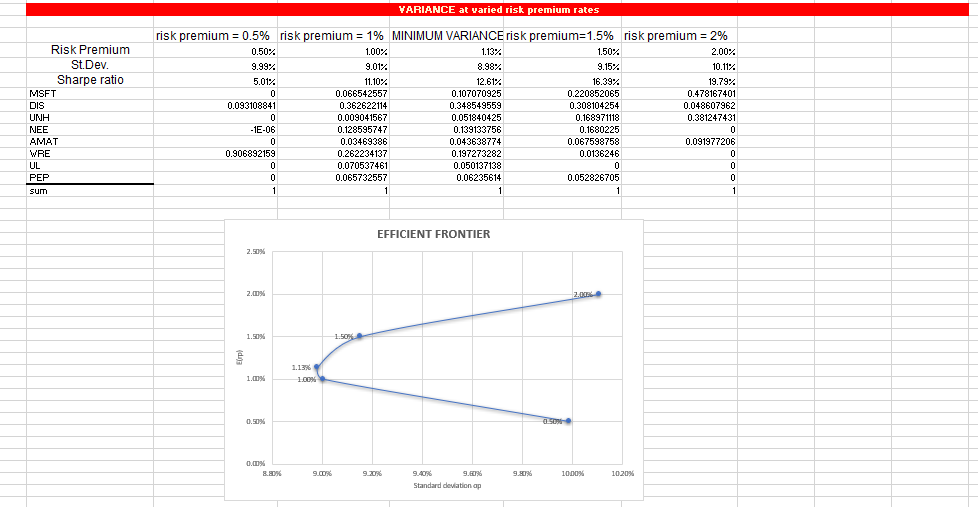

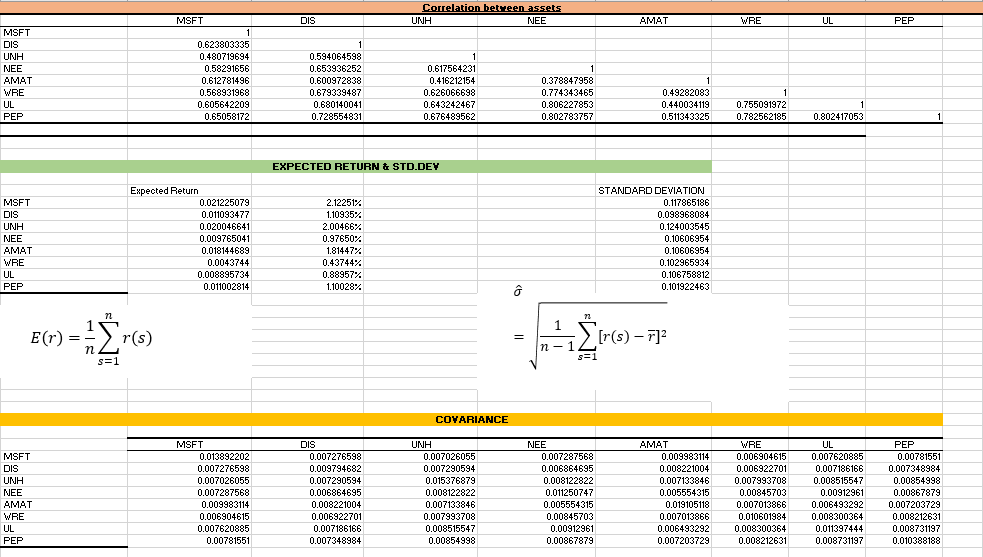

Explain and interpret the data below of the 8 stocks and the Markowitz efficient frontier below E VARIANCE at varied risk premium rates Risk Premium

Explain and interpret the data below of the 8 stocks and the Markowitz efficient frontier below

E

E

VARIANCE at varied risk premium rates Risk Premium St.Dev. Sharpe ratio MSFT DIS UNH NEE AMAT WRE UL PEP sum risk premium = 0.5% risk premium = 1% MINIMUM VARIANCE risk premium=1.5% risk premium = 2% 0.50% 1.00% 1.13% 1.50% 2.00% 9.99% 9.01% 8.98% 9.15% 10.11% 5.01% 11.10% 12.61% % 16.39% 19.79% 0 0 0.066542557 0.107070925 0.220852065 0.478167401 0.093108841 0.362622114 0.348549559 0.308104254 0.048607962 0 0.009041567 0.051840425 0.168971118 0.381247431 -1E-06 - 0.128595747 0.139133756 0.1680225 0 0 0.03469386 0.043638774 0.067598758 0.091977206 0.906892159 0.262234137 0.197273282 0.0136246 0 0 0.070537461 0.050137138 0 0 0 0 0.065732557 0.06235614 0.052826705 0 1 1 1 1 1 1 EFFICIENT FRONTIER 2.50% 2.00% 1.50% 1.50 1.1396 1.00% 1.6% 0.50% 0.00% 8.8% 9.2056 9.30 1000% 1020% 9.4096 9. Standard deviation ap Correlation between assets UNH NEE MSET DIS AMAT WRE UL PEP MSFT DIS UNH NEE AMAT WRE UL PEP 0.623803335 0.480719694 0.58291656 0.612781496 0.568931968 0.605642209 0.65058172 1 0.594064598 0.653936252 0.600972838 0.679339487 0.680140041 0.728554831 1 0.617564231 0.416212154 0.626066698 0.643242467 0.676489562 1 0.378847958 0.774343465 0.806227853 0.802783757 1 0.49282083 0.440034119 0.511343325 1 0.755091972 0.782562185 0.802417053 1 EXPECTED RETURN & STD.DEY MSFT DIS UNH NEE AMAT WRE UL PEP Expected Return 0.021225079 0.011093477 0.020046641 0.009765041 0.018144689 0.0043744 0.008895734 0.011002814 2.12251% 1.10935% 2.00466% 0.97650% 1.81447% 0.43744% 0.88957% 1.100287 STANDARD DEVIATION 0.117865186 0.098968084 0.124003545 0.10606954 0.10606954 0.102965934 0.106758812 0.101922463 n 72 E(r) = =- ) = re [r(s) - 7] r(s) s=1 n n-1 s=1 s COVARIANCE MSFT DIS UNH NEE AMAT WRE UL PEP MSFT 0.013892202 0.007276598 0.007026055 0.007287568 0.009983114 0.006904615 0.007620885 0.00781551 DIS 0.007276598 0.009794682 0.007290594 0.006864695 0.008221004 0.006922701 0.007186166 0.007348984 UNH 0.007026055 0.007290594 0.015376879 0.008122822 0.007133846 0.007993708 0.008515547 0.00854998 NEE 0.007287568 0.006864695 0.008122822 0.011250747 0.005554315 0.00845703 0.00912961 0.00867879 AMAT 0.009983114 0.008221004 0.007133846 0.005554315 0.019105118 0.007013866 0.006493292 0.007203729 WRE 0.006904615 0.006922701 0.007993708 0.00845703 0.007013866 0.010601984 0.008300364 0.008212631 UL 0.007620885 0.007186166 0.008515547 0.00912961 0.006493292 0.008300364 0.011397444 0.008731197 PEP 0.00781551 0.007348984 0.00854998 0.00867879 0.007203729 0.008212631 0.008731197 0.010388188 VARIANCE at varied risk premium rates Risk Premium St.Dev. Sharpe ratio MSFT DIS UNH NEE AMAT WRE UL PEP sum risk premium = 0.5% risk premium = 1% MINIMUM VARIANCE risk premium=1.5% risk premium = 2% 0.50% 1.00% 1.13% 1.50% 2.00% 9.99% 9.01% 8.98% 9.15% 10.11% 5.01% 11.10% 12.61% % 16.39% 19.79% 0 0 0.066542557 0.107070925 0.220852065 0.478167401 0.093108841 0.362622114 0.348549559 0.308104254 0.048607962 0 0.009041567 0.051840425 0.168971118 0.381247431 -1E-06 - 0.128595747 0.139133756 0.1680225 0 0 0.03469386 0.043638774 0.067598758 0.091977206 0.906892159 0.262234137 0.197273282 0.0136246 0 0 0.070537461 0.050137138 0 0 0 0 0.065732557 0.06235614 0.052826705 0 1 1 1 1 1 1 EFFICIENT FRONTIER 2.50% 2.00% 1.50% 1.50 1.1396 1.00% 1.6% 0.50% 0.00% 8.8% 9.2056 9.30 1000% 1020% 9.4096 9. Standard deviation ap Correlation between assets UNH NEE MSET DIS AMAT WRE UL PEP MSFT DIS UNH NEE AMAT WRE UL PEP 0.623803335 0.480719694 0.58291656 0.612781496 0.568931968 0.605642209 0.65058172 1 0.594064598 0.653936252 0.600972838 0.679339487 0.680140041 0.728554831 1 0.617564231 0.416212154 0.626066698 0.643242467 0.676489562 1 0.378847958 0.774343465 0.806227853 0.802783757 1 0.49282083 0.440034119 0.511343325 1 0.755091972 0.782562185 0.802417053 1 EXPECTED RETURN & STD.DEY MSFT DIS UNH NEE AMAT WRE UL PEP Expected Return 0.021225079 0.011093477 0.020046641 0.009765041 0.018144689 0.0043744 0.008895734 0.011002814 2.12251% 1.10935% 2.00466% 0.97650% 1.81447% 0.43744% 0.88957% 1.100287 STANDARD DEVIATION 0.117865186 0.098968084 0.124003545 0.10606954 0.10606954 0.102965934 0.106758812 0.101922463 n 72 E(r) = =- ) = re [r(s) - 7] r(s) s=1 n n-1 s=1 s COVARIANCE MSFT DIS UNH NEE AMAT WRE UL PEP MSFT 0.013892202 0.007276598 0.007026055 0.007287568 0.009983114 0.006904615 0.007620885 0.00781551 DIS 0.007276598 0.009794682 0.007290594 0.006864695 0.008221004 0.006922701 0.007186166 0.007348984 UNH 0.007026055 0.007290594 0.015376879 0.008122822 0.007133846 0.007993708 0.008515547 0.00854998 NEE 0.007287568 0.006864695 0.008122822 0.011250747 0.005554315 0.00845703 0.00912961 0.00867879 AMAT 0.009983114 0.008221004 0.007133846 0.005554315 0.019105118 0.007013866 0.006493292 0.007203729 WRE 0.006904615 0.006922701 0.007993708 0.00845703 0.007013866 0.010601984 0.008300364 0.008212631 UL 0.007620885 0.007186166 0.008515547 0.00912961 0.006493292 0.008300364 0.011397444 0.008731197 PEP 0.00781551 0.007348984 0.00854998 0.00867879 0.007203729 0.008212631 0.008731197 0.010388188

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started