Question

Explain and show steps for all questions 1.Why are some risks diversifiable and some non-diversifiable? Give an example of each. 2. What is the expected

Explain and show steps for all questions

1.Why are some risks diversifiable and some non-diversifiable? Give an example of each.

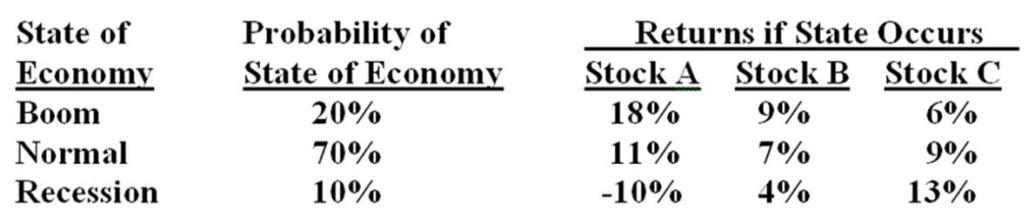

2. What is the expected return on a portfolio which is invested 20% in stock A, 50% in stock B, and 30% in stock C?

3. Peter's Audio Shop has a cost of debt of 7%, a cost of equity of 11%, and a cost of preferred stock of 8%. The firm has 104,000 shares of common stock outstanding at a market price of $20 a share. There are 40,000 shares of preferred stock outstanding at a market price of $34 a share. The bond issue has a total face value of $500,000 and sells at 102% of face value. The tax rate is 34%. What is the weighted average cost of capital for Peter's Audio Shop?

4. On-line Text Co. has four new text publishing products that it must decide on publishing to expand its services. The firm's WACC has been 17%. The projects are of equal risk, s of 1.6. The risk-free rate is 7% and the market rate is expected to be 12%. The projects are expected to earn as follows: Project W- 14% Project X- 18% Project Y- 17% Project Z- 15%

What projects should be selected and why?

State of Economv Boom Normal Recession Probabilitv of Returns if State Occurs State of Economv 20% 70% 10% Stock A 18% 11% -10% StockB 9% 7% 4% Stock ( 6% 9% 13%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started