Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Explain Answer Show Work Assume the betas for securities A, B, and C are as shown here: a. Calculate the change in return for each

Explain Answer Show Work

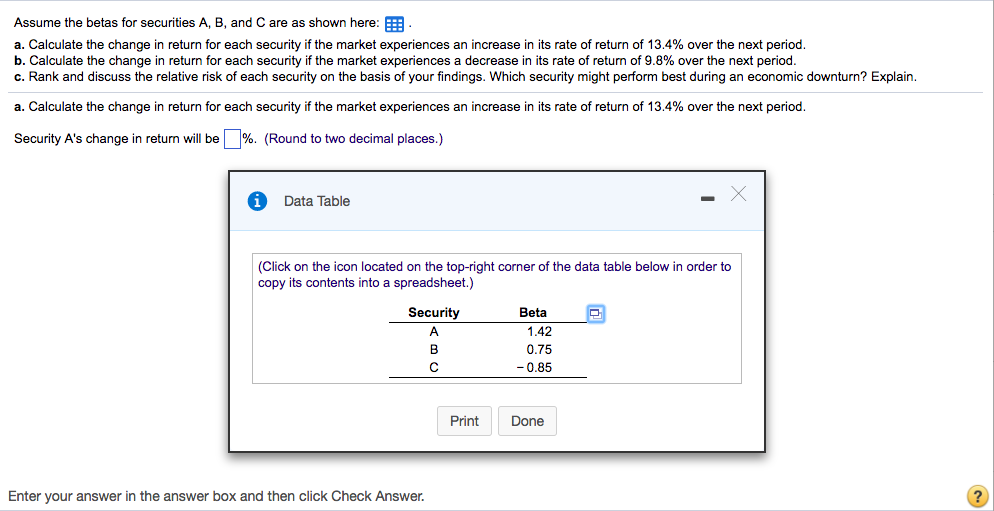

Assume the betas for securities A, B, and C are as shown here: a. Calculate the change in return for each security if the market experiences an increase in its rate of return of 134% over the next period. b. Calculate the change in return for each security if the market experiences a decrease in its rate of return of 9.8% over the next period c. Rank and discuss the relative risk of each security on the basis of your findings. Which security might perform best during an economic downturn? Explain. a. Calculate the change in return for each security if the market experiences an increase in its rate of return of 13.4% over the next period. Security A's change in return will be 96. (Round to two decimal places.) Data Table (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) Security Beta 1.42 0.75 -0.85 Print Done Enter your answer in the answer box and then click Check

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started