Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Explain COST OF GOODS SOLD in Income Statement? (20 Marks) Sales Revenue 400,000 50,000 25,000 120,000 Sales returns and allowances Sales discount Cost of

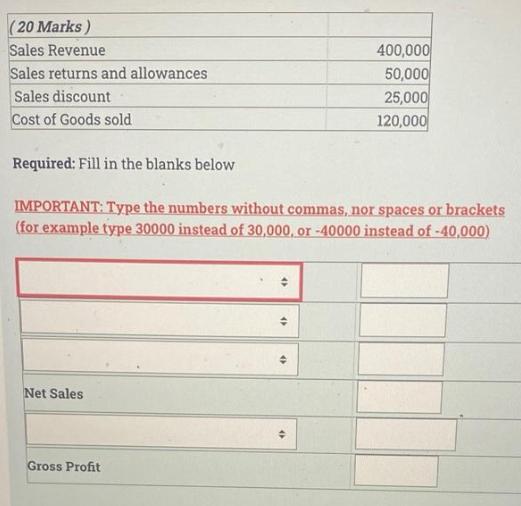

Explain "COST OF GOODS SOLD" in Income Statement? (20 Marks) Sales Revenue 400,000 50,000 25,000 120,000 Sales returns and allowances Sales discount Cost of Goods sold Required: Fill in the blanks below IMPORTANT: Type the numbers without commas, nor spaces or brackets (for example type 30000 instead of 30,000, or -40000 instead of -40,000) Net Sales Gross Profit Explain "COST OF GOODS SOLD" in Income Statement? (20 Marks) Sales Revenue 400,000 50,000 25,000 120,000 Sales returns and allowances Sales discount Cost of Goods sold Required: Fill in the blanks below IMPORTANT: Type the numbers without commas, nor spaces or brackets (for example type 30000 instead of 30,000, or -40000 instead of -40,000) Net Sales Gross Profit Explain "COST OF GOODS SOLD" in Income Statement? (20 Marks) Sales Revenue 400,000 50,000 25,000 120,000 Sales returns and allowances Sales discount Cost of Goods sold Required: Fill in the blanks below IMPORTANT: Type the numbers without commas, nor spaces or brackets (for example type 30000 instead of 30,000, or -40000 instead of -40,000) Net Sales Gross Profit Explain "COST OF GOODS SOLD" in Income Statement? (20 Marks) Sales Revenue 400,000 50,000 25,000 120,000 Sales returns and allowances Sales discount Cost of Goods sold Required: Fill in the blanks below IMPORTANT: Type the numbers without commas, nor spaces or brackets (for example type 30000 instead of 30,000, or -40000 instead of -40,000) Net Sales Gross Profit Explain "COST OF GOODS SOLD" in Income Statement? (20 Marks) Sales Revenue 400,000 50,000 25,000 120,000 Sales returns and allowances Sales discount Cost of Goods sold Required: Fill in the blanks below IMPORTANT: Type the numbers without commas, nor spaces or brackets (for example type 30000 instead of 30,000, or -40000 instead of -40,000) Net Sales Gross Profit Explain "COST OF GOODS SOLD" in Income Statement? (20 Marks) Sales Revenue 400,000 50,000 25,000 120,000 Sales returns and allowances Sales discount Cost of Goods sold Required: Fill in the blanks below IMPORTANT: Type the numbers without commas, nor spaces or brackets (for example type 30000 instead of 30,000, or -40000 instead of -40,000) Net Sales Gross Profit Explain "COST OF GOODS SOLD" in Income Statement? (20 Marks) Sales Revenue 400,000 50,000 25,000 120,000 Sales returns and allowances Sales discount Cost of Goods sold Required: Fill in the blanks below IMPORTANT: Type the numbers without commas, nor spaces or brackets (for example type 30000 instead of 30,000, or -40000 instead of -40,000) Net Sales Gross Profit Explain "COST OF GOODS SOLD" in Income Statement? (20 Marks) Sales Revenue 400,000 50,000 25,000 120,000 Sales returns and allowances Sales discount Cost of Goods sold Required: Fill in the blanks below IMPORTANT: Type the numbers without commas, nor spaces or brackets (for example type 30000 instead of 30,000, or -40000 instead of -40,000) Net Sales Gross Profit Explain "COST OF GOODS SOLD" in Income Statement? (20 Marks) Sales Revenue 400,000 50,000 25,000 120,000 Sales returns and allowances Sales discount Cost of Goods sold Required: Fill in the blanks below IMPORTANT: Type the numbers without commas, nor spaces or brackets (for example type 30000 instead of 30,000, or -40000 instead of -40,000) Net Sales Gross Profit

Step by Step Solution

★★★★★

3.51 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

1 Cost of Goods Sold in Income statement Cost of goods sold is referred to as cost of sales Cost of goods sold includes all of the costs and expenses ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started