Question

Texas Oil Company has the following data in connection with Lease A as follows: Property Cost $ 70,000 Drilling Cost (one Well) 240,000 Estimated

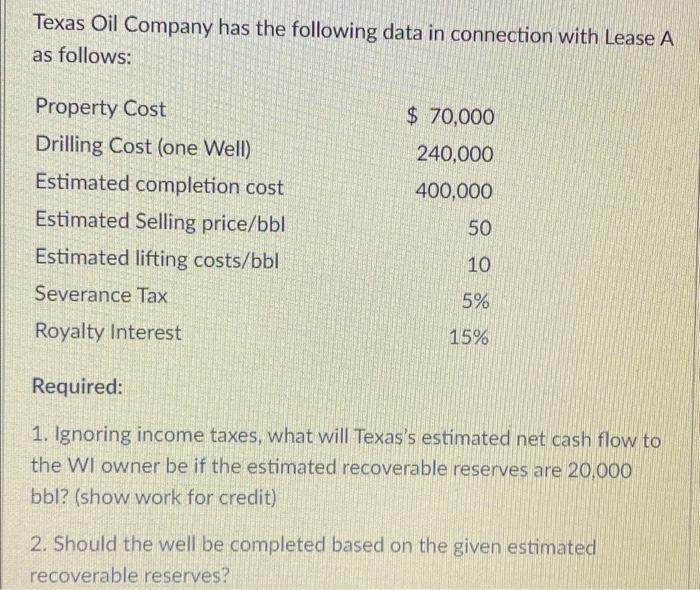

Texas Oil Company has the following data in connection with Lease A as follows: Property Cost $ 70,000 Drilling Cost (one Well) 240,000 Estimated completion cost 400,000 Estimated Selling price/bbl 50 Estimated lifting costs/bbl 10 Severance Tax 5% Royalty Interest 15% Required: 1. Ignoring income taxes, what will Texas's estimated net cash flow to the WI owner be if the estimated recoverable reserves are 20,000 bbl? (show work for credit) 2. Should the well be completed based on the given estimated recoverable reserves?

Step by Step Solution

3.43 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

In Extimated Selling Ricelbbl 50 E Estimated diftiy contalbld 10 Royaldy mtent soX ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Accounting Principles

Authors: Jerry J. Weygandt, Paul D. Kimmel, Donald E. Kieso

9th Edition

978-0470317549, 9780470387085, 047031754X, 470387084, 978-0470533475

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App