Explain each of the following ratios and calculate all the ratios for year 2017 using the financial statement in Table 1-3.

*PLEASE SHOW ALL CALCULATIONS!*

Activity Ratios/Efficiency Ratios

Inventory Turnover Ratio

Days inventory outstanding (DIO)

Accounts receivable turnover

Days sales outstanding (DSO)

Accounts payable turnover

Days payable outstanding (DPO)

Total Asset turnover

Fixed asset turnover

Liquidity Ratio

Current ratio

Quick ratio

Solvency Ratios

Liability to assets

Interest coverage ratio

Profitability Ratios

ROA

ROE

Gross profit margin

Operating profit margin

Net operating profit margin

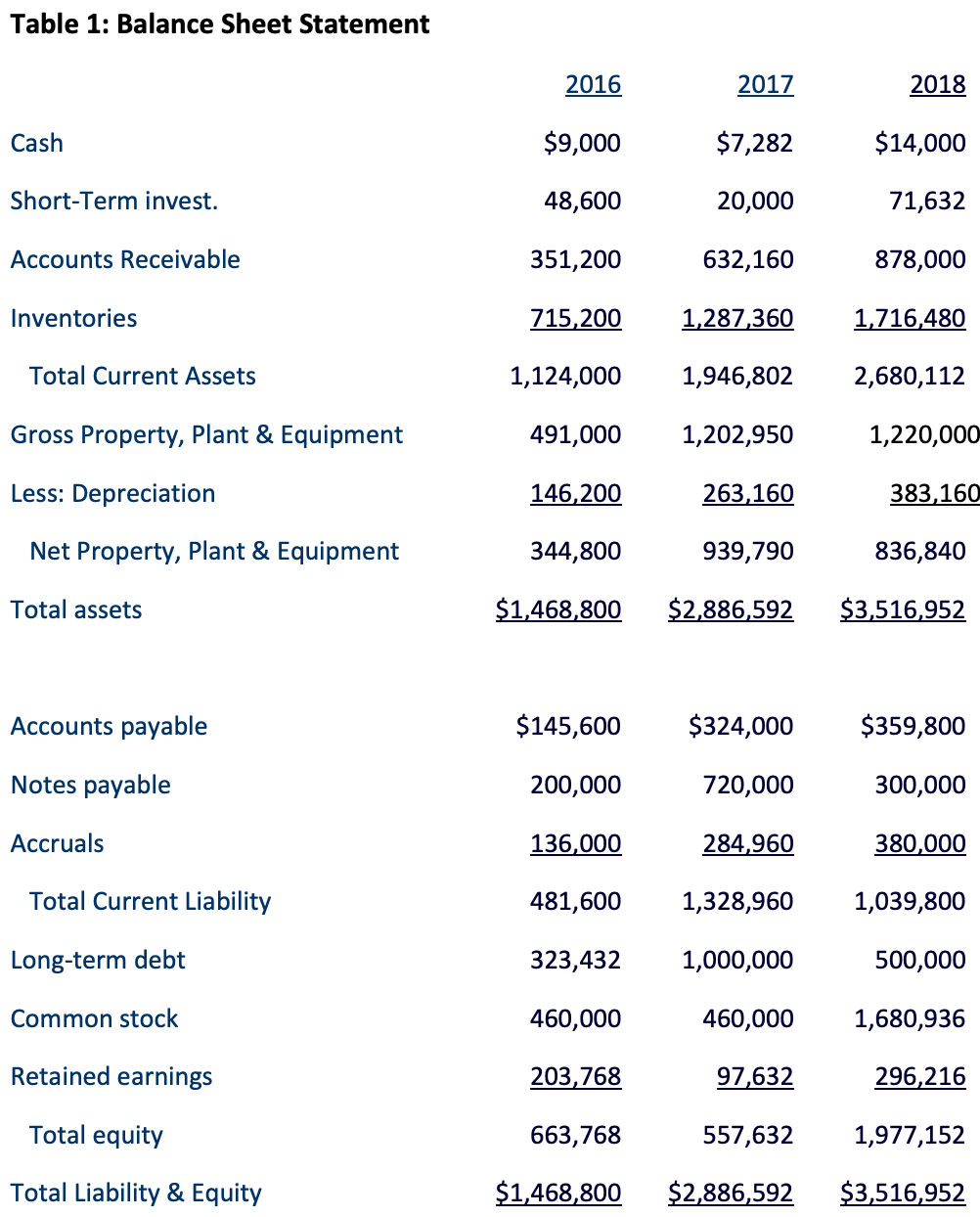

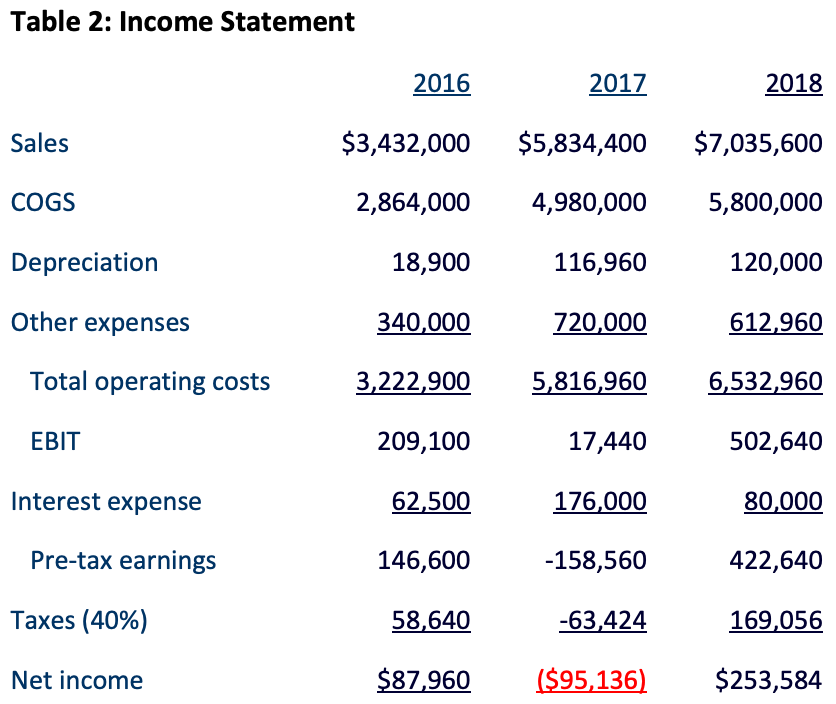

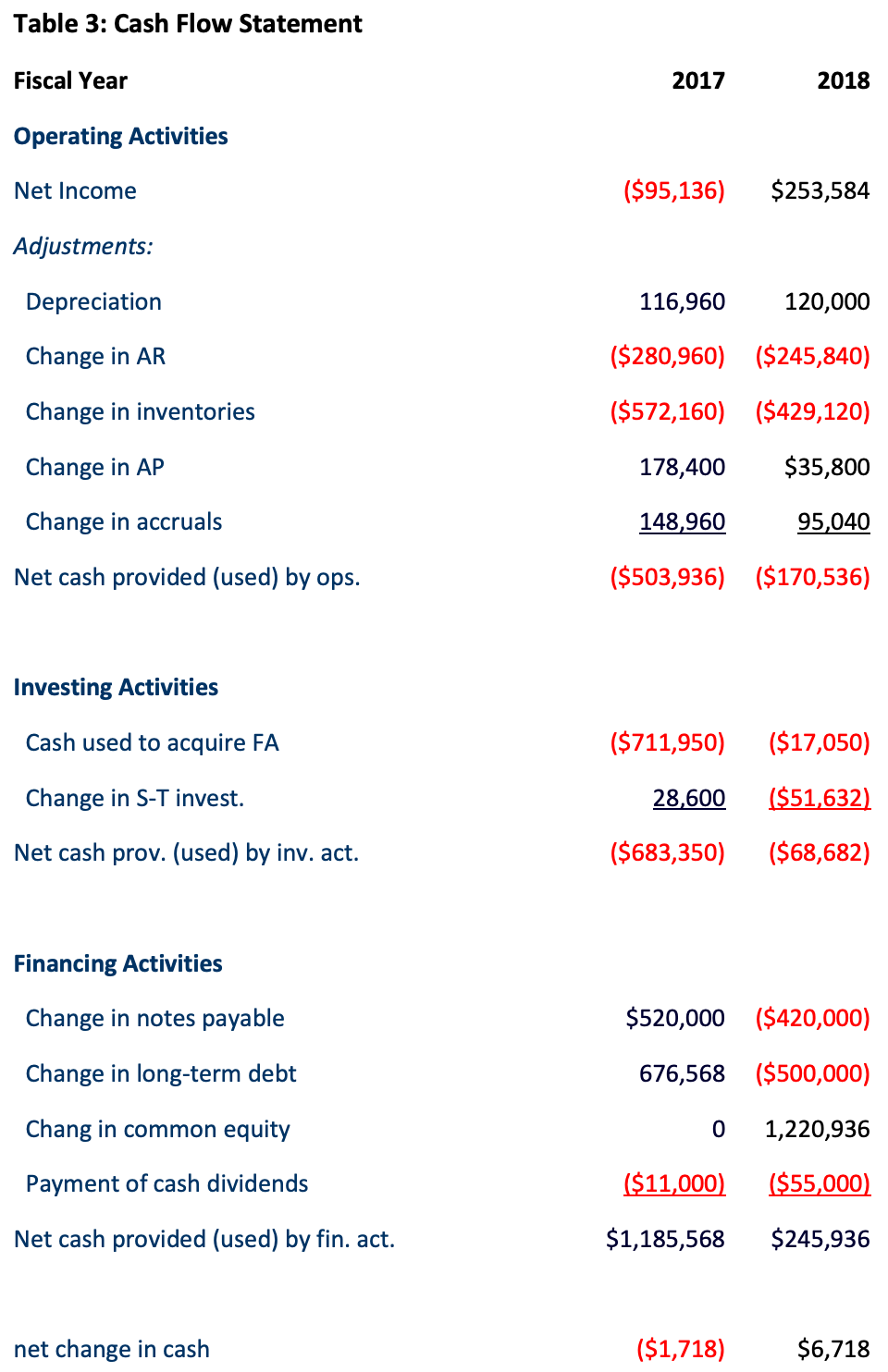

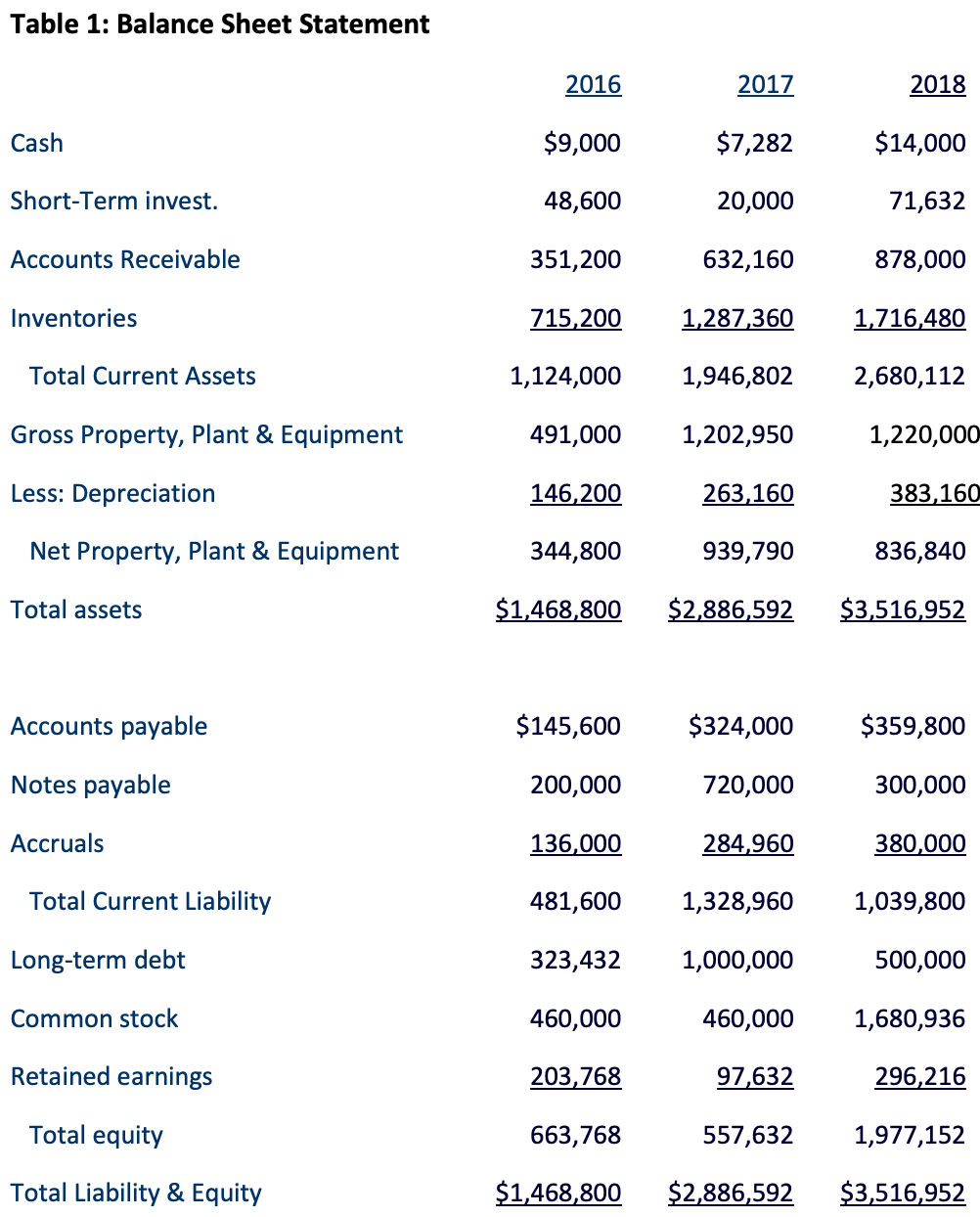

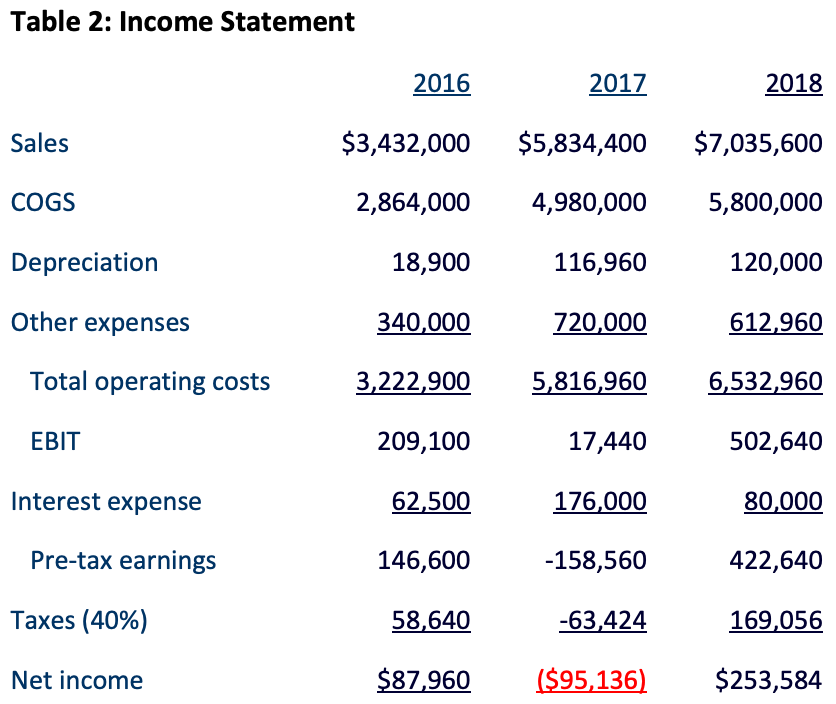

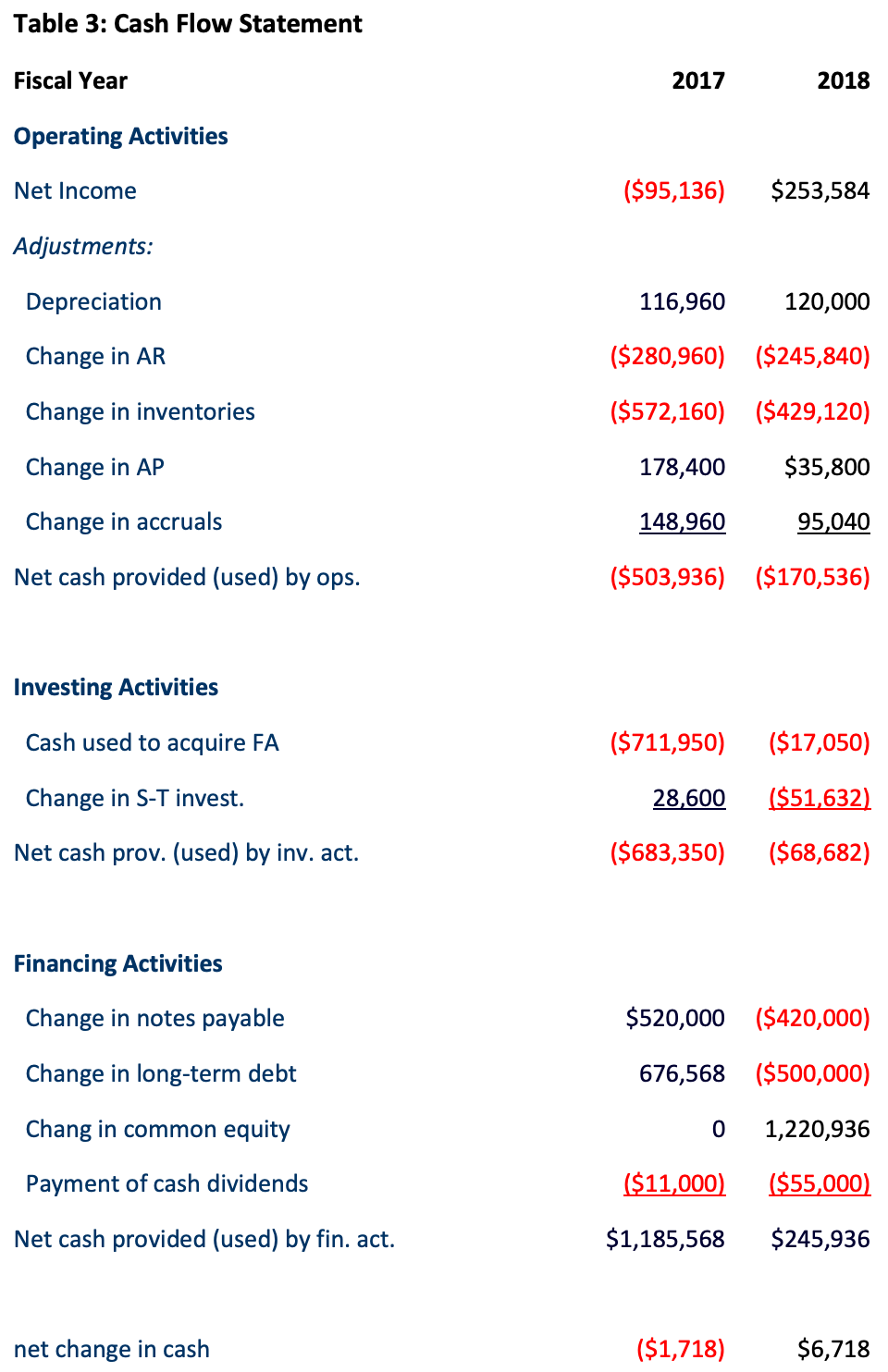

Table 1: Balance Sheet Statement 2016 2017 2018 Cash $9,000 $7,282 $14,000 Short-Term invest. 48,600 20,000 71,632 Accounts Receivable 351,200 632,160 878,000 Inventories 715,200 1,287,360 1,716,480 Total Current Assets 1,124,000 1,946,802 2,680,112 Gross Property, Plant & Equipment 491,000 1,202,950 1,220,000 Less: Depreciation 146,200 263,160 383,160 Net Property, Plant & Equipment 344,800 939,790 836,840 Total assets $1,468,800 $2,886,592 $3,516,952 Accounts payable $145,600 $324,000 $359,800 Notes payable 200,000 720,000 300,000 Accruals 136,000 284,960 380,000 Total Current Liability 481,600 1,328,960 1,039,800 Long-term debt 323,432 1,000,000 500,000 Common stock 460,000 460,000 1,680,936 Retained earnings 203,768 97,632 296,216 Total equity 663,768 557,632 1,977,152 Total Liability & Equity $1,468,800 $2,886,592 $3,516,952 Table 2: Income Statement 2016 2017 2018 Sales $3,432,000 $5,834,400 $7,035,600 COGS 2,864,000 4,980,000 5,800,000 Depreciation 18,900 116,960 120,000 Other expenses 340,000 720,000 612,960 Total operating costs 3,222,900 5,816,960 6,532,960 EBIT 209,100 17,440 502,640 Interest expense 62,500 176,000 80,000 Pre-tax earnings 146,600 -158,560 422,640 Taxes (40%) 58,640 -63,424 169,056 Net income $87,960 ($95,136) $253,584 Table 3: Cash Flow Statement Fiscal Year 2017 2018 Operating Activities Net Income ($95,136) $253,584 Adjustments: Depreciation 116,960 120,000 Change in AR ($280,960) ($245,840) Change in inventories ($572,160) $429,120) Change in AP 178,400 $35,800 Change in accruals 148,960 95,040 Net cash provided (used) by ops. ($503,936) ($170,536) Investing Activities Cash used to acquire FA ($711,950) ($17,050) Change in S-T invest. 28,600 ($51,632) Net cash prov. (used) by inv. act. ($683,350) ($68,682) Financing Activities Change in notes payable $520,000 ($420,000) Change in long-term debt 676,568 ($500,000) Chang in common equity 0 1,220,936 Payment of cash dividends ($11,000) ($55,000) Net cash provided (used) by fin. act. $1,185,568 $245,936 net change in cash ($1,718) $6,718