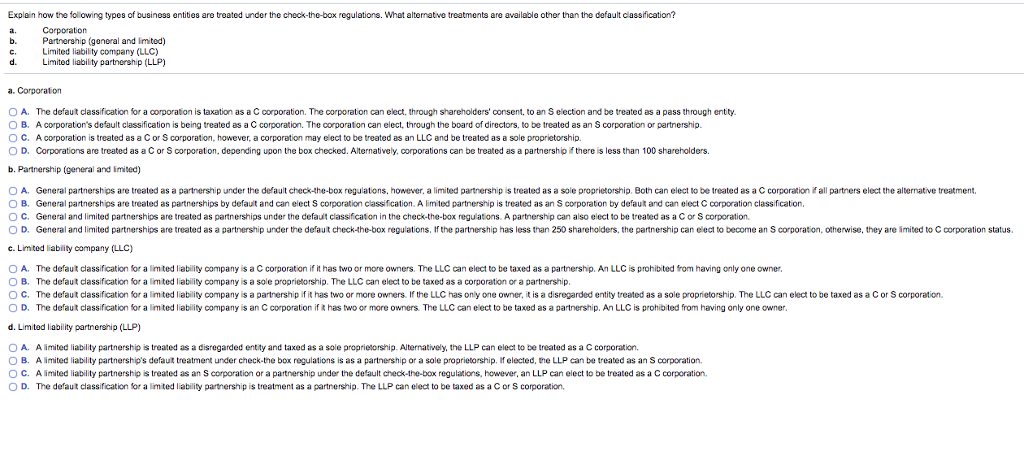

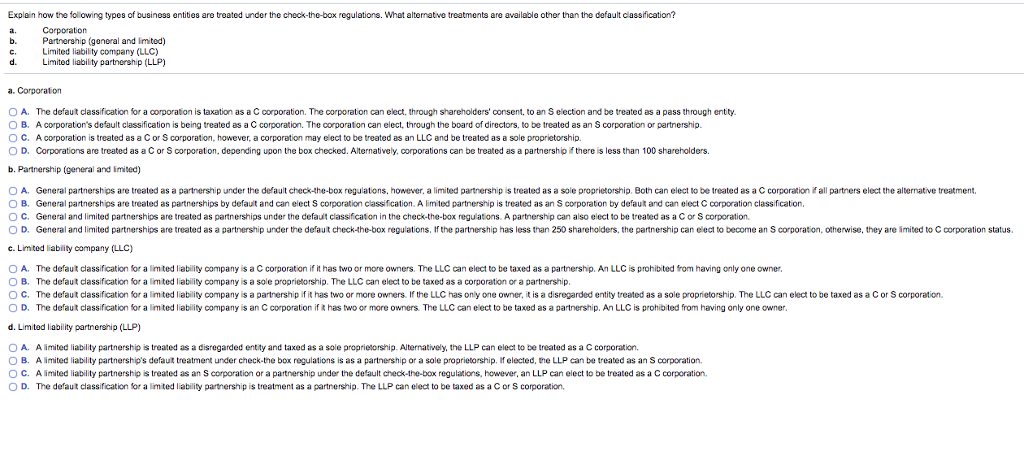

Explain how the fol lowing types of business entiies are treated under the check-the-box regulations. Whet alternatve treatments are available other than the default cassification? b. Partnership (general and limited) C. d. Limited liability partnership (LLP) Limited liability company (LLC) O A. The defaut classification for a corporation is taxation as a C corporation. The corporation can elect, through shareholders' consent, to an S election and be treated as a pass through entty O B. A corporation's default classification is being treated as a C corporation. The corporation can elect, through the board of directors, to be treated as an S corporation or partnership. O C. A corporaton is treated as a C or S corporation, however, a corporation may elect to be treated es an LLC and be treated as a sole proprietorship. O D Corporations are treated as a C or S corporation, depending upon the box checked. Alternatively, corporations can be treated as a partnershp there is less than 100 shareholders b. Partnership (general and imited) O A. General partnerships are treated as a partnership under the default check-the-box regulations, however, a limited partnership is treated as a sole proprietorship. Both can elect to be treated as a C corporation if all partners elect the alternative treatment O B. General partnerships are treated as partnerships by defauit and can elect S corporation cassification. A limited partnership is treated as an S corporation by defaut and can elect C corporation classification C. General and limited partnerships are treated as partnerships under the default classificaton in the check-the-box reguatons. A partnership can also elect to be treated as a C or S corporation . General and limited partnerships are treated as a partners p under e de aut chec ? ? ?? egulations f the partnership has less an shareholders, the partnership ca eectto ecome an corporat n otherwise, yarein dto C co poration us. c. Limited liabiity company (LLC) O A. The defaut classification for a lim ted liability company is a C corporation if it has two or more owners. The LLC can elect to be taxed as a partnership. An LLC is prohibited from having only one owner O B. The defaut classifcation for a lim ted liability company is a sole proprietorship. The LLC can elect to be taxed as a corporation or a partnership O C. The defaut classifcation for a lim ted liability company is a partnership if it has two or more owners. If the LLC has only one owner, it is a disregarded entity treated as a sole proprietorship. The LLC can elect to be taxed as a C or S corporation ?D. The defaut ciassification a l ted i ability company is an ? corporation if t has two o more owners The LLC can eect to be taxed as a partners p. A C is prohibited-rom having on y one owne d. Limited lability partnership (LLP) OA. A limited liability partnership is treated as a disregarded entity and taxed as a sole proprietorship. Alternatively, the LLP can elect to be treated as a C corporation B. A imited liability partnership's defaut treatment under check-the box regulations is as a partnership or a sole proprietorship. if elected,te LLP can be treated as an S corporation O C. A limited liability partnership is treated as an S corporation or a partnership under the default check-the-box regulations, however, an LLP can elect to be treated as a C corporation O D. The defaut dassification for a limited liability partnership is treatment as a partnership. The LLP can elect to be taxed as a C or S corporation. Explain how the fol lowing types of business entiies are treated under the check-the-box regulations. Whet alternatve treatments are available other than the default cassification? b. Partnership (general and limited) C. d. Limited liability partnership (LLP) Limited liability company (LLC) O A. The defaut classification for a corporation is taxation as a C corporation. The corporation can elect, through shareholders' consent, to an S election and be treated as a pass through entty O B. A corporation's default classification is being treated as a C corporation. The corporation can elect, through the board of directors, to be treated as an S corporation or partnership. O C. A corporaton is treated as a C or S corporation, however, a corporation may elect to be treated es an LLC and be treated as a sole proprietorship. O D Corporations are treated as a C or S corporation, depending upon the box checked. Alternatively, corporations can be treated as a partnershp there is less than 100 shareholders b. Partnership (general and imited) O A. General partnerships are treated as a partnership under the default check-the-box regulations, however, a limited partnership is treated as a sole proprietorship. Both can elect to be treated as a C corporation if all partners elect the alternative treatment O B. General partnerships are treated as partnerships by defauit and can elect S corporation cassification. A limited partnership is treated as an S corporation by defaut and can elect C corporation classification C. General and limited partnerships are treated as partnerships under the default classificaton in the check-the-box reguatons. A partnership can also elect to be treated as a C or S corporation . General and limited partnerships are treated as a partners p under e de aut chec ? ? ?? egulations f the partnership has less an shareholders, the partnership ca eectto ecome an corporat n otherwise, yarein dto C co poration us. c. Limited liabiity company (LLC) O A. The defaut classification for a lim ted liability company is a C corporation if it has two or more owners. The LLC can elect to be taxed as a partnership. An LLC is prohibited from having only one owner O B. The defaut classifcation for a lim ted liability company is a sole proprietorship. The LLC can elect to be taxed as a corporation or a partnership O C. The defaut classifcation for a lim ted liability company is a partnership if it has two or more owners. If the LLC has only one owner, it is a disregarded entity treated as a sole proprietorship. The LLC can elect to be taxed as a C or S corporation ?D. The defaut ciassification a l ted i ability company is an ? corporation if t has two o more owners The LLC can eect to be taxed as a partners p. A C is prohibited-rom having on y one owne d. Limited lability partnership (LLP) OA. A limited liability partnership is treated as a disregarded entity and taxed as a sole proprietorship. Alternatively, the LLP can elect to be treated as a C corporation B. A imited liability partnership's defaut treatment under check-the box regulations is as a partnership or a sole proprietorship. if elected,te LLP can be treated as an S corporation O C. A limited liability partnership is treated as an S corporation or a partnership under the default check-the-box regulations, however, an LLP can elect to be treated as a C corporation O D. The defaut dassification for a limited liability partnership is treatment as a partnership. The LLP can elect to be taxed as a C or S corporation