Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Explain how the Zhou discretionary family trust with the following particulars could distribute residual income to minimize tax at the end of the 2021

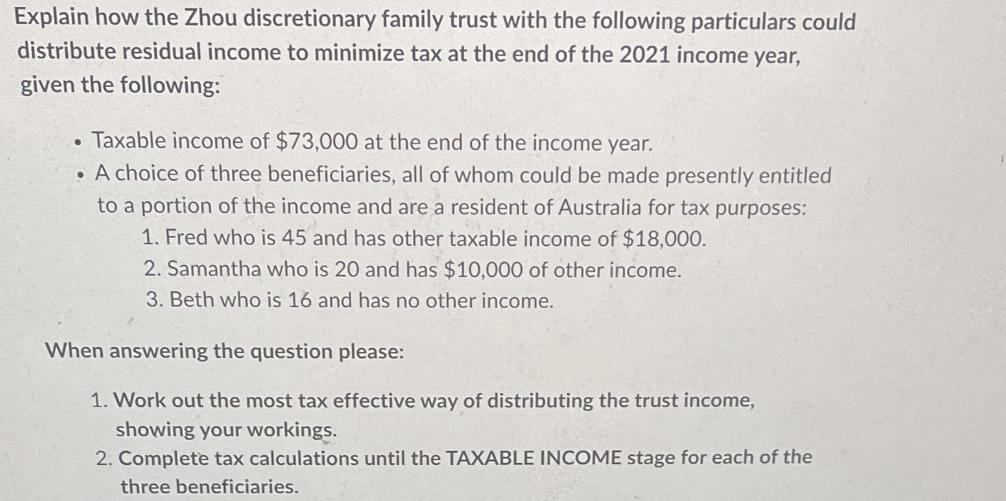

Explain how the Zhou discretionary family trust with the following particulars could distribute residual income to minimize tax at the end of the 2021 income year, given the following: Taxable income of $73,000 at the end of the income year. A choice of three beneficiaries, all of whom could be made presently entitled to a portion of the income and are a resident of Australia for tax purposes: 1. Fred who is 45 and has other taxable income of $18,000. 2. Samantha who is 20 and has $10,000 of other income. 3. Beth who is 16 and has no other income. When answering the question please: 1. Work out the most tax effective way of distributing the trust income, showing your workings. 2. Complete tax calculations until the TAXABLE INCOME stage for each of the three beneficiaries.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

TaxEffective Distribution of Zhou Family Trust Income 1 Strategy The goal is to distribute the incom...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started