Answered step by step

Verified Expert Solution

Question

1 Approved Answer

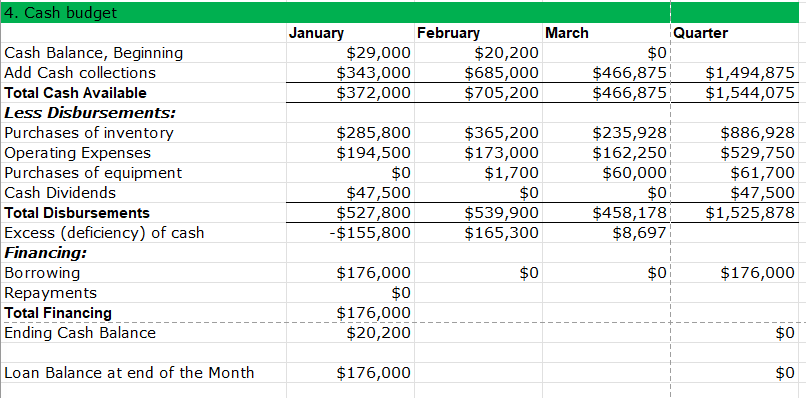

explain how to get the repayment amount for February. The Cash Budget should not include interest expense as it is not paid until the

explain how to get the repayment amount for February.

The Cash Budget should not include interest expense as it is not paid until the entire loan balance is paid off.

| The company must maintain a minimum cash balance of $20,000. An open line of credit is available at a local bank for any borrowing that may be needed during the quarter. All borrowing is done at the beginning of a month, and all repayments are made at the end of a month. Borrowings and repayments of principal must be in multiples of $1,000. Interest is paid only at the time of payment of complete repayment of total principal. Interest is computed on funds utilized for each month. The annual interest rate is 15%. (Figure interest on whole months, e.g., 1/15, 2/15) |

The interest expense must be accrued in the income statement monthly. The borrowing in January is $176,000 to bring the cash balance to over $20,000. Remember you must borrow in increments of $1000. The ending Cash balance for the quarter must equal the ending cash balance for the month of March.

4. Cash budget January February March Quarter Cash Balance, Beginning $29,000 $20,200 $0 Add Cash collections $343,000 $685,000 $466,875 $1,494,875 Total Cash Available Less Disbursements: Purchases of inventory Operating Expenses Purchases of equipment $372,000 $705,200 $466,875 $1,544,075 $285,800 $365,200 $235,928 $886,928 $194,500 $173,000 $162,250 $529,750 $0 $1,700 $60,000 Cash Dividends $47,500 $0 $0 Total Disbursements $527,800 $539,900 $458,178 $61,700 $47,500 $1,525,878 Excess (deficiency) of cash -$155,800 $165,300 $8,697 Financing: Borrowing $176,000 $0 $0 $176,000 Repayments $0 Total Financing $176,000 Ending Cash Balance $20,200 Loan Balance at end of the Month $176,000 $0 $0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started