Answered step by step

Verified Expert Solution

Question

1 Approved Answer

explain in deatil step by step calculation Sai Ltd. is a manufacturing company considering a project with an Investment of Rs.15000. The Project is expected

explain in deatil step by step calculation

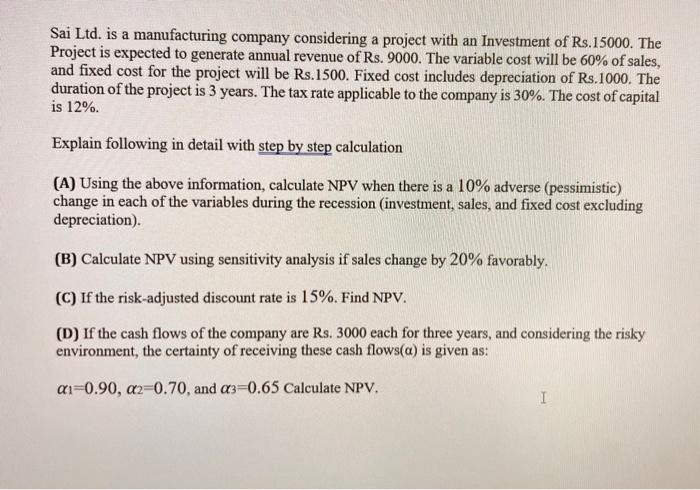

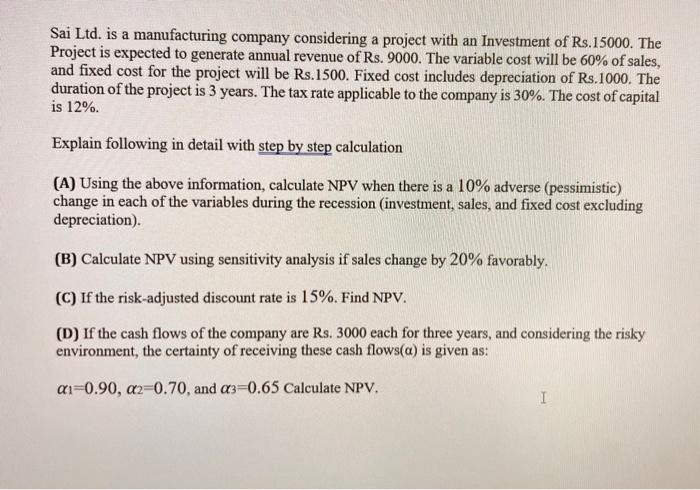

Sai Ltd. is a manufacturing company considering a project with an Investment of Rs.15000. The Project is expected to generate annual revenue of Rs. 9000 . The variable cost will be 60% of sales, and fixed cost for the project will be Rs.1500. Fixed cost includes depreciation of Rs.1000. The duration of the project is 3 years. The tax rate applicable to the company is 30%. The cost of capital is 12%. Explain following in detail with step by step calculation (A) Using the above information, calculate NPV when there is a 10% adverse (pessimistic) change in each of the variables during the recession (investment, sales, and fixed cost excluding depreciation). (B) Calculate NPV using sensitivity analysis if sales change by 20% favorably. (C) If the risk-adjusted discount rate is 15%. Find NPV. (D) If the cash flows of the company are Rs. 3000 each for three years, and considering the risky environment, the certainty of receiving these cash flows () is given as: 1=0.90,2=0.70, and 3=0.65 Calculate NPV

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started