Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Explain in detail and show step by step how to do it in excel so i can understand. 1. You are evaluating the purchase of

Explain in detail and show step by step how to do it in excel so i can understand.

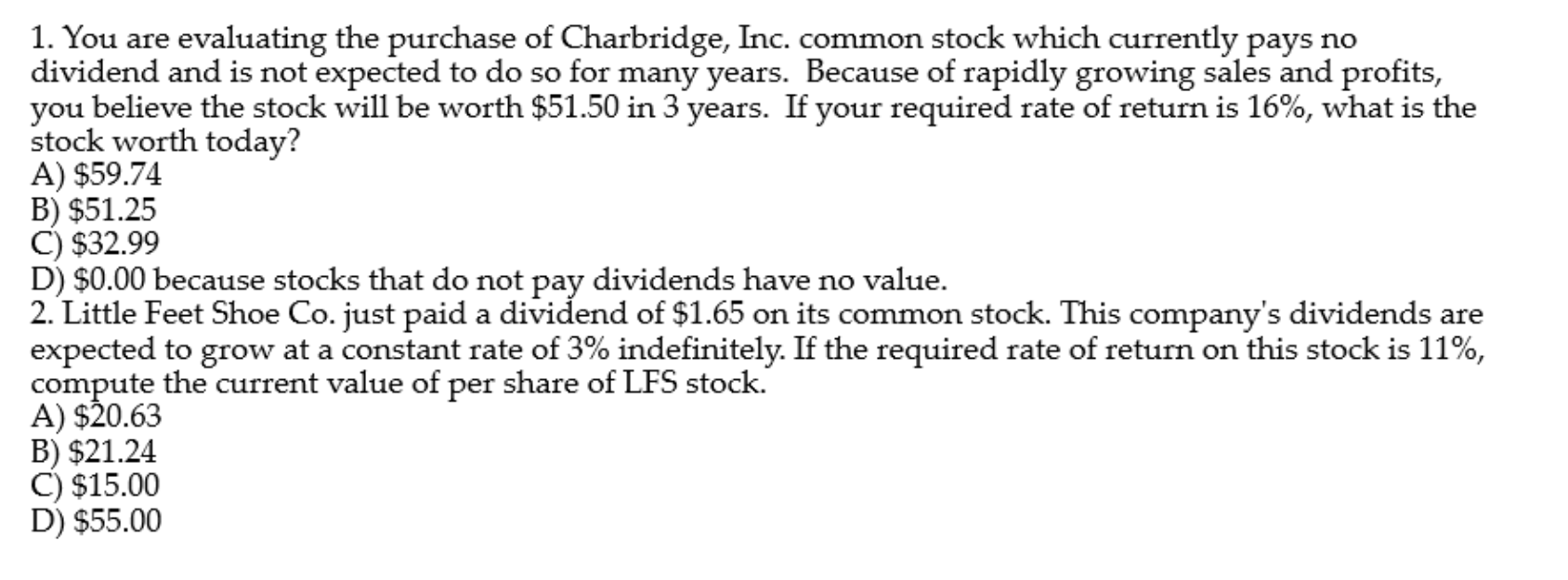

1. You are evaluating the purchase of Charbridge, Inc. common stock which currently pays no dividend and is not expected to do so for many years. Because of rapidly growing sales and profits, you believe the stock will be worth $51.50 in 3 years. If your required rate of return is 16%, what is the stock worth today? A) $59.74 B) $51.25 C) $32.99 D) $0.00 because stocks that do not pay dividends have no value. 2. Little Feet Shoe Co. just paid a dividend of $1.65 on its common stock. This company's dividends are expected to grow at a constant rate of 3% indefinitely. If the required rate of return on this stock is 11%, compute the current value of per share of LFS stock. A) $20.63 B) $21.24 C) $15.00 D) $55.00Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started