Answered step by step

Verified Expert Solution

Question

1 Approved Answer

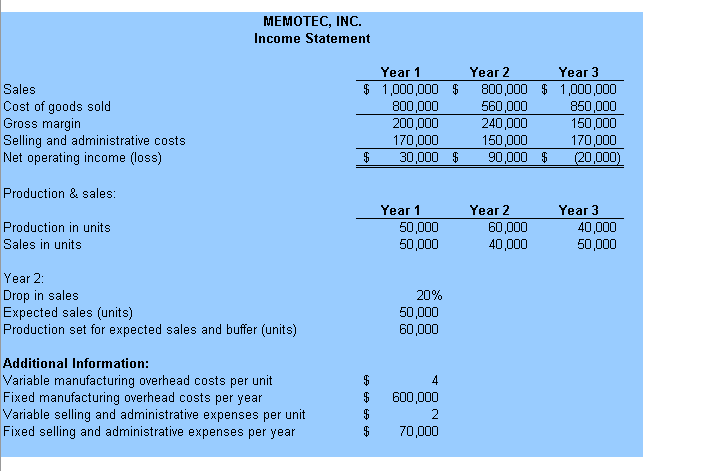

Explain in detail MEMOTEC, INC. Income Statement Sales Cost of goods sold Gross margin Selling and administrative costs Net operating income (loss) Production & sales:

Explain in detail

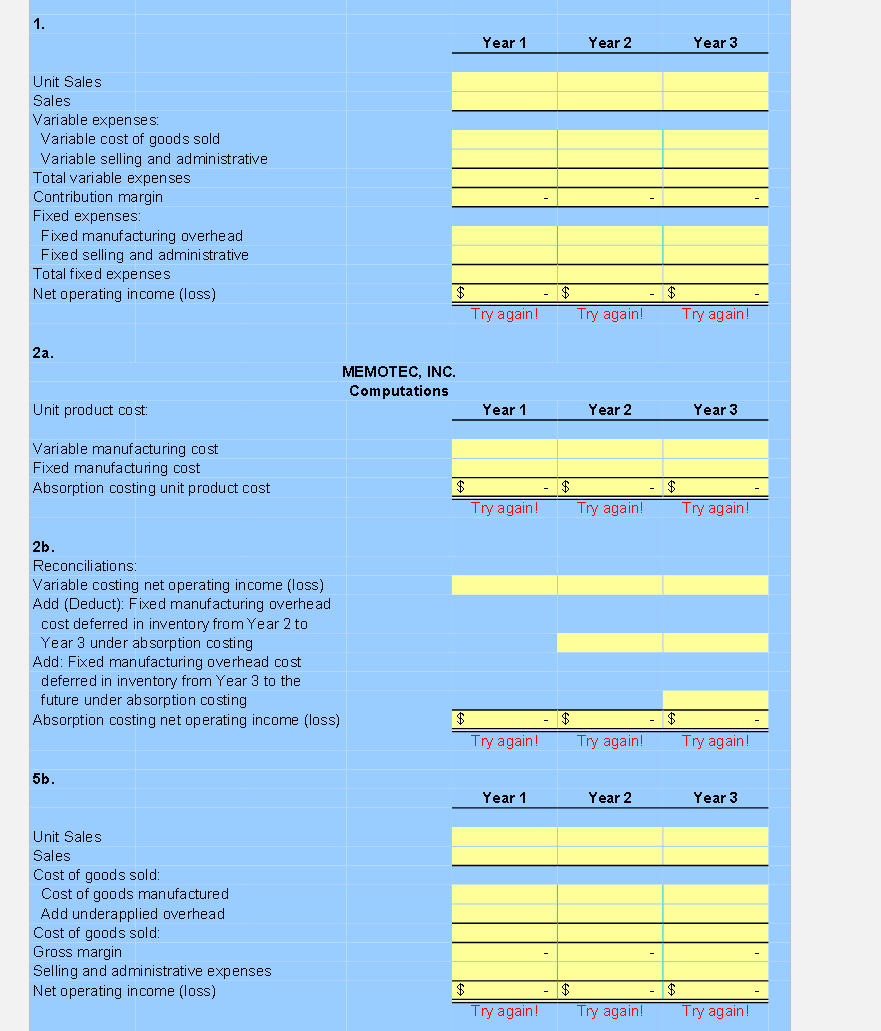

MEMOTEC, INC. Income Statement Sales Cost of goods sold Gross margin Selling and administrative costs Net operating income (loss) Production \& sales: Production in units Sales in units \begin{tabular}{crr} Year 1 & Year 2 & \multicolumn{1}{c}{ Year 3 } \\ \hline 50,000 & 60,000 & 40,000 \\ 50,000 & 40,000 & 50,000 \end{tabular} Year 2: Drop in sales 20% Expected sales (units) 50,000 Production set for expected sales and buffer (units) 60,000 Additional Information: Variable manufacturing overhead costs per unit Fixed manufacturing overhead costs per year Variable selling and administrative expenses per unit Fixed selling and administrative expenses per year $$$$4600,000270,000 1. Year 1 Year 2 Year 3 Unit Sales Sales Variable expenses: Variable cost of goods sold Variable selling and administrative Total variable expenses Contribution margin Fixed expenses: Fixed manufacturing overhead Fixed selling and administrative Total fixed expenses Net operating income (loss) 2a. MEMOTEC, INC. Computations Unit product cost: Year1 Year 2 Year 3 Variable manufacturing cost Fixed manufacturing cost Absorption costing unit product cost 2b. Reconciliations: Variable costing net operating income (loss) Add (Deduct): Fixed manufacturing overhead cost deferred in inventory from Year 2 to Year 3 under absorption costing Add: Fixed manufacturing overhead cost deferred in inventory from Year 3 to the future under absorption costing Absorption costing net operating income (loss) 5b. Unit Sales Sales Cost of goods sold: Cost of goods manufactured Add underapplied overhead Cost of goods sold: Gross margin Selling and administrative expenses Net operating income (loss) MEMOTEC, INC. Income Statement Sales Cost of goods sold Gross margin Selling and administrative costs Net operating income (loss) Production \& sales: Production in units Sales in units \begin{tabular}{crr} Year 1 & Year 2 & \multicolumn{1}{c}{ Year 3 } \\ \hline 50,000 & 60,000 & 40,000 \\ 50,000 & 40,000 & 50,000 \end{tabular} Year 2: Drop in sales 20% Expected sales (units) 50,000 Production set for expected sales and buffer (units) 60,000 Additional Information: Variable manufacturing overhead costs per unit Fixed manufacturing overhead costs per year Variable selling and administrative expenses per unit Fixed selling and administrative expenses per year $$$$4600,000270,000 1. Year 1 Year 2 Year 3 Unit Sales Sales Variable expenses: Variable cost of goods sold Variable selling and administrative Total variable expenses Contribution margin Fixed expenses: Fixed manufacturing overhead Fixed selling and administrative Total fixed expenses Net operating income (loss) 2a. MEMOTEC, INC. Computations Unit product cost: Year1 Year 2 Year 3 Variable manufacturing cost Fixed manufacturing cost Absorption costing unit product cost 2b. Reconciliations: Variable costing net operating income (loss) Add (Deduct): Fixed manufacturing overhead cost deferred in inventory from Year 2 to Year 3 under absorption costing Add: Fixed manufacturing overhead cost deferred in inventory from Year 3 to the future under absorption costing Absorption costing net operating income (loss) 5b. Unit Sales Sales Cost of goods sold: Cost of goods manufactured Add underapplied overhead Cost of goods sold: Gross margin Selling and administrative expenses Net operating income (loss)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started