Answered step by step

Verified Expert Solution

Question

1 Approved Answer

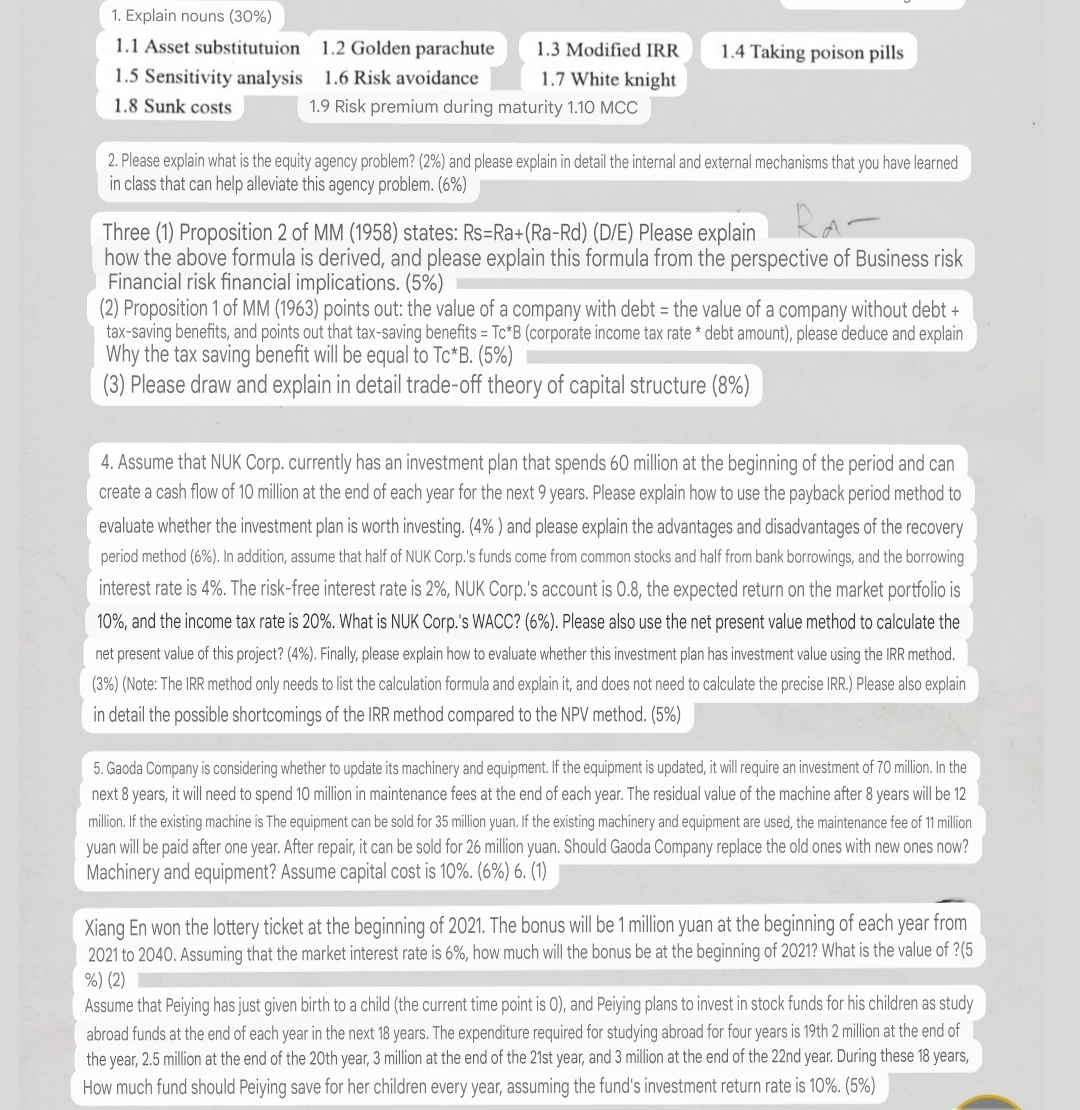

Explain nouns ( 3 0 % ) 1 . 1 Asset substitutuion 1 . 2 Golden parachute 1 . 3 Modified IRR 1 . 4

Explain nouns

Asset substitutuion

Golden parachute

Modified IRR

Taking poison pills

Sensitivity analysis

Risk avoidance

White knight

Sunk costs

Risk premium during maturity MCC

Please explain what is the equity agency problem? and please explain in detail the internal and external mechanisms that you have learned in class that can help alleviate this agency problem.

Three Proposition of MM states: RsRaRaRdDE Please explain how the above formula is derived, and please explain this formula from the perspective of Business risk Financial risk financial implications.

Proposition of MM points out: the value of a company with debt the value of a company without debt taxsaving benefits, and points out that taxsaving benefits TcB

Please draw and explain in detail tradeoff theory of capital structure

Assume that NUK Corp. currently has an investment plan that spends million at the beginning of the period and can create a cash flow of million at the end of each year for the next years. Please explain how to use the payback period method to evaluate whether the investment plan is worth investing. and please explain the advantages and disadvantages of the recovery period method In addition, assume that half of NUK Corp.s funds come from common stocks and half from bank borrowings, and the borrowing interest rate is The riskfree interest rate is NUK Corp.s account is the expected return on the market portfolio is and the income tax rate is What is NUK Corp.s WACC? Please also use the net present value method to calculate the net present value of this project? Finally, please explain how to evaluate whether this investment plan has investment value using the IRR method. Note: The IRR method only needs to list the calculation formula and explain it and does not need to calculate the precise IRR. Please also explain in detail the possible shortcomings of the IRR method compared to the NPV method.

Gaoda Company is considering whether to update its machinery and equipment. If the equipment is updated, it will require an investment of million. In the next years, it will need to spend million in maintenance fees at the end of each year. The residual value of the machine after years will be million. If the existing machine is The equipment can be sold for million yuan. If the existing machinery and equipment are used, the maintenance fee of million yuan will be paid after one year. After repair, it can be sold for million yuan. Should Gaoda Company replace the old ones with new ones now? Machinery and equipment? Assume capital cost is

Xiang En won the lottery ticket at the beginning of The bonus will be million yuan at the beginning of each year from to Assuming that the market interest rate is how much will the bonus be at the beginning of What is the value of

Assume that Peiying has just given birth to a child the current time point is and Peiving plans to invest in stock funds for his children as study abroad funds at the end of each year in the next years. The expenditure required for studying abroad for four years is th million at the end of the year, million at the end of the th year, million at the end of the st year, and million at the end of the nd year. During these years, How much fund should Peiying save for her children every year, assuming the fund's investment return rate is

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started