Answered step by step

Verified Expert Solution

Question

1 Approved Answer

explain step by step please In 2019 you have invested for six months in four different securities (A, B, C, and D). During this whole

explain step by step please

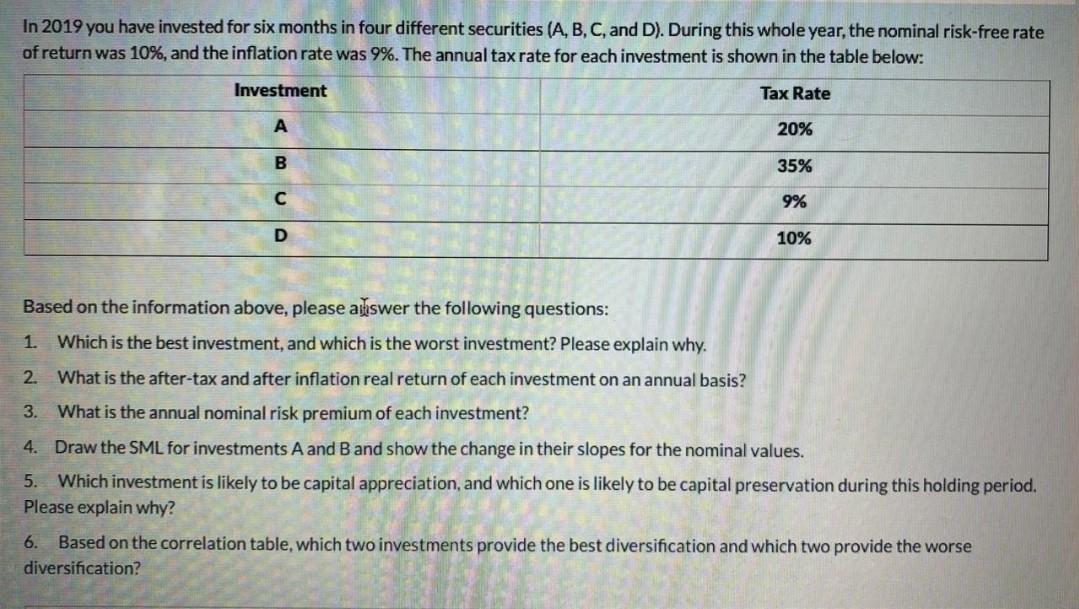

In 2019 you have invested for six months in four different securities (A, B, C, and D). During this whole year, the nominal risk-free rate of return was 10%, and the inflation rate was 9%. The annual tax rate for each investment is shown in the table below: Based on the information above, please arswer the following questions: 1. Which is the best investment, and which is the worst investment? Please explain why. 2. What is the after-tax and after inflation real return of each investment on an annual basis? 3. What is the annual nominal risk premium of each investment? 4. Draw the SML for investments A and B and show the change in their slopes for the nominal values. 5. Which investment is likely to be capital appreciation, and which one is likely to be capital preservation during this holding period. Please explain why? 6. Based on the correlation table, which two investments provide the best diversification and which two provide the worse diversification

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started