explain step by step. Thanks

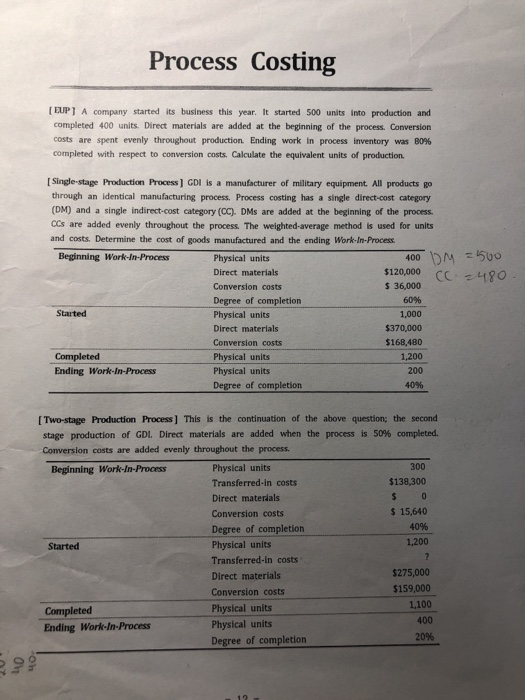

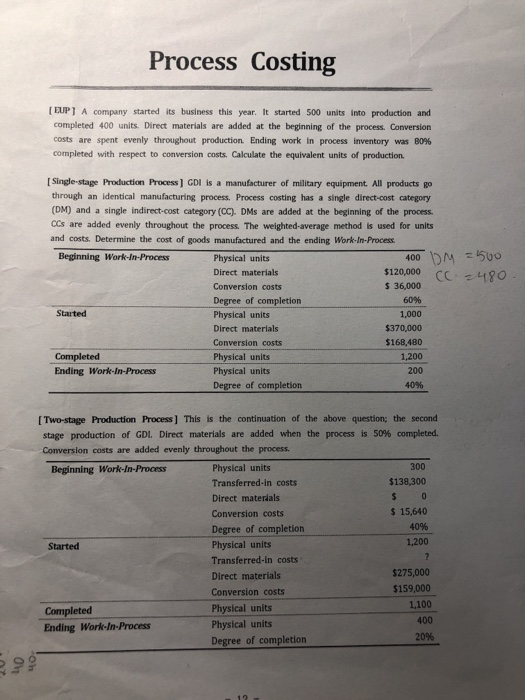

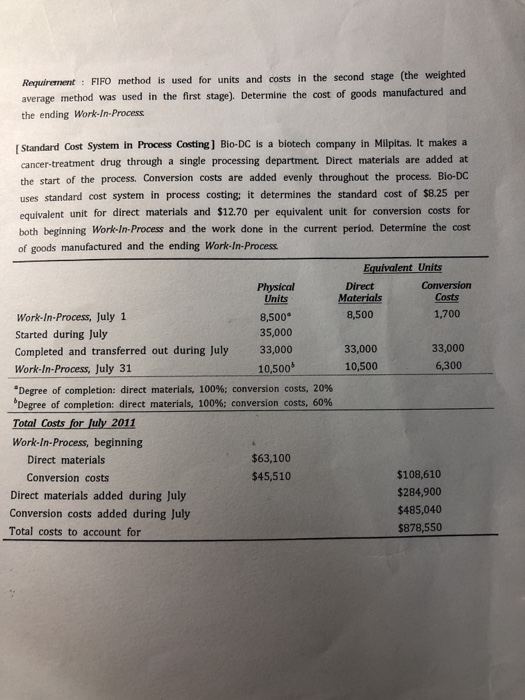

Process Costing EUP A company started its business this year. It started 500 units into production and completed 400 units. Direct materials are added at the beginning of the process. Conversion costs are spent evenly throughout production. Ending work in process inventory was 80 % completed with respect to conversion costs. Calculate the equivalent units of production. [Single-stage Production Process] GDI is a manufacturer of military equipment. All products go through an identical manufacturing process. Process costing has a single direct-cost category (DM) and a single indirect-cost category (CC). DMs are added at the beginning of the process CCs are added evenly throughout the process. The weighted-average method is used for units and costs. Determine the cost of goods manufactured and the ending Work-In-Process DM =500 CC480 Beginning Work-In-Process Physical units 400 $120,000 Direct materials $ 36,000 Conversion costs 60% Degree of completion Started Physical units 1,000 $370,000 Direct materlals Conversion costs $168,480 Completed Physical units 1.200 Ending Work-In-Process Physical units 200 Degree of completion 40% [Two-stage Production Process] This is the continuation of the above question: the second stage production of GDI. Direct materials are added when the process is 50 % completed. Conversion costs are added evenly throughout the process. 300 Physical units Beginning Work-In-Process $138,300 Transferred-in costs S Direct materials $ 15,640 Conversion costs 40% Degree of completion Physical units 1.200 Started Transferred-in costs $275,000 Direct materials $159,000 Conversion costs 1.100 Physical units Completed Ending Work-In-Process 400 Physical units 20% Degree of completion Requirement FIFO method is used for units and costs in the second stage (the weighted average method was used in the first stage). Determine the cost of goods manufactured and the ending Work-In-Process Standard Cost System in Process Costing] Bio-DC is a biotech company in Milpitas. It makes a cancer-treatment drug through a single processing department. Direct materials are added at the start of the process. Conversion costs are added evenly throughout the process. Bio-DC uses standard cost system in process costing: it determines the standard cost of $8.25 per equivalent unit for direct materials and $12.70 per equivalent unit for conversion costs for both beginning Work-In-Process and the work done in the current period. Determine the cost of goods manufactured and the ending Work-In-Process Equivalent Units Direct Materials Conversion Costs Physical Units 8,500 1,700 Work-In-Process, July 1 8,500* 35,000 Started during July 33,000 33,000 33,000 Completed and transferred out during July 6,300 10,500 10,500 Work-In-Process, July 31 Degree of completion: direct materials, 100 % ; conversion costs, 20 % Degree of completion: direct materials, 100 % ; conversion costs, 60 % Total Costs for July 2011 Work-In-Process, beginning $63,100 Direct materials $108,610 $45,510 Conversion costs $284,900 Direct materials added during July Conversion costs added during July $485,040 $878,550 Total costs to account for Process Costing EUP A company started its business this year. It started 500 units into production and completed 400 units. Direct materials are added at the beginning of the process. Conversion costs are spent evenly throughout production. Ending work in process inventory was 80 % completed with respect to conversion costs. Calculate the equivalent units of production. [Single-stage Production Process] GDI is a manufacturer of military equipment. All products go through an identical manufacturing process. Process costing has a single direct-cost category (DM) and a single indirect-cost category (CC). DMs are added at the beginning of the process CCs are added evenly throughout the process. The weighted-average method is used for units and costs. Determine the cost of goods manufactured and the ending Work-In-Process DM =500 CC480 Beginning Work-In-Process Physical units 400 $120,000 Direct materials $ 36,000 Conversion costs 60% Degree of completion Started Physical units 1,000 $370,000 Direct materlals Conversion costs $168,480 Completed Physical units 1.200 Ending Work-In-Process Physical units 200 Degree of completion 40% [Two-stage Production Process] This is the continuation of the above question: the second stage production of GDI. Direct materials are added when the process is 50 % completed. Conversion costs are added evenly throughout the process. 300 Physical units Beginning Work-In-Process $138,300 Transferred-in costs S Direct materials $ 15,640 Conversion costs 40% Degree of completion Physical units 1.200 Started Transferred-in costs $275,000 Direct materials $159,000 Conversion costs 1.100 Physical units Completed Ending Work-In-Process 400 Physical units 20% Degree of completion Requirement FIFO method is used for units and costs in the second stage (the weighted average method was used in the first stage). Determine the cost of goods manufactured and the ending Work-In-Process Standard Cost System in Process Costing] Bio-DC is a biotech company in Milpitas. It makes a cancer-treatment drug through a single processing department. Direct materials are added at the start of the process. Conversion costs are added evenly throughout the process. Bio-DC uses standard cost system in process costing: it determines the standard cost of $8.25 per equivalent unit for direct materials and $12.70 per equivalent unit for conversion costs for both beginning Work-In-Process and the work done in the current period. Determine the cost of goods manufactured and the ending Work-In-Process Equivalent Units Direct Materials Conversion Costs Physical Units 8,500 1,700 Work-In-Process, July 1 8,500* 35,000 Started during July 33,000 33,000 33,000 Completed and transferred out during July 6,300 10,500 10,500 Work-In-Process, July 31 Degree of completion: direct materials, 100 % ; conversion costs, 20 % Degree of completion: direct materials, 100 % ; conversion costs, 60 % Total Costs for July 2011 Work-In-Process, beginning $63,100 Direct materials $108,610 $45,510 Conversion costs $284,900 Direct materials added during July Conversion costs added during July $485,040 $878,550 Total costs to account for