Explain the attached questions below.

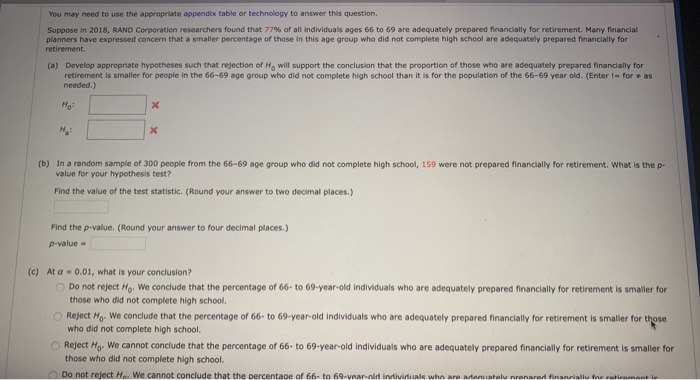

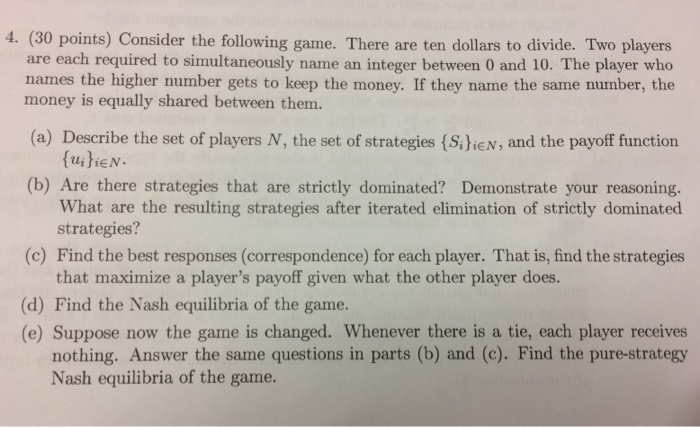

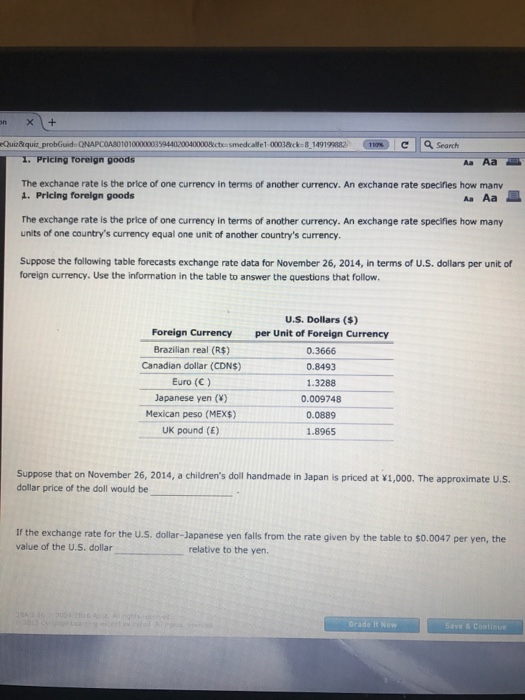

You may need to use the appropriate appendix table or technology to answer this question. Suppose In 2018, RAND Corporation researchers found that 77% of all individuals ages 66 to 65 are adequately prepared financially for retirement, Many financial planners have expressed concern that a smaller percentage of those in this age group who did not complete high school are adequately prepared financially for retirement. (a) Develop appropriate hypotheses such that rejection of N, will support the conclusion that the proportion of those who are adequately prepared financially for retirement is smaller for people in the 66-69 age group who did not complete high school than it is for the population of the 66-69 year old. (Enter In for a as needed.} (b) In a random sample of 300 people from the 65-69 age group who did not complete high school, 159 were not prepared financially for retirement. What is the p- value for your hypothesis test? Find the value of the test statistic. (Round your answer to two decimal places.) Find the p-value. (Round your answer to four decimal places.) p-value = (c] At a = 0.01, what is your conclusion? Do not reject He. We conclude that the percentage of 66- to 69-year-old individuals who are adequately prepared financially for retirement is smaller for those who did not complete high school. Reject Ho. We conclude that the percentage of 66- to 69-year-old individuals who are adequately prepared financially for retirement is smaller for those who did not complete high school. Reject Ho. We cannot conclude that the percentage of 66- to 69-year-old individuals who are adequately prepared financially for retirement is smaller for those who did not complete high school. Do not reject H,. We cannot conclude that the percentage of 66- to 69-vear-old individuals who are adequately pranarad financially far vatican4. (30 points) Consider the following game. There are ten dollars to divide. Two players are each required to simultaneously name an integer between 0 and 10. The player who names the higher number gets to keep the money. If they name the same number, the money is equally shared between them. (a) Describe the set of players N, the set of strategies { Silien, and the payoff function QuitiEN. (b) Are there strategies that are strictly dominated? Demonstrate your reasoning. What are the resulting strategies after iterated elimination of strictly dominated strategies? (c) Find the best responses (correspondence) for each player. That is, find the strategies that maximize a player's payoff given what the other player does. (d) Find the Nash equilibria of the game. (e) Suppose now the game is changed. Whenever there is a tie, each player receives nothing. Answer the same questions in parts (b) and (c). Find the pure-strategy Nash equilibria of the game.+ Quizaquiz probGuid=(NAPCOA$01010001003594-40200400008cix-smedcalle1-00018ck-8_14919842 10 C Q Sand 1. Pricing foreign goods As Aa The exchange rate Is the price of one currency in terms of another currency. An exchange rate specifies how many 1. Pricing foreign goods An Aa The exchange rate Is the price of one currency in terms of another currency. An exchange rate specifies how many units of one country's currency equal one unit of another country's currency. Suppose the following table forecasts exchange rate data for November 26, 2014, in terms of U.S. dollars per unit of foreign currency. Use the information in the table to answer the questions that follow. U.S. Dollars ($) Foreign Currency per Unit of Foreign Currency Brazilian real (R$) 0.3666 Canadian dollar (CDN$) 0.8493 Euro (C ) 1.3288 Japanese yen (#) 0.009748 Mexican peso (MEX$) 0.0889 UK pound (E) 1.8965 Suppose that on November 26, 2014, a children's doll handmade in Japan is priced at V1,000. The approximate U.S. dollar price of the doll would be If the exchange rate for the U.S. dollar-Japanese yen falls from the rate given by the table to $0.0047 per yen, the value of the U.S. dollar relative to the yen. Grade It Now Save & Continue