Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Explain the balance sheet and income statement per step Case 5-2 Grennell Farm Early in 2010, Denise Grey was notified by a lawyer that her

Explain the balance sheet and income statement per step

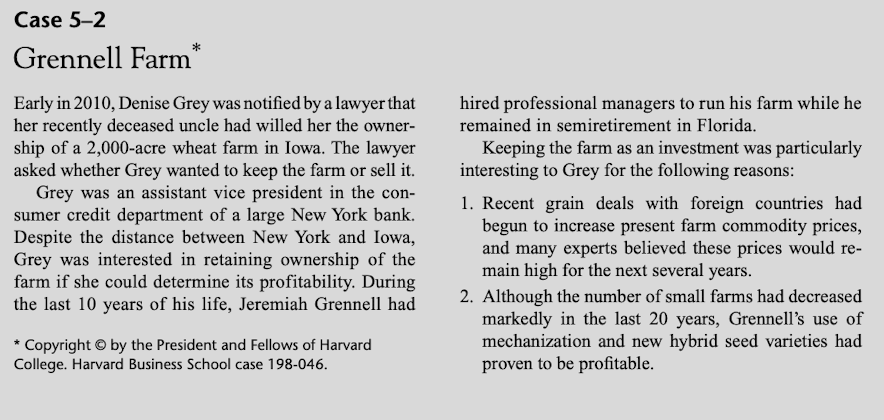

Case 5-2 Grennell Farm Early in 2010, Denise Grey was notified by a lawyer that her recently deceased uncle had willed her the owner- ship of a 2,000-acre wheat farm in Iowa. The lawyer asked whether Grey wanted to keep the farm or sell it. Grey was an assistant vice president in the con- sumer credit department of a large New York bank. Despite the distance between New York and Iowa, Grey was interested in retaining ownership of the farm if she could determine its profitability. During the last 10 years of his life, Jeremiah Grennell had * Copyright by the President and Fellows of Harvard College. Harvard Business School case 198-046. hired professional managers to run his farm while he remained in semiretirement in Florida. Keeping the farm as an investment was particularly interesting to Grey for the following reasons: 1. Recent grain deals with foreign countries had begun to increase present farm commodity prices, and many experts believed these prices would re- main high for the next several years. 2. Although the number of small farms had decreased markedly in the last 20 years, Grennell's use of mechanization and new hybrid seed varieties had proven to be profitable. 3. After some downward movement in the early 2000s, the value of good farmland in Iowa was beginning to appreciate at about 10 percent a year. Included in the lawyer's letter were data on revenues and expenses for 2009 and certain information on bal- ance sheet items, which are summarized below: Land The original cost of the land was $375,000. It was appraised for estate tax purposes at $1,050 per acre. Buildings and Machinery Buildings and machinery with an original cost of $412,500 and accumulated depreciation of $300,000 are employed on the farm. The equipment was ap- praised at net book value. Beginning inventory 2009 wheat production Shipped to grain elevator Grain stored at farm at end of 2009 O bushels 210,000 bushels 180,000 bushels 30,000 bushels Current Liabilities The farm has notes payable and accounts payable to- taling $33,000 2009 Expenses for the Grennell Farm $ 0.053 0.295 0.107 0.058 $ 0.513 A. Production costs per bushel: Seed Fertilizer and chemicals Machinery costs, fuel, and repairs Part-time labor and other costs Total production cost per bushel B. Annual costs not related to the volume of production: Salaries and wages Insurance Taxes Depreciation Other expenses Total costs not related to production volume $ 72,500 4,500 32,500 28,500 45,000 $183,000 a This figure excludes income taxes since the corporation was taxed as a sole proprietorship. Owner's Equity Common stock has a par value of $7,500 plus an addi- tional paid-in capital of $450,000. There was no record of retained earnings. It was known that Jere- miah Grennell withdrew all of the farm's earnings in the last few years in order to continue the lifestyle to which he had become accustomed in Florida. Looking over the data on revenues and expenses, Grey discovered that there were no monetary numbers for 2009's total revenues or ending inventory. The lawyer's letter explained that there was some doubt in his mind about when revenue for the farm should be recognized and about the appropriate way to value the grain inventory. The lawyer's understanding was that there are at least three alternative stages in the wheat growing cycle at which revenue could be counted in unaudited statements. First, the production method could be used. Since wheat has a daily valuation on the Chicago Commodity Exchange, any unsold inventory as of December 31 could be valued at market price very objectively. In this way, revenue can be counted for all wheat produced in a given year, regardless of whether it is sold or not. A decision not to sell this wheat before December 31 is based on speculation about future wheat price increases. Second, the sales method (also called the delivery method) could be used. This approach would recognize revenue when the grain is purchased and received from the farm by the grain elevator operator in the neighbor- ing town. In this instance, the owner of the grain eleva- tor had just sold control to a Kansas City company with limited experience in running such a facility. The manager of the Grennell Farm had expressed some concern about selling to an unknown operator. Third, the collection method could be used. Under this approach, revenue is counted when the cash is Prices The average price per bushel that the elevator operator had agreed to pay for wheat shipped to the grain eleva- tor in 2009 was $2.90. The price per bushel at the time of the wheat harvest was $2.80. The closing price per bushel on December 31, 2009, was $3.07. Accounts Receivable At year-end, the proceeds from 20,000 bushels shipped to the grain elevator had not yet been received from the elevator operator. The average sales price of these 20,000 bushels of wheat had been $2.98 per bushel. There were no uncollected proceeds on December 31, 2009. Cash The farm had a checking account balance of $7,700 and a money market account balance of $23,200. actually received by the farm from the grain elevator operator. Full collection often took several months be- cause a grain elevator operator might keep wheat for a considerable time in the hope that prices would rise so the elevator company could sell at a higher price than that paid the farmer. (Hint: Under the collection method, accounts re- ceivable are zero. Under the production method, ending inventory is zero. Under all three methods, assume beginning retained earnings are zero.) 2. Assume that the Grennell Farm had received a firm offer of $225,000 for 100 acres of the farm that would be used as the site of a new housing devel- opment. This development would have no effect on the use of the remaining acreage as a farm, and Ms. Grey planned to accept it. How would you ac- count in the 2009 financial statements for the eco- nomic gain represented by this appreciation in land values? 3. Should Ms. Grey retain ownership of the farm? Questions 1. Prepare the 2009 income statement and the related ending balance sheet for the Grennell Farm recog- nizing revenue by the a. Sales (delivery method). b. Collection method. c. Production methodStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started