Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Explain the difference between closed - fact and open - fact situations. A . In a closed - fact situation, the facts have occurred, and

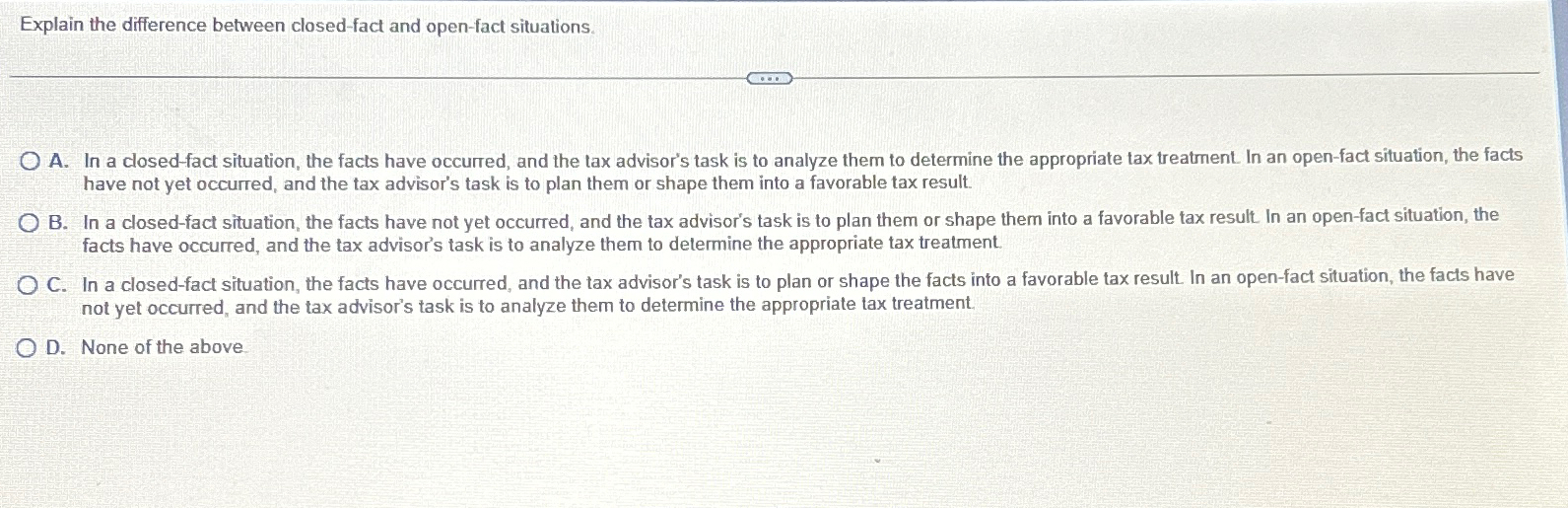

Explain the difference between closedfact and openfact situations.

A In a closedfact situation, the facts have occurred, and the tax advisor's task is to analyze them to determine the appropriate tax treatment. In an openfact situation, the facts have not yet occurred, and the tax advisor's task is to plan them or shape them into a favorable tax result.

B In a closedfact situation, the facts have not yet occurred, and the tax advisor's task is to plan them or shape them into a favorable tax result In an openfact situation, the facts have occurred, and the tax advisor's task is to analyze them to determine the appropriate tax treatment.

C In a closedfact situation, the facts have occurred, and the tax advisor's task is to plan or shape the facts into a favorable tax result. In an openfact situation, the facts have not yet occurred and the tax advisor's task is to analyze them to determine the appropriate tax treatment.

D None of the above

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started