Answered step by step

Verified Expert Solution

Question

1 Approved Answer

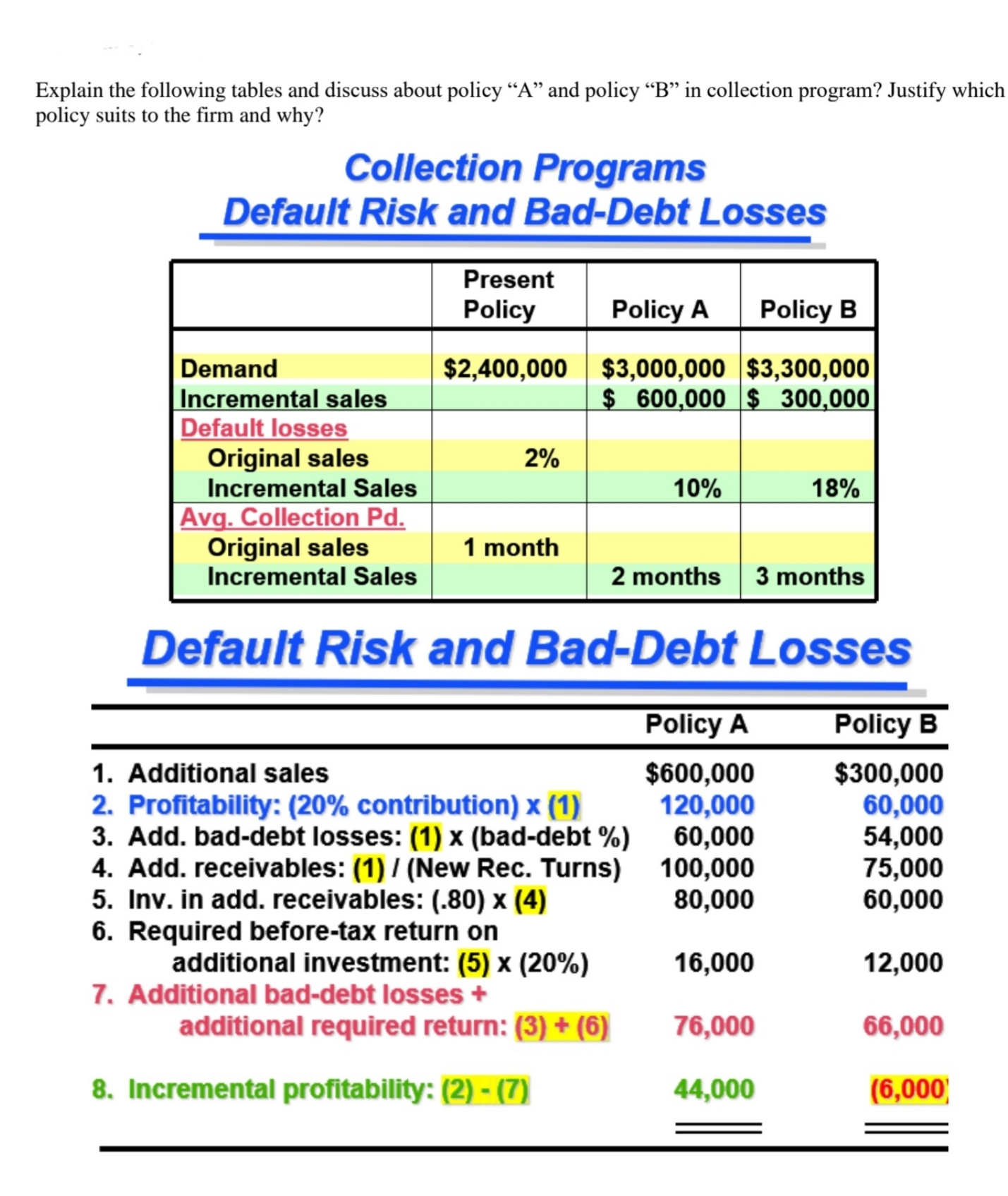

Explain the following tables and discuss about policy A and policy B in collection program? Justify which policy suits to the firm and why?

Explain the following tables and discuss about policy "A" and policy "B" in collection program? Justify which policy suits to the firm and why? Collection Programs Default Risk and Bad-Debt Losses Present Policy $2,400,000 2% Demand Incremental sales Default losses Original sales Incremental Sales Avg. Collection Pd. Original sales Incremental Sales 2 months 3 months Default Risk and Bad-Debt Losses 1 month Policy A Policy B $3,000,000 $3,300,000 $ 600,000 $ 300,000 1. Additional sales 2. Profitability: (20% contribution) x (1) 3. Add. bad-debt losses: (1) x (bad-debt %) 4. Add. receivables: (1) / (New Rec. Turns) 5. Inv. in add. receivables: (.80) x (4) 6. Required before-tax return on additional investment: (5) x (20%) 7. Additional bad-debt losses + additional required return: (3) + (6) 8. Incremental profitability: (2)-(7) 10% Policy A $600,000 120,000 60,000 100,000 80,000 16,000 76,000 44,000 18% Policy B $300,000 60,000 54,000 75,000 60,000 12,000 66,000 (6,000)

Step by Step Solution

★★★★★

3.55 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

The tables provided represent different collection programs and their impact on default risk baddebt losses incremental sales and profitability The po...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started