Question

Explain the intent of the taxation policy decisions you made of your seven-year term. What were the macroeconomic principles or models that influenced your decision

Explain the intent of the taxation policy decisions you made of your seven-year term. What were the macroeconomic principles or models that influenced your decision making?

Identify the impact of your changes to the income and corporate tax rates. How were consumption and investment affected by your tax policy decisions? Explain these dynamics using specific macroeconomic principles from the course reading.

Compare and contrast the impact of your tax policy decisions with those of current or historical examples in the United States. What do these examples demonstrate about the validity of macroeconomic models? Be sure to cite your research appropriately.

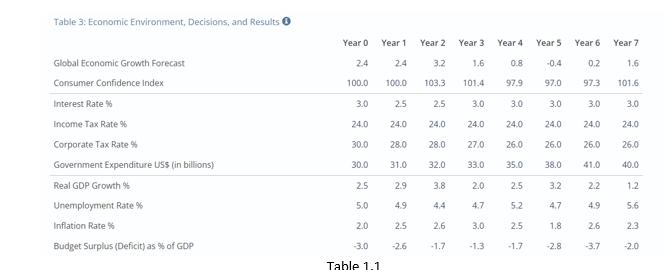

Table 3: Economic Environment, Decisions, and Results Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Global Economic Growth Forecast 2.4 24 3.2 1.6 0.8 -0.4 0.2 1.61 Consumer Confidence Index 100.0 100.0 103.3 101.4 97.9 97.0 97.3 101.6 Interest Rate % 3.0 25 2.5 3.0 3.0 3.0 3.0 3.0 Income Tax Rate % 24.0 24.0 24.0 24.0 24.0 24.0 24.0 24.0 Corporate Tax Rate % 30.0 28.0 28.0 27.0 26.0 26.0 26.0 26.0 Government Expenditure US$ (in billions) 30.0 31.0 32.0 33.0 35.0 38.0 41.0 40.0 Real GDP Growth % 2.5 2.9 3.8 2.0 2.5 3.2 2.2 1.2 Unemployment Rate % 5.0 4.9 4.4 4.7 5.2 4.7 4.9 5.6 Inflation Rate % 2.0 2.5 2.6 3.0 2.5 1.8 2.6 2.3 Budget Surplus (Deficit) as % of GDP 3.0 -2.6 -1.7 -1.3 -1.7 -2.8 -3.7 -20 Table 1.1

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started