Answered step by step

Verified Expert Solution

Question

1 Approved Answer

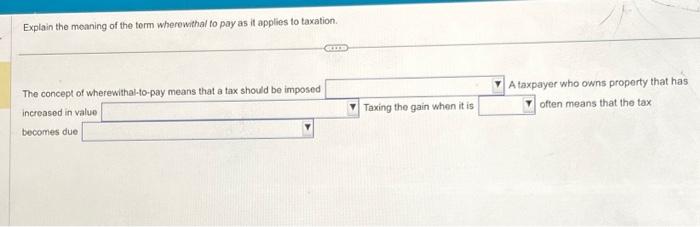

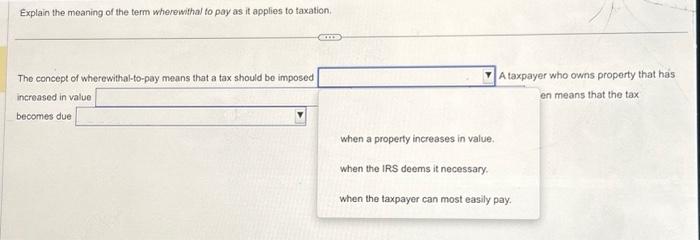

Explain the meaning of the term wherewithal to pay as it applies to taxation. The concept of wherewithal-to-pay means that a tax should be

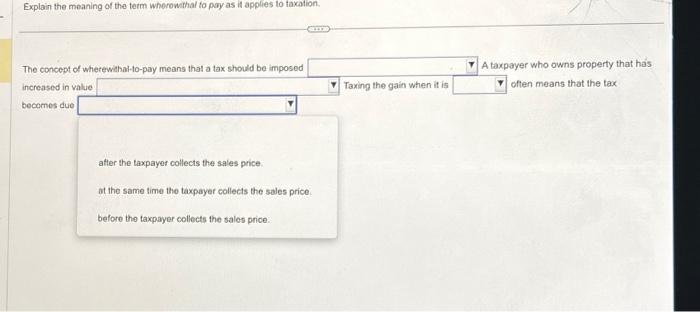

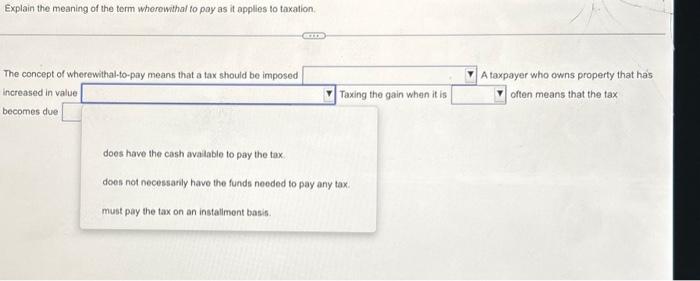

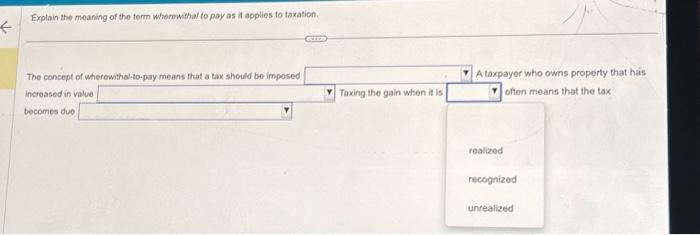

Explain the meaning of the term wherewithal to pay as it applies to taxation. The concept of wherewithal-to-pay means that a tax should be imposed increased in value becomes due CUTE Taxing the gain when it is A taxpayer who owns property that has often means that the tax Explain the meaning of the term wherewithal to pay as it applies to taxation. The concept of wherewithal-to-pay means that a tax should be imposed increased in value becomes due after the taxpayer collects the sales price. at the same time the taxpayer collects the sales price. before the taxpayer collects the sales price. Taxing the gain when it is A taxpayer who owns property that has often means that the taxi Explain the meaning of the term wherewithal to pay as it applies to taxation. The concept of wherewithal-to-pay means that a tax should be imposed increased in value becomes due Taxing the gain when it is does have the cash available to pay the tax does not necessarily have the funds needed to pay any tax. must pay the tax on an installment basis. A taxpayer who owns property that has often means that the tax Explain the meaning of the term wherewithal to pay as it applies to taxation. The concept of wherewithal-to-pay means that a tax should be imposed increased in value becomes due Taxing the gain when it is A taxpayer who owns property that has often means that the tax realized recognized unrealized Explain the meaning of the term wherewithal to pay as it applies to taxation, The concept of wherewithal-to-pay means that a tax should be imposed increased in value becomes due COCOS A taxpayer who owns property that has en means that the tax when a property increases in value. when the IRS deems it necessary. when the taxpayer can most easily pay.

Step by Step Solution

★★★★★

3.40 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

The term wherewithal to pay in the context of taxation refers to a principle that taxes should be im...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started