Answered step by step

Verified Expert Solution

Question

1 Approved Answer

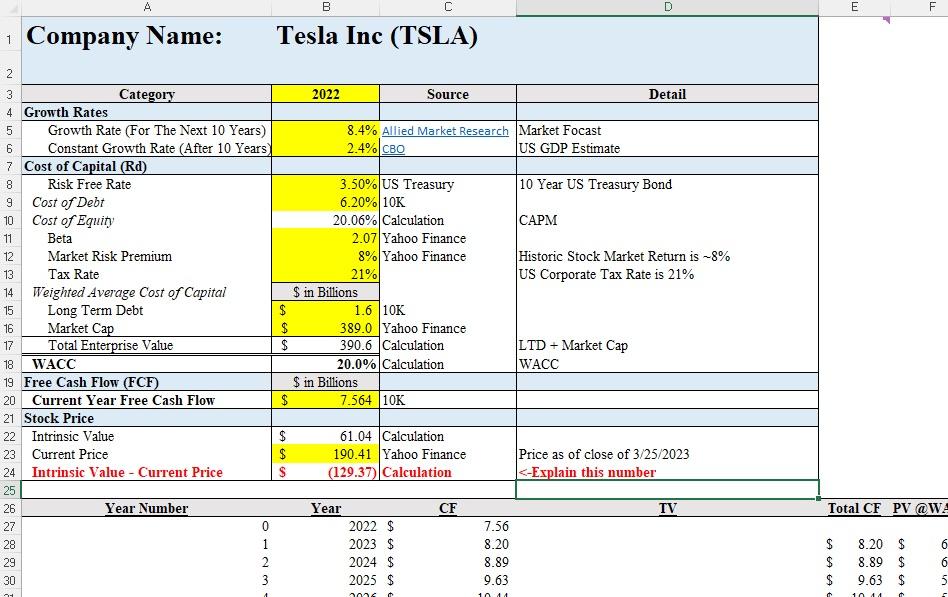

Explain the number (intrinsic value - current price) based on the FCF, WACC, and 8.4% Growth Rate & why this number is not the same

Explain the number (intrinsic value - current price) based on the FCF, WACC, and 8.4% Growth Rate & why this number is not the same to the current price? Based on your analysis, is Tesla overvalued or undervalued?

Company Name: 1 2 W 4 Growth Rates 6 7 8 9 10 11 12 13 VEKTRAN22238 14 15 16 17 18 19 25 26 Category Growth Rate (For The Next 10 Years) Constant Growth Rate (After 10 Years) Free Cash Flow (FCF) 20 Current Year Free Cash Flow 27 A 21 Stock Price 22 Intrinsic Value 23 Current Price 29 Cost of Capital (Rd) Risk Free Rate 30 Cost of Debt Cost of Equity Beta Market Risk Premium Tax Rate Weighted Average Cost of Capital Long Term Debt 24 Intrinsic Value - Current Price Market Cap Total Enterprise Value WACC Year Number OIN M- 0 1 2 3 B Tesla Inc (TSLA) GA GA GA $ $ $ $ 69 69 69 2022 8.4% Allied Market Research Market Focast 2.4% CBO US GDP Estimate 3.50% US Treasury 6.20% 10K 20.06% Calculation $ in Billions C 2.07 Yahoo Finance 8% Yahoo Finance. 21% $ in Billions Source 1.6 10K 389.0 Yahoo Finance 390.6 Calculation 20.0% Calculation 7.564 10K Year 61.04 Calculation 190.41 Yahoo Finance (129.37) Calculation 2022 $ 2023 $ 2024 $ 2025 $ 2006 CF 7.56 8.20 8.89 9.63 10 11 Detail 10 Year US Treasury Bond CAPM Historic Stock Market Return is -8% US Corporate Tax Rate is 21% LTD+ Market Cap WACC Price as of close of 3/25/2023

Step by Step Solution

★★★★★

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

The number Intrinsic Value Current Price represents the difference between the intrinsic value of Te...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started