Question

JTM pays its C-suite officers with stock options. Treasury asked you to price them. JTM's stock trades at $22.50/share; U.S. Treasurys, aka the risk-free

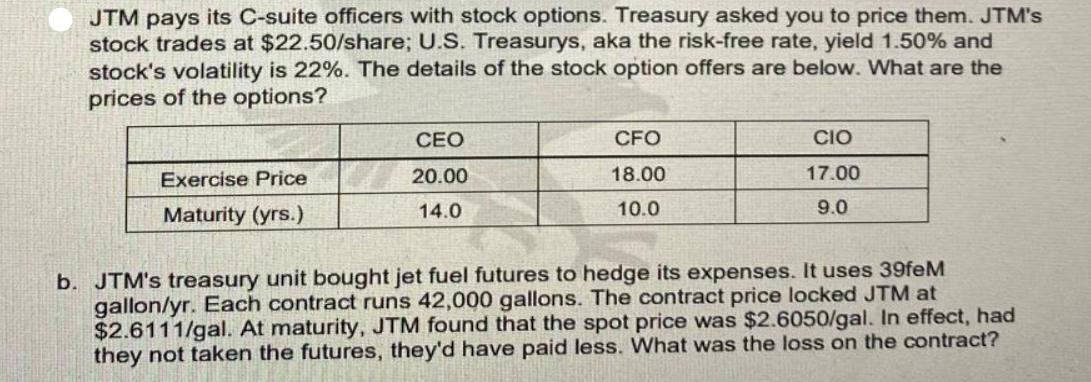

JTM pays its C-suite officers with stock options. Treasury asked you to price them. JTM's stock trades at $22.50/share; U.S. Treasurys, aka the risk-free rate, yield 1.50% and stock's volatility is 22%. The details of the stock option offers are below. What are the prices of the options? Exercise Price Maturity (yrs.) CEO 20.00 14.0 CFO 18.00 10.0 CIO 17.00 9.0 b. JTM's treasury unit bought jet fuel futures to hedge its expenses. It uses 39feM gallon/yr. Each contract runs 42,000 gallons. The contract price locked JTM at $2.6111/gal. At maturity, JTM found that the spot price was $2.6050/gal. In effect, had they not taken the futures, they'd have paid less. What was the loss on the contract?

Step by Step Solution

3.48 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

a CEO 289 CFO 250 CIO 219 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Investment Analysis and Portfolio Management

Authors: Frank K. Reilly, Keith C. Brown

10th Edition

538482109, 1133711774, 538482389, 9780538482103, 9781133711773, 978-0538482387

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App