Answered step by step

Verified Expert Solution

Question

1 Approved Answer

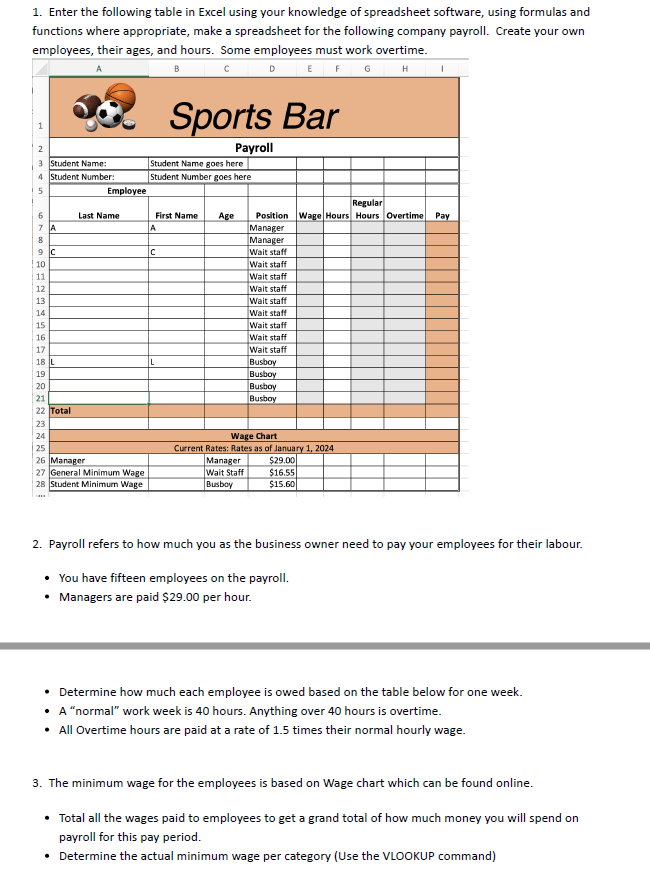

explain thoroughly 1. Enter the following table in Excel using your knowledge of spreadsheet software, using formulas and functions where appropriate, make a spreadsheet for

explain thoroughly

1. Enter the following table in Excel using your knowledge of spreadsheet software, using formulas and functions where appropriate, make a spreadsheet for the following company payroll. Create your own employees, their ages, and hours. Some employees must work overtime. DEF H 3 Student Name: 4 Student Number: 5 CHAHHAHSASSARI 6 7 A 8 9 C 10 11 12 13 14 15 16 17 18 L 19 20 21 22 Total 23 24 25 26 27 Employee Last Name Manager General Minimum Wage 28 Student Minimum Wage Sports Bar Payroll Student Name goes here Student Number goes here First Name Age A C Regular Position Wage Hours Hours Overtime Pay Manager Manager Wait staff Wait staff Wait staff Wait staff Wait staff Wait staff Wait staff Wait staff Wait staff Busboy Busboy Busboy Busboy Wage Chart Current Rates: Rates as of January 1, 2024 Manager Wait Staff Busboy 1 $29.00 $16.55 $15.60 2. Payroll refers to how much you as the business owner need to pay your employees for their labour. You have fifteen employees on the payroll. Managers are paid $29.00 per hour. Determine how much each employee is owed based on the table below for one week. A "normal" work week is 40 hours. Anything over 40 hours is overtime. All Overtime hours are paid at a rate of 1.5 times their normal hourly wage. 3. The minimum wage for the employees is based on Wage chart which can be found online. Total all the wages paid to employees to get a grand total of how much money you will spend on payroll for this pay period. Determine the actual minimum wage per category (Use the VLOOKUP command)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started