Answered step by step

Verified Expert Solution

Question

1 Approved Answer

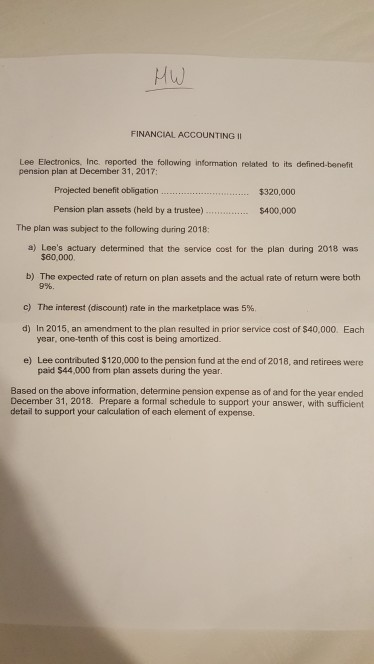

explain thoroughly Mw FINANCIAL ACCOUNTINGII Lee Electronics, Inc. reported the following information related to its defined-benefit pension plan at December 31, 2017: Projected benefit obligation

explain thoroughly

Mw FINANCIAL ACCOUNTINGII Lee Electronics, Inc. reported the following information related to its defined-benefit pension plan at December 31, 2017: Projected benefit obligation Pension plan assets (held by a trustee) ....$400,000 5320,000 The plan was subject to the following during 2018: a) Lee's actuary determined that the service cost for the plan during 2018 was $60,000 b) The expected rate of return on plan assets and the actual rate of return were both 9%. c) The interest (discount) rate in the marketplace was 5% d) In 2015, an amendment to the plan resulted in prior service cost of $40,000. Each e) Lee contributed $120,000 to the pension fund at the end of 2018, and retirees were Based on the above information, determine pension expense as of and for the year ended year, one-tenth of this cost is being amortized. paid $44,000 from plan assets during the year December 31, 2018. Prepare a formal schedule to support your answer, with sufficient detail to support your calculation of each element of expenseStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started