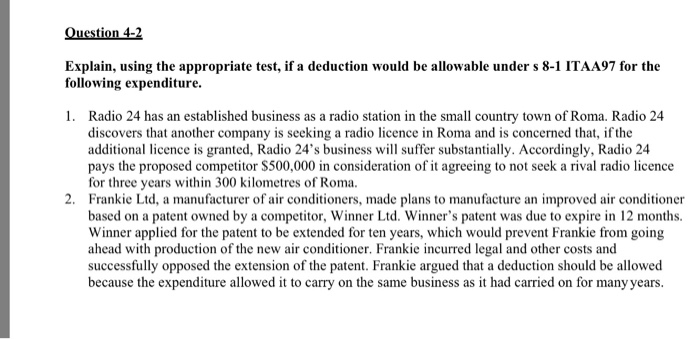

Explain, using the appropriate test, if a deduction would be allowable under s 8-1 ITAA97 for the following expenditure. . Radio 24 has an established business as a radio station in the small country town of Roma. Radio 24 discovers that another company is seeking a radio licence in Roma and is concerned that, if the additional licence is granted, Radio 24's business will suffer substantially. Accordingly, Radio 24 pays the proposed competitor $500,000 in consideration of it agreeing to not seek a rival radio licence for three years within 300 kilometres of Roma. Frankie Ltd, a manufacturer of air conditioners, made plans to manufacture an improved air conditioner based on a patent owned by a competitor, Winner Ltd. Winner's patent was due to expire in 12 months. Winner applied for the patent to be extended for ten years, which would prevent Frankie from going ahead with production of the new air conditioner. Frankie incurred legal and other costs and successfully opposed the extension of the patent. Frankie argued that a deduction should be allowed because the expenditure allowed it to carry on the same business as it had carried on for manyyears 2. Explain, using the appropriate test, if a deduction would be allowable under s 8-1 ITAA97 for the following expenditure. . Radio 24 has an established business as a radio station in the small country town of Roma. Radio 24 discovers that another company is seeking a radio licence in Roma and is concerned that, if the additional licence is granted, Radio 24's business will suffer substantially. Accordingly, Radio 24 pays the proposed competitor $500,000 in consideration of it agreeing to not seek a rival radio licence for three years within 300 kilometres of Roma. Frankie Ltd, a manufacturer of air conditioners, made plans to manufacture an improved air conditioner based on a patent owned by a competitor, Winner Ltd. Winner's patent was due to expire in 12 months. Winner applied for the patent to be extended for ten years, which would prevent Frankie from going ahead with production of the new air conditioner. Frankie incurred legal and other costs and successfully opposed the extension of the patent. Frankie argued that a deduction should be allowed because the expenditure allowed it to carry on the same business as it had carried on for manyyears 2