Answered step by step

Verified Expert Solution

Question

1 Approved Answer

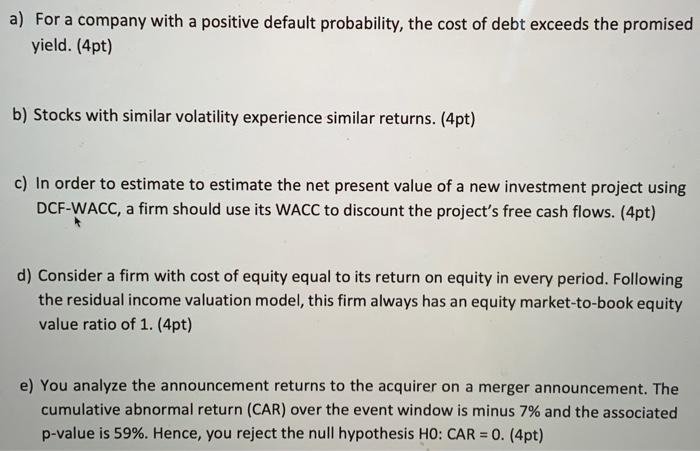

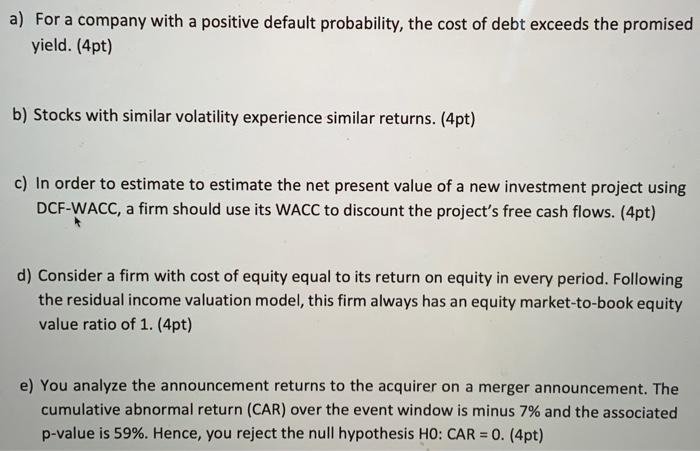

Explain why the following statements are right or wrong a) For a company with a positive default probability, the cost of debt exceeds the promised

Explain why the following statements are right or wrong

a) For a company with a positive default probability, the cost of debt exceeds the promised yield. (4pt) b) Stocks with similar volatility experience similar returns. (4pt) c) In order to estimate to estimate the net present value of a new investment project using DCF-WACC, a firm should use its WACC to discount the project's free cash flows. (4pt) d) Consider a firm with cost of equity equal to its return on equity in every period. Following the residual income valuation model, this firm always has an equity market-to-book equity value ratio of 1.(4pt) e) You analyze the announcement returns to the acquirer on a merger announcement. The cumulative abnormal return (CAR) over the event window is minus 7% and the associated p-value is 59%. Hence, you reject the null hypothesis HO : CAR =0. ( 4pt)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started