- EXPLAIN WITH FULLY EXPLANATION

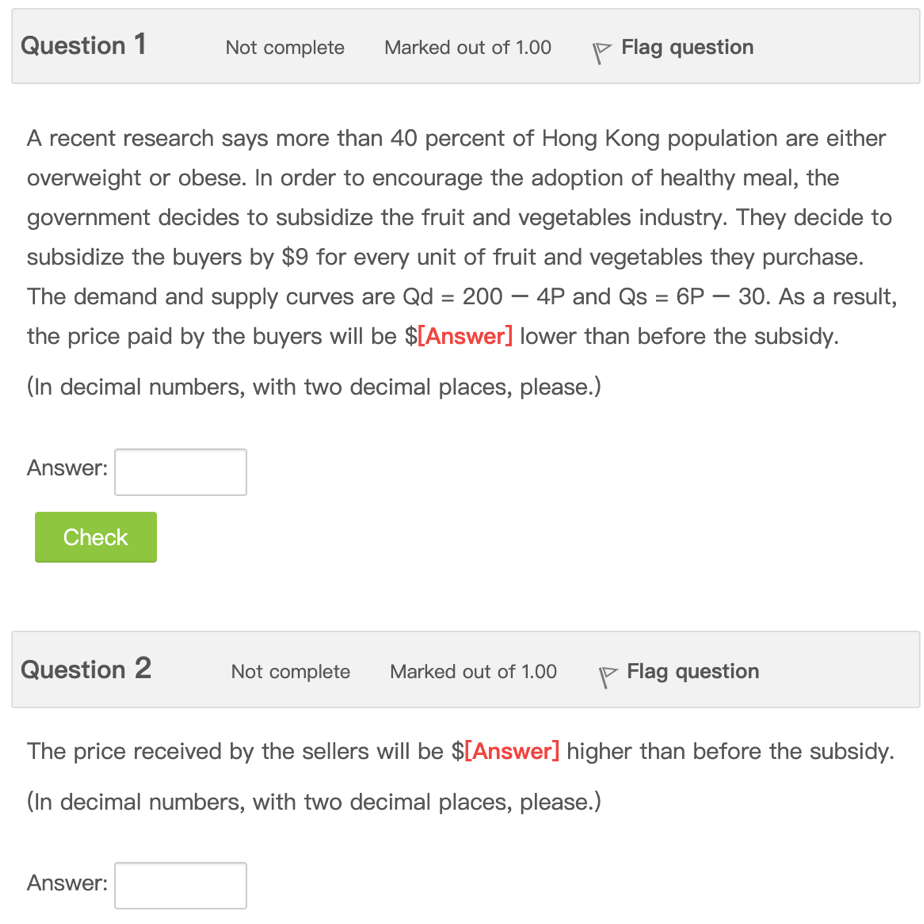

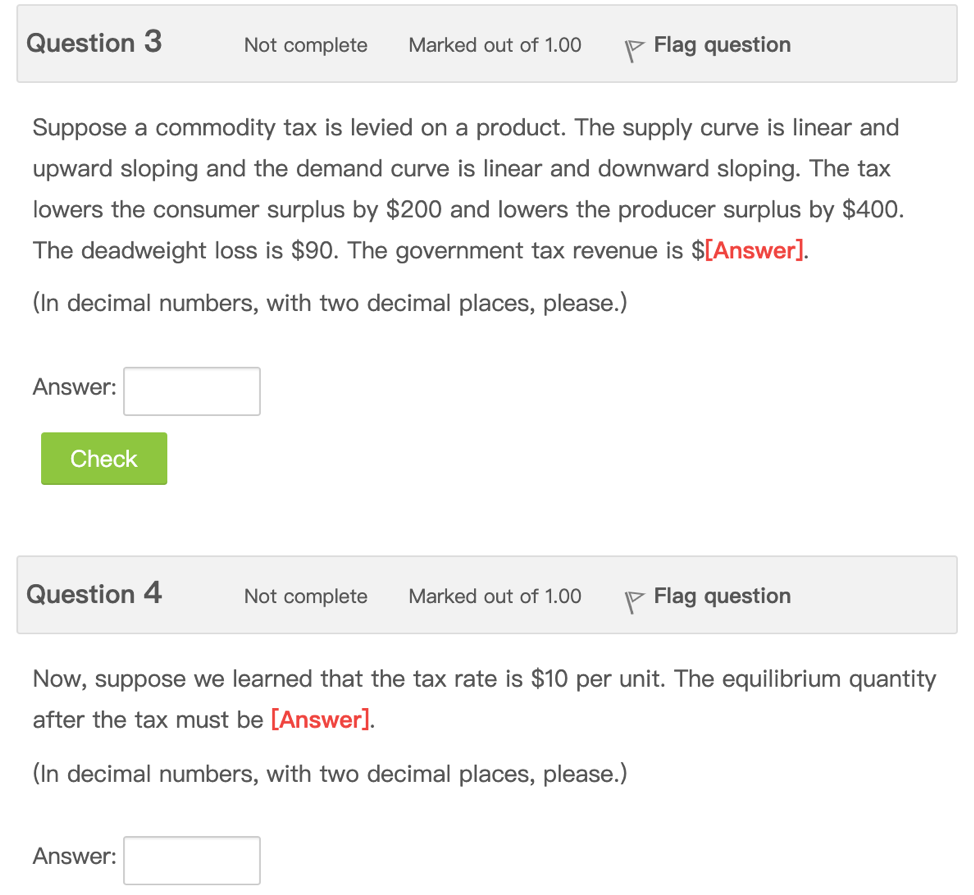

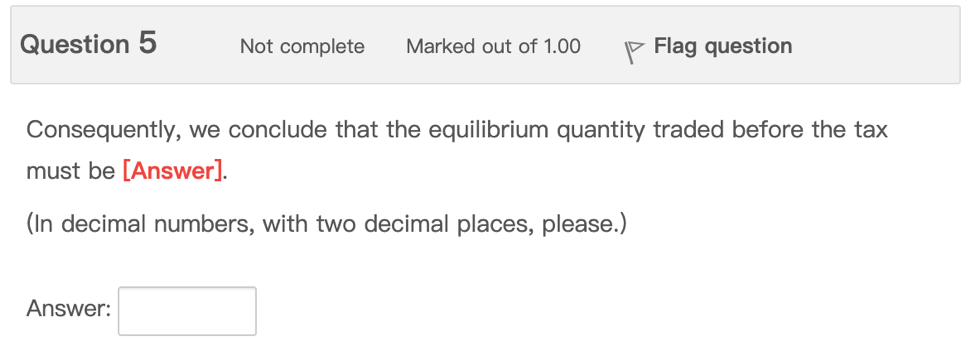

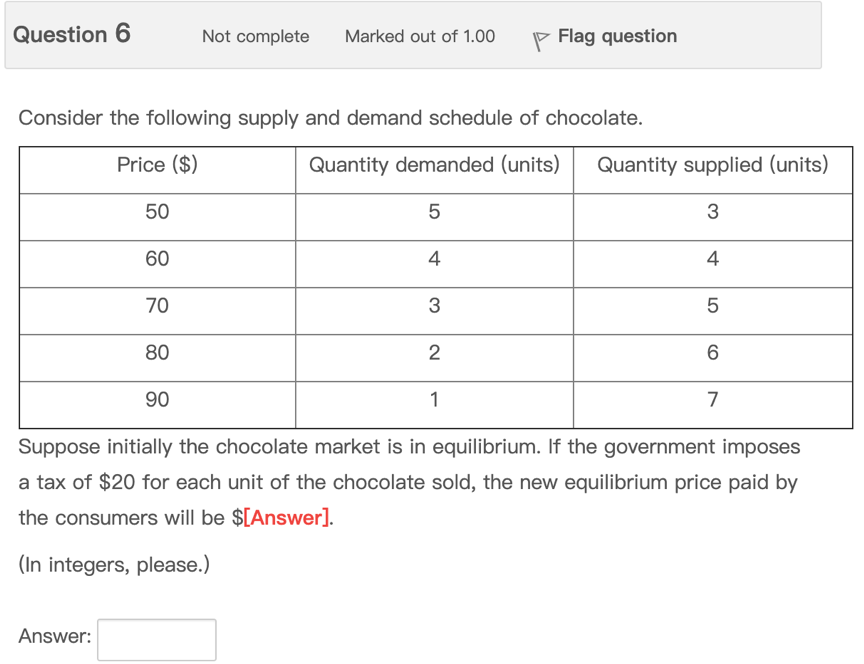

Question 1 Not complete Marked out of 1.00 V Flag question A recent research says more than 40 percent of Hong Kong population are either overweight or obese. In order to encourage the adoption of healthy meal, the government decides to subsidize the fruit and vegetables industry. They decide to subsidize the buyers by $9 for every unit of fruit and vegetables they purchase. The demand and supply curves are Qd = 200 4P and GS = 6P 30. As a result, the price paid by the buyers will be $[Answer] lower than before the subsidy. (In decimal numbers, with two decimal places, please.) Answer: ' Question 2 Not complete Marked out of 1.00 'l' Flag question The price received by the sellers will be $[Answer] higher than before the subsidy. (In decimal numbers, with two decimal places, please.) Answer: I Question 3 Not complete Marked out of 1.00 V Flag question Suppose a commodity tax is levied on a product. The supply curve is linear and upward sloping and the demand curve is linear and downward sloping. The tax lowers the consumer surplus by $200 and lowers the producer surplus by $400. The deadweight loss is $90. The government tax revenue is $[Answer]. (In decimal numbers, with two decimal places, please.) Answer: Question 4 Not complete Marked out of 1.00 \\V Flag question Now, suppose we learned that the tax rate is $10 per unit. The equilibrium quantity after the tax must be [Answer]. (In decimal numbers, with two decimal places, please.) Answer: Question 5 Not complete Marked out of 1.00 V Flag question Consequently, we conclude that the equilibrium quantity traded before the tax must be [Answer]. (In decimal numbers, with two decimal places, please.) Answer: Question 6 Not complete Marked out of 1.00 V Flag question Consider the following supply and demand schedule of chocolate. Quantity demanded (units) Quantity supplied (units) 50 60 70 8O 90 Suppose initially the chocolate market is in equilibrium. If the government imposes a tax of $20 for each unit of the chocolate sold, the new equilibrium price paid by the consumers will be $[Answer]. (In integers, please.) Answer: Question 7 Not complete Marked out of 1.00 '7 Flag question Given the above information, the government's tax revenue will be $[Answer]. (In decimal numbers, with two decimal places, please.) Answer: Question 8 Not complete Marked out of 1.00 V Flag question Consider a market in which the demand curve is given by Q = 26 2P. The supply curve is given by P = 10. The government is considering imposing a tax. If the government wants to maximize the tax revenue collected from this market, the optimal tax rate would be [Answer] per unit. (In decimal numbers, with two decimal places, please.)