Answered step by step

Verified Expert Solution

Question

1 Approved Answer

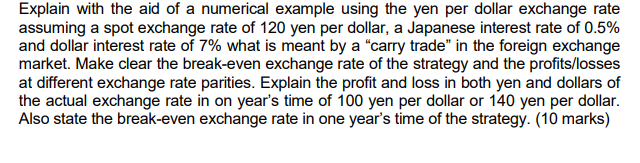

Explain with the aid of a numerical example using the yen per dollar exchange rate assuming a spot exchange rate of 120 yen per

Explain with the aid of a numerical example using the yen per dollar exchange rate assuming a spot exchange rate of 120 yen per dollar, a Japanese interest rate of 0.5% and dollar interest rate of 7% what is meant by a "carry trade" in the foreign exchange market. Make clear the break-even exchange rate of the strategy and the profits/losses at different exchange rate parities. Explain the profit and loss in both yen and dollars of the actual exchange rate in on year's time of 100 yen per dollar or 140 yen per dollar. Also state the break-even exchange rate in one year's time of the strategy. (10 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

A carry trade is a popular strategy in the foreign exchange market where an investor borrows money in a currency with a lowinterest rate and then uses ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started