Answered step by step

Verified Expert Solution

Question

1 Approved Answer

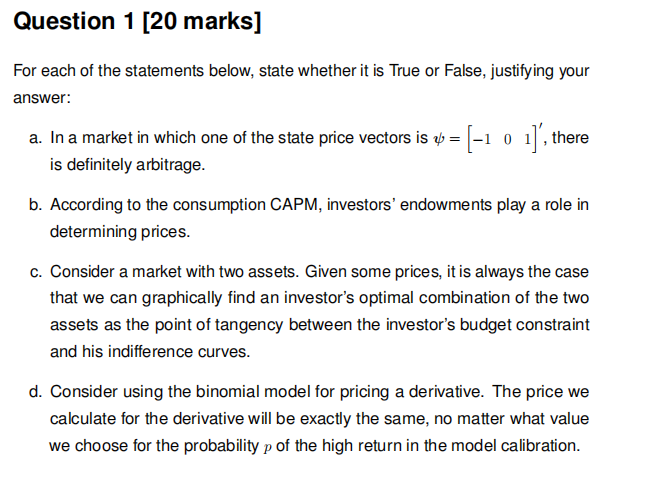

explain your answer Question 1 [20 marks] For each of the statements below, state whether it is True or False, justifying your answer: a. In

explain your answer

Question 1 [20 marks] For each of the statements below, state whether it is True or False, justifying your answer: a. In a market in which one of the state price vectors is * = (-1 o 1)', there v is definitely arbitrage. b. According to the consumption CAPM, investors' endowments play a role in determining prices. c. Consider a market with two assets. Given some prices, it is always the case that we can graphically find an investor's optimal combination of the two assets as the point of tangency between the investor's budget constraint and his indifference curves. d. Consider using the binomial model for pricing a derivative. The price we calculate for the derivative will be exactly the same, no matter what value we choose for the probability p of the high return in the model calibration. Question 1 [20 marks] For each of the statements below, state whether it is True or False, justifying your answer: a. In a market in which one of the state price vectors is * = (-1 o 1)', there v is definitely arbitrage. b. According to the consumption CAPM, investors' endowments play a role in determining prices. c. Consider a market with two assets. Given some prices, it is always the case that we can graphically find an investor's optimal combination of the two assets as the point of tangency between the investor's budget constraint and his indifference curves. d. Consider using the binomial model for pricing a derivative. The price we calculate for the derivative will be exactly the same, no matter what value we choose for the probability p of the high return in the model calibrationStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started