Question

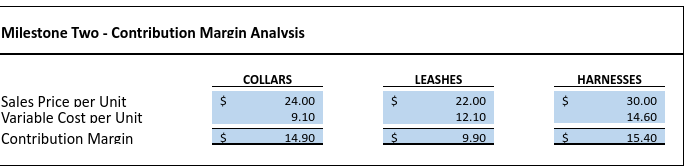

explain your contribution margin per unit. How did you arrive at these numbers? Be sure to reference your cost-volume-profit analysis in your defense. Specify the

explain your contribution margin per unit. How did you arrive at these numbers? Be sure to reference your cost-volume-profit analysis in your defense.

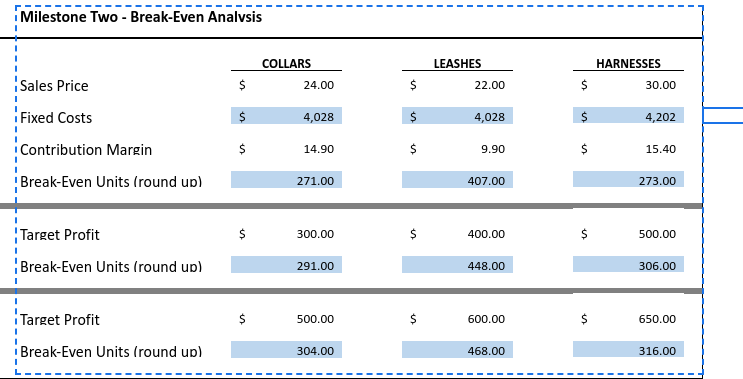

Specify the break-even points you determined for achieving different target profit levels. Then, explain and defend the target profits you selected for each area of your business. Be sure to reference your cost-volume-profit analysis in your defense.

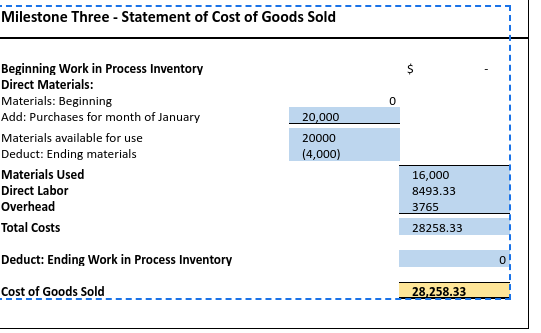

Compare the actual cost of goods sold over the last month and evaluate the companys performance against the budgeted benchmarks. Are the numbers close to what you expected? Interpret the performance and explain what happened

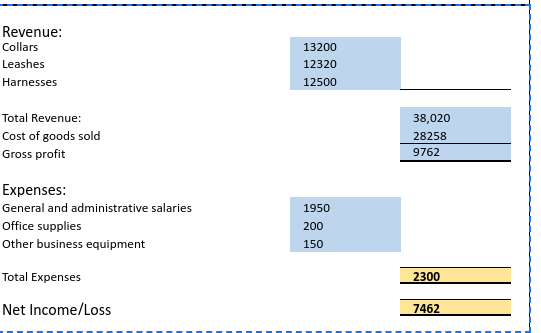

Based on your income statement, logically interpret the businesss performance against the provided benchmarks. Did the company do as well as expected? Explain what happened.

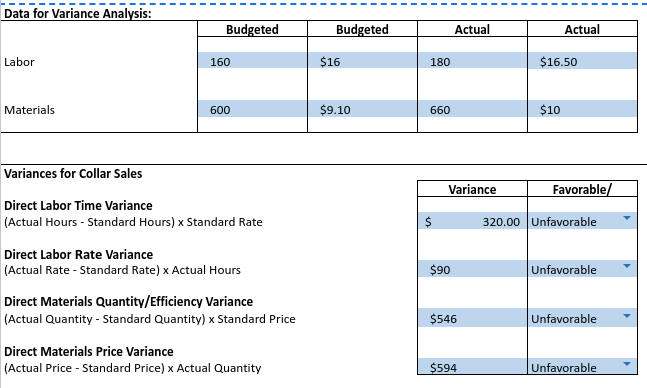

Illustrate the variances observed between the planned and actual values for the direct labor time and the direct materials price for collars. What changed?]

Evaluate the significance of the variances. Are the variances favorable or unfavorable? What does it mean? Explain whether and how your evaluation will affect your budgeting and planning decisions for the next month or quarter.]

Milestone Three - Statement of Cost of Goods Sold Beginning Work in Process Inventory Direct Materials: Materials: Beginning Add: Purchases for month of January Materials available for use Deduct: Ending materials \begin{tabular}{ll} & 0 \\ 20,000 & \\ \hline 20000 & \\ (4,000) & \end{tabular} Materials Used Direct Labor Overhead Total Costs $ 0 Deduct: Ending Work in Process Inventory 28,258.33 Revenue: Collars Leashes Harnesses \begin{tabular}{l|l} 13200 & \\ 12320 & \\ 12500 & \\ \cline { 2 - 2 } & 38,020 \\ & 28258 \\ \hline & 9762 \\ \hline \end{tabular} Total Revenue: Cost of goods sold Gross profit Expenses: General and administrative salaries Office supplies Other business equipment Total Expenses Net Income/Loss 2300 7462 \begin{tabular}{|c|c|c|c|c|c|c|} \hline \multirow[b]{2}{*}{ Sales Price } & \multicolumn{2}{|c|}{ COLLARS } & \multicolumn{2}{|c|}{ LEASHES } & \multicolumn{2}{|c|}{ HARNESSES } \\ \hline & $ & 24.00 & $ & 22.00 & $ & 30.00 \\ \hline Fixed Costs & $ & 4,028 & $ & 4,028 & $ & 4,202 \\ \hline Contribution Margin & $ & 14.90 & $ & 9.90 & $ & 15.40 \\ \hline Break-Even Units (round up) & & 271.00 & & 407.00 & & 273.00 \\ \hline Target Profit & $ & 300.00 & $ & 400.00 & $ & 500.00 \\ \hline |'Break-Even Units (round up) & & 291.00 & & 448.00 & & 306.00 \\ \hline Target Profit & $ & 500.00 & $ & 600.00 & $ & 650.00 \\ \hline Break-Even Units (round up) & & 304.00 & & 468.00 & & 316.00 \\ \hline \end{tabular} Data for Variance Analysis: \begin{tabular}{l|l|l|l|l|} \hline & Budgeted & Budgeted & Actual & Actual \\ \cline { 2 - 5 } & & & & \\ Labor & 160 & $16 & 180 & $16.50 \\ Materials & & & & \\ \hline \end{tabular} Variances for Collar Sales Direct Labor Time Variance (Actual Hours - Standard Hours) x Standard Rate Direct Labor Rate Variance (Actual Rate - Standard Rate) x Actual Hours Direct Materials Quantity/Efficiency Variance (Actual Quantity - Standard Quantity) x Standard Price Direct Materials Price Variance (Actual Price - Standard Price) x Actual Quantity \begin{tabular}{|ll|ll|} \hline \multicolumn{2}{|c|}{ Variance } & \multicolumn{2}{|c|}{ Favorable/ } \\ \hline & 320.00 & Unfavorable & - \\ & & & \\ $90 & & Unfavorable & \\ & & & \\ $546 & & Unfavorable & - \\ & & & \\ $594 & & Unfavorable & - \\ \hline \end{tabular} Milestone Two - Contribution Margin Analvsis \begin{tabular}{|c|c|c|c|c|c|c|} \hline \multirow[b]{2}{*}{SalesPriceperUnitVariableCostperUnit} & \multicolumn{2}{|c|}{ COLLARS } & \multicolumn{2}{|c|}{ LEASHES } & \multicolumn{2}{|c|}{ HARNESSES } \\ \hline & $ & 24.009.10 & $ & 22.0012.10 & $ & 30.0014.60 \\ \hline ntribution Margin & 5 & 14.90 & 5 & 9.90 & 5 & 15.40 \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started