Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(Explain your work! Make your spreadsheet easy to read! Write your own present-value formulas (do not use Excels =PV or =NPV built-in functions). Do not

(Explain your work! Make your spreadsheet easy to read! Write your own present-value formulas (do not use Excels =PV or =NPV built-in functions). Do not write numbers into formulas: use cell references.)

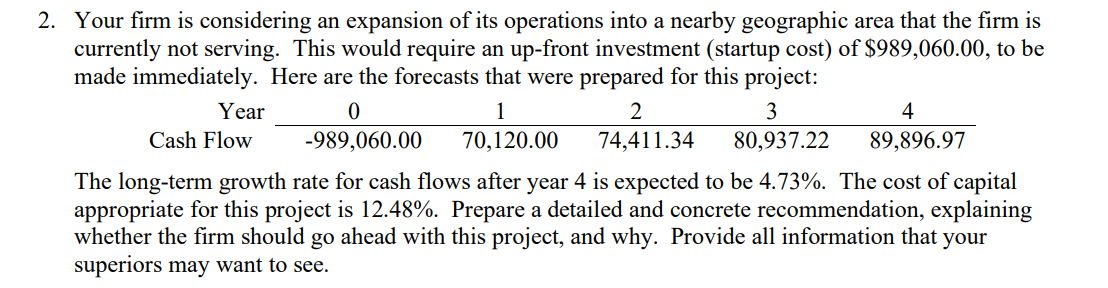

Your firm is considering an expansion of its operations into a nearby geographic area that the firm is currently not serving. This would require an up-front investment (startup cost) of $989,060.00, to be made immediately. Here are the forecasts that were prepared for this project: The long-term growth rate for cash flows after year 4 is expected to be 4.73%. The cost of capital appropriate for this project is 12.48%. Prepare a detailed and concrete recommendation, explaining whether the firm should go ahead with this project, and why. Provide all information that your superiors may want to see

Your firm is considering an expansion of its operations into a nearby geographic area that the firm is currently not serving. This would require an up-front investment (startup cost) of $989,060.00, to be made immediately. Here are the forecasts that were prepared for this project: The long-term growth rate for cash flows after year 4 is expected to be 4.73%. The cost of capital appropriate for this project is 12.48%. Prepare a detailed and concrete recommendation, explaining whether the firm should go ahead with this project, and why. Provide all information that your superiors may want to see Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started