Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Exploration 3.2 - Prepaid Expense - Adjusting Entries (18) Goal: Learn to apply adjustments to prepaid expenses. Instructions: A description of an adjustment to

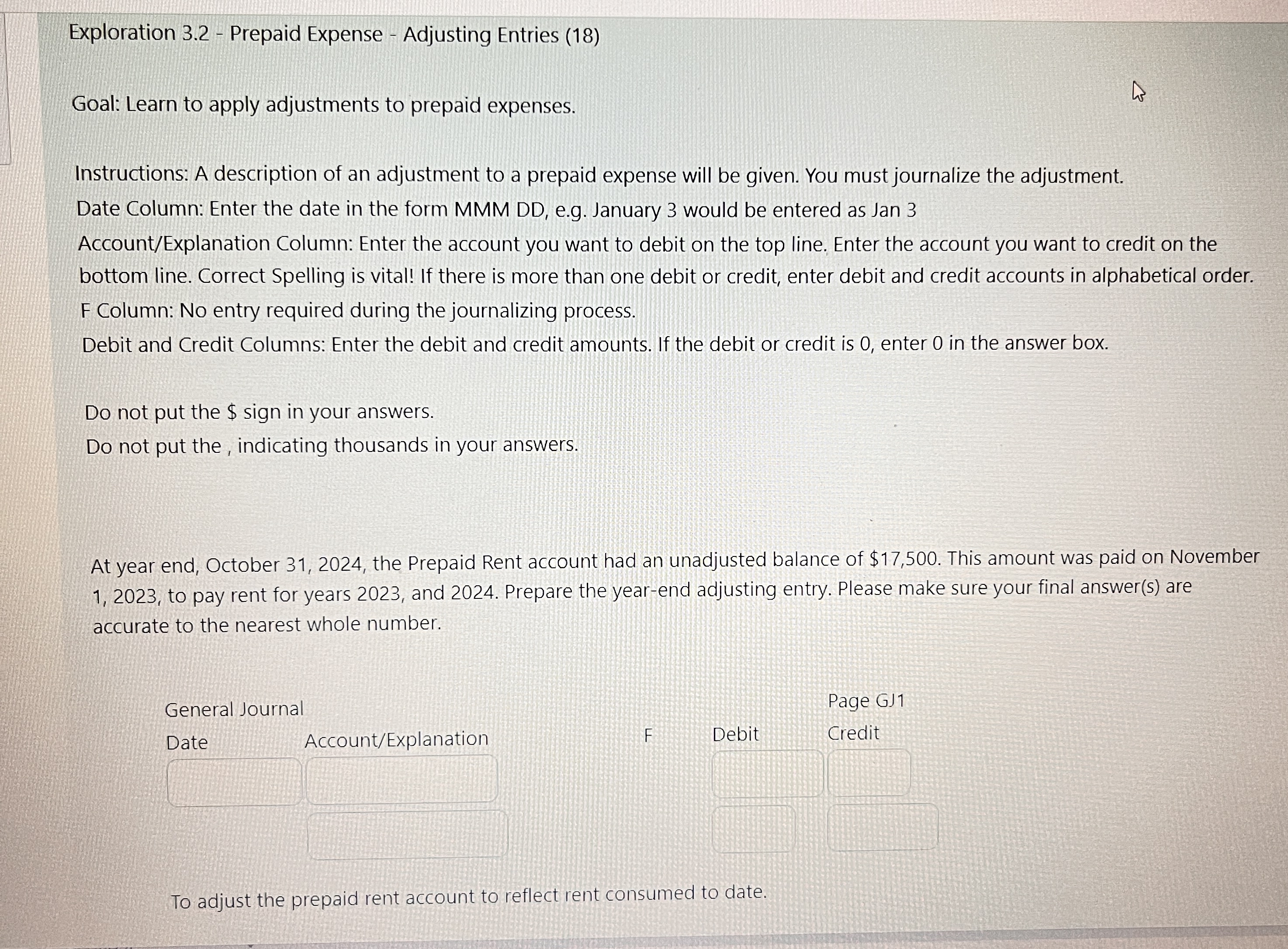

Exploration 3.2 - Prepaid Expense - Adjusting Entries (18) Goal: Learn to apply adjustments to prepaid expenses. Instructions: A description of an adjustment to a prepaid expense will be given. You must journalize the adjustment. Date Column: Enter the date in the form MMM DD, e.g. January 3 would be entered as Jan 3 1 Account/Explanation Column: Enter the account you want to debit on the top line. Enter the account you want to credit on the bottom line. Correct Spelling is vital! If there is more than one debit or credit, enter debit and credit accounts in alphabetical order. F Column: No entry required during the journalizing process. Debit and Credit Columns: Enter the debit and credit amounts. If the debit or credit is 0, enter 0 in the answer box. Do not put the $ sign in your answers. Do not put the, indicating thousands in your answers. At year end, October 31, 2024, the Prepaid Rent account had an unadjusted balance of $17,500. This amount was paid on November 1, 2023, to pay rent for years 2023, and 2024. Prepare the year-end adjusting entry. Please make sure your final answer(s) are accurate to the nearest whole number. General Journal Date Account/Explanation Page GJ1 F Debit Credit To adjust the prepaid rent account to reflect rent consumed to date.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started