Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Explore Ronnie's information. Using the provided template above, calculate the remaining expenses, revenues, and balance for Rapid Rentals. Then, in the same document provide a

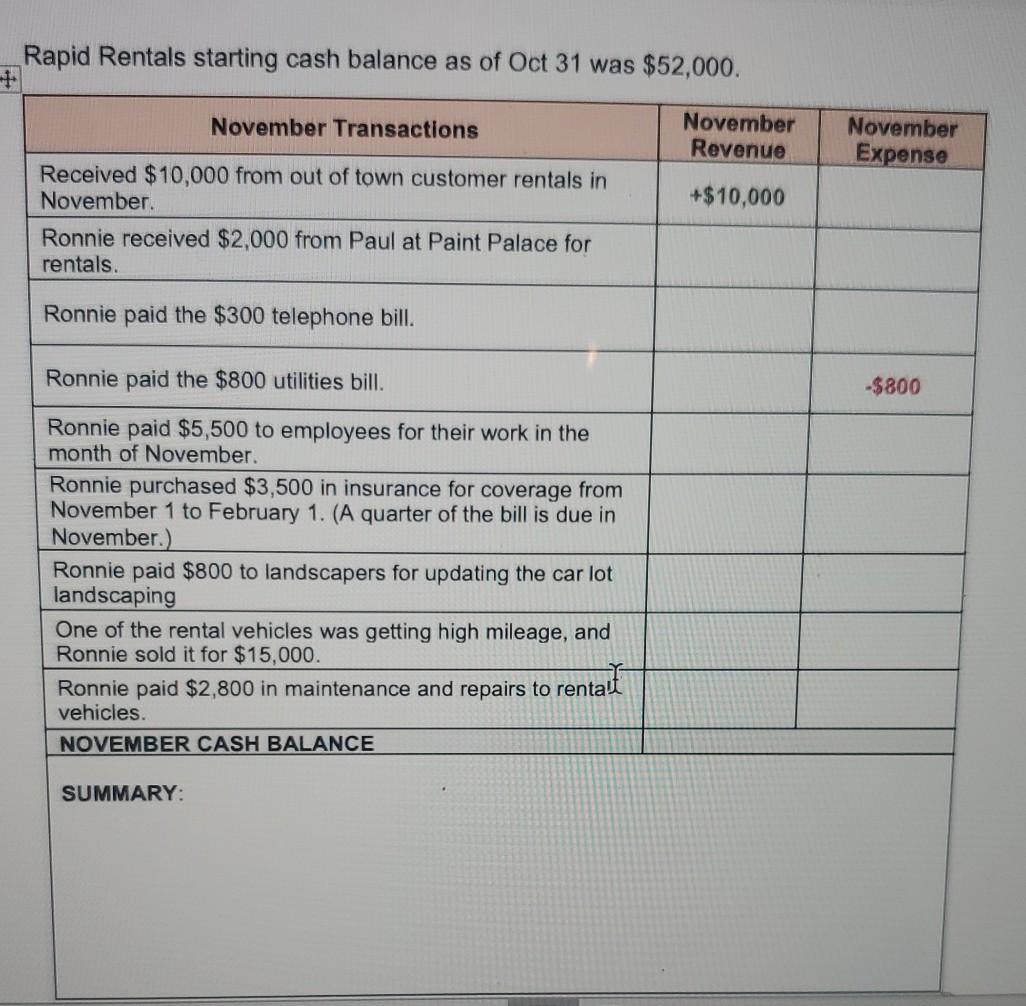

Explore Ronnie's information. Using the provided template above, calculate the remaining expenses, revenues, and balance for Rapid Rentals. Then, in the same document provide a paragraph summary on the company's financial status at the end of November that addresses (at a minimum) the following questions. (A) HOW MUCH, IF ANY, OF A PROFIT DID RAPID RENTALS MAKE DURING THE MONTH OF NOVEMBER? (B) WHAT SHOULD RONNIE DO WITH THE REMAINING REVENUE OR EXPENSE AT THE END OF THE MONTH? Explain your answer. Use the amounts in the template/ table

Trar Rapid Rentals Review Ronnie's financial information for the month of November and get ready to provide some financial advice to Rapid Rentals. At the end of October, Rapid Rentals had a cash balance of $52,000. The following data represents the transactions for Rapid Rentals during the month of November: $10,000 collected from out-of-town customers $2,000 collected from Paul's Paint Palace for rentals $300 telephone bill $800 utilities bill $5,500 payment to employees $3,500 purchase of insurance coverage; payment to span equally over 4 months $800 payment to landscapers $17,000 received for the sale of one of the rentals on the lot $2,800 paid for vehicle maintenance and repairs Rapid Rentals starting cash balance as of Oct 31 was $52,000. November Transactions November Revenue November Expense +$10,000 Received $10,000 from out of town customer rentals in November Ronnie received $2,000 from Paul at Paint Palace for rentals. Ronnie paid the $300 telephone bill. Ronnie paid the $800 utilities bill. -$800 Ronnie paid $5,500 to employees for their work in the month of November. Ronnie purchased $3,500 in insurance for coverage from November 1 to February 1. (A quarter of the bill is due in November.) Ronnie paid $800 to landscapers for updating the car lot landscaping One of the rental vehicles was getting high mileage, and Ronnie sold it for $15,000. Ronnie paid $2,800 in maintenance and repairs to rentalt vehicles. NOVEMBER CASH BALANCE SUMMARY: Trar Rapid Rentals Review Ronnie's financial information for the month of November and get ready to provide some financial advice to Rapid Rentals. At the end of October, Rapid Rentals had a cash balance of $52,000. The following data represents the transactions for Rapid Rentals during the month of November: $10,000 collected from out-of-town customers $2,000 collected from Paul's Paint Palace for rentals $300 telephone bill $800 utilities bill $5,500 payment to employees $3,500 purchase of insurance coverage; payment to span equally over 4 months $800 payment to landscapers $17,000 received for the sale of one of the rentals on the lot $2,800 paid for vehicle maintenance and repairs Rapid Rentals starting cash balance as of Oct 31 was $52,000. November Transactions November Revenue November Expense +$10,000 Received $10,000 from out of town customer rentals in November Ronnie received $2,000 from Paul at Paint Palace for rentals. Ronnie paid the $300 telephone bill. Ronnie paid the $800 utilities bill. -$800 Ronnie paid $5,500 to employees for their work in the month of November. Ronnie purchased $3,500 in insurance for coverage from November 1 to February 1. (A quarter of the bill is due in November.) Ronnie paid $800 to landscapers for updating the car lot landscaping One of the rental vehicles was getting high mileage, and Ronnie sold it for $15,000. Ronnie paid $2,800 in maintenance and repairs to rentalt vehicles. NOVEMBER CASH BALANCE SUMMARYStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started