Answered step by step

Verified Expert Solution

Question

1 Approved Answer

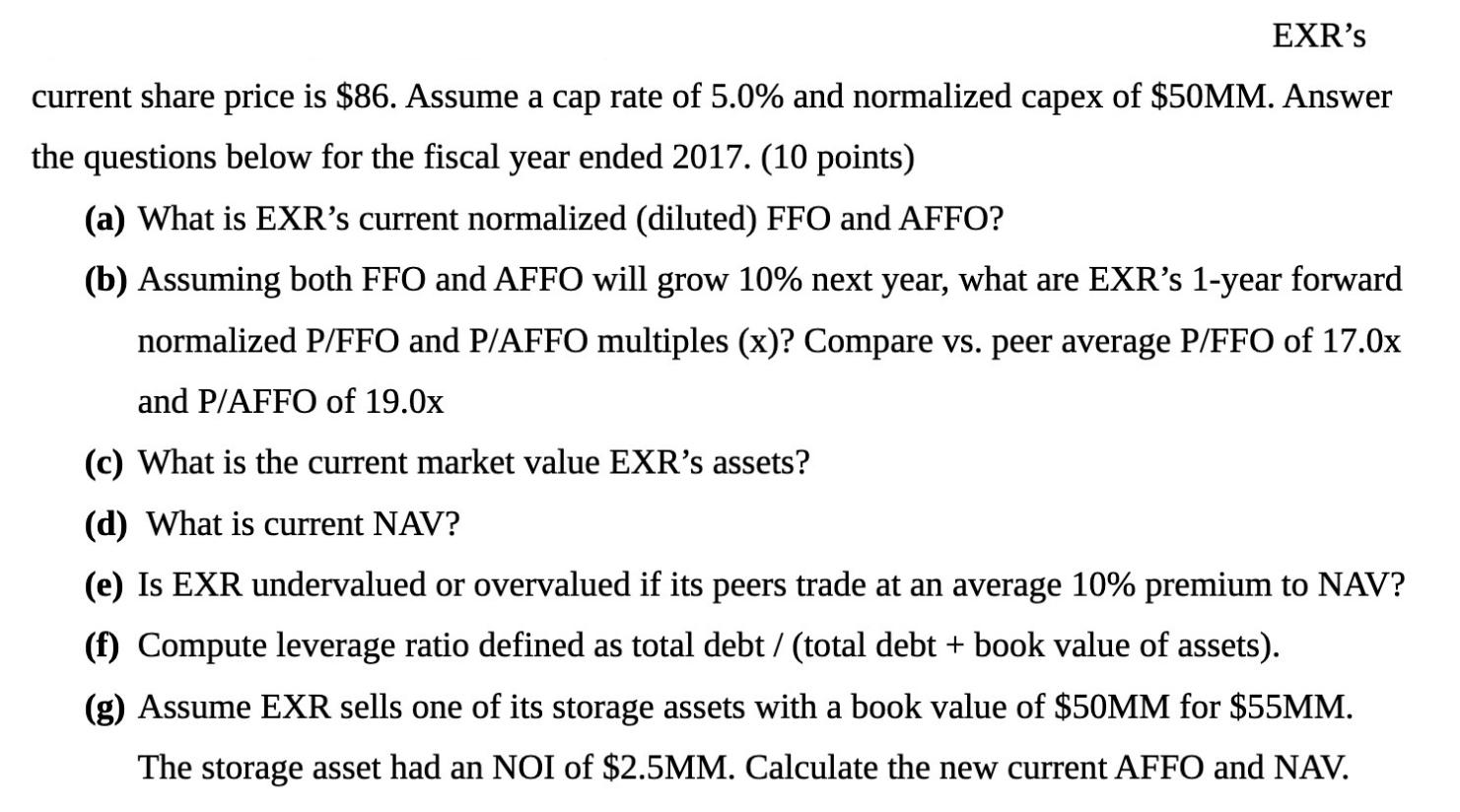

EXR's current share price is $86. Assume a cap rate of 5.0% and normalized capex of $50MM. Answer the questions below for the fiscal

EXR's current share price is $86. Assume a cap rate of 5.0% and normalized capex of $50MM. Answer the questions below for the fiscal year ended 2017. (10 points) (a) What is EXR's current normalized (diluted) FFO and AFFO? (b) Assuming both FFO and AFFO will grow 10% next year, what are EXR's 1-year forward normalized P/FFO and P/AFFO multiples (x)? Compare vs. peer average P/FFO of 17.0x and P/AFFO of 19.0x (c) What is the current market value EXR's assets? (d) What is current NAV? (e) Is EXR undervalued or overvalued if its peers trade at an average 10% premium to NAV? (f) Compute leverage ratio defined as total debt / (total debt + book value of assets). (g) Assume EXR sells one of its storage assets with a book value of $50MM for $55MM. The storage asset had an NOI of $2.5MM. Calculate the new current AFFO and NAV.

Step by Step Solution

★★★★★

3.43 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION a To calculate the current normalized FFO we need to subtract normalized capex from FFO Normalized FFO FFO Normalized Capex Normalized FFO 430 50MM Normalized FFO 425 per share To calculate t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started