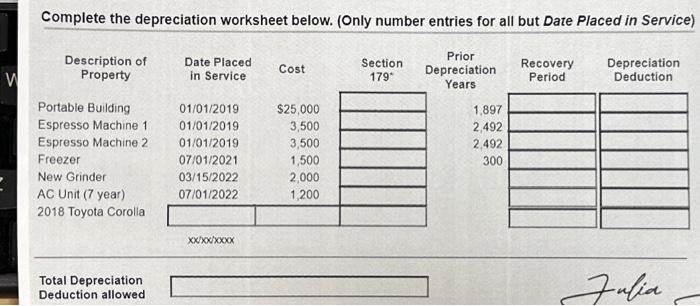

W Complete the depreciation worksheet below. (Only number entries for all but Date Placed in Service) Prior Depreciation Years Description of Property Portable Building

W Complete the depreciation worksheet below. (Only number entries for all but Date Placed in Service) Prior Depreciation Years Description of Property Portable Building Espresso Machine 1 Espresso Machine 2 Freezer New Grinder AC Unit (7 year) 2018 Toyota Corolla Total Depreciation Deduction allowed Date Placed in Service 01/01/2019 01/01/2019 01/01/2019 07/01/2021 03/15/2022 07/01/2022 xx/xx/xxXxXxxxx Cost $25,000 3,500 3,500 1,500 2,000 1,200 Section. 179* 1,897 2,492 2,492 300 Recovery Period Depreciation Deduction Julia

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To complete the depreciation worksheet we need the recovery period or depreciation me...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started