Answered step by step

Verified Expert Solution

Question

1 Approved Answer

EXTRA CREDIT ASSIGNMENT- Please do a Financial Statement Analysis 1. Examine financial statements a. Examine the balance sheet and common-size balance sheet looking for trends

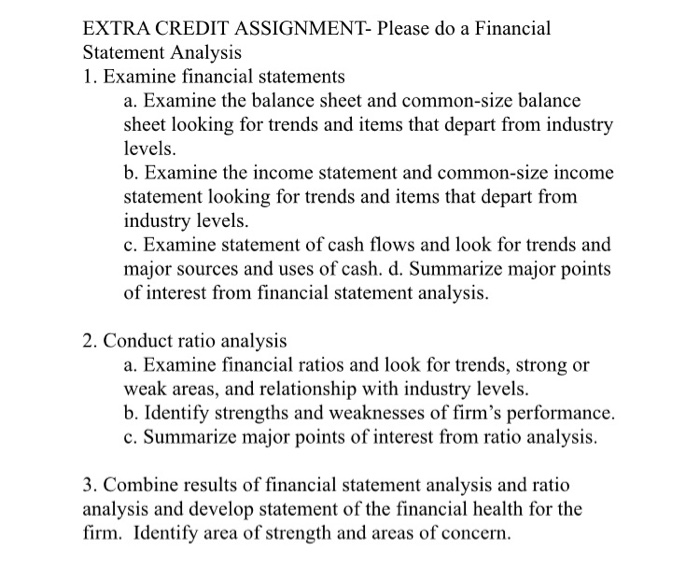

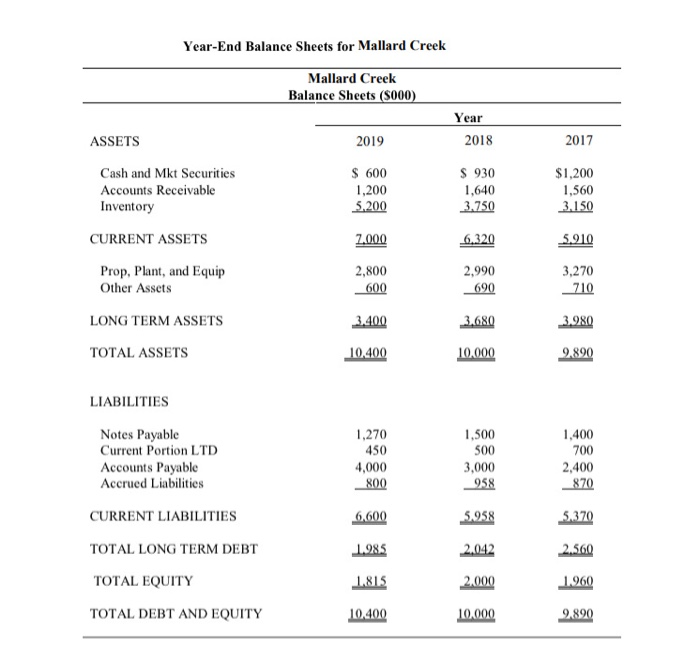

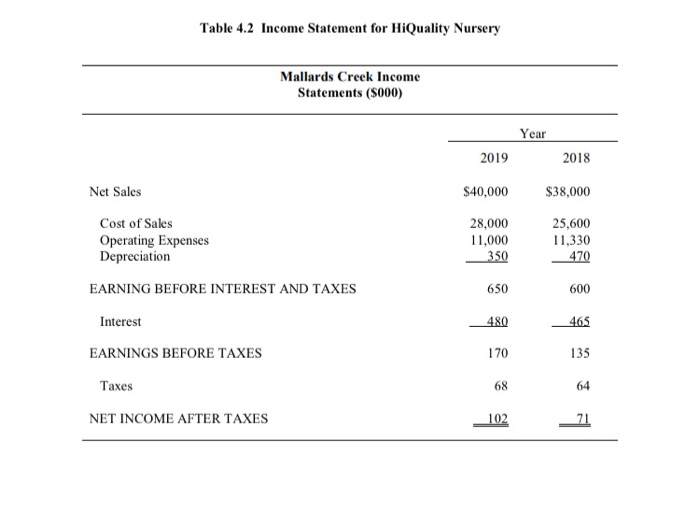

EXTRA CREDIT ASSIGNMENT- Please do a Financial Statement Analysis 1. Examine financial statements a. Examine the balance sheet and common-size balance sheet looking for trends and items that depart from industry levels. b. Examine the income statement and common-size income statement looking for trends and items that depart from industry levels. c. Examine statement of cash flows and look for trends and major sources and uses of cash. d. Summarize major points of interest from financial statement analysis. 2. Conduct ratio analysis a. Examine financial ratios and look for trends, strong or weak areas, and relationship with industry levels. b. Identify strengths and weaknesses of firm's performance. c. Summarize major points of interest from ratio analysis. 3. Combine results of financial statement analysis and ratio analysis and develop statement of the financial health for the firm. Identify area of strength and areas of concern. Year-End Balance Sheets for Mallard Creek Mallard Creek Balance Sheets (5000) Year 2018 ASSETS 2019 2017 Cash and Mkt Securities Accounts Receivable Inventory $ 600 1,200 $ 930 1,640 3.750 $1,200 1,560 3.150 5.200 CURRENT ASSETS 7.000 6,320 5.910 Prop, Plant, and Equip Other Assets 2,800 600 2,990 690 3,270 710 LONG TERM ASSETS 3.400 3.680 3.980 TOTAL ASSETS 10.400 10.000 2.890 LIABILITIES Notes Payable Current Portion LTD Accounts Payable Accrued Liabilities 1,270 450 4,000 800 1,500 500 3,000 958 1,400 700 2,400 870 CURRENT LIABILITIES 6,600 5.958 5.370 TOTAL LONG TERM DEBT 1.985 2.042 2.560 TOTAL EQUITY 1.813 2.000 1.960 TOTAL DEBT AND EQUITY 10,400 10.000 2.890 Table 4.2 Income Statement for HiQuality Nursery Mallards Creek Income Statements (5000) Year 2019 2018 Net Sales $40,000 $38,000 Cost of Sales Operating Expenses Depreciation 28,000 11,000 350 25,600 11,330 470 EARNING BEFORE INTEREST AND TAXES 650 600 Interest 480 465 EARNINGS BEFORE TAXES Taxes NET INCOME AFTER TAXES Table 4.3 Financial Cash Flow Mallard Creek Mallard Creek Statement of Cash Flows (5000) Year CASH FLOWS FROM OPERATIONS 2019 2018 $ 71 Net Income $ 102 Depreciation Expense Change in Acct. Rec. Change in Inventory Change in Current Liabilities 350 440 - 1450 642 470 -80 -600 588 Net Cash from Operations 449 CASH FLOWS FROM INVESTMENTS Net cash from investments -170 CASH FLOWS FROM FINANCING ACTIVITIES Payment of LTD Payment of dividends Net cash from financing -57 -287 -344 CHANGE IN CASH POSITION -330 EXTRA CREDIT ASSIGNMENT- Please do a Financial Statement Analysis 1. Examine financial statements a. Examine the balance sheet and common-size balance sheet looking for trends and items that depart from industry levels. b. Examine the income statement and common-size income statement looking for trends and items that depart from industry levels. c. Examine statement of cash flows and look for trends and major sources and uses of cash. d. Summarize major points of interest from financial statement analysis. 2. Conduct ratio analysis a. Examine financial ratios and look for trends, strong or weak areas, and relationship with industry levels. b. Identify strengths and weaknesses of firm's performance. c. Summarize major points of interest from ratio analysis. 3. Combine results of financial statement analysis and ratio analysis and develop statement of the financial health for the firm. Identify area of strength and areas of concern. Year-End Balance Sheets for Mallard Creek Mallard Creek Balance Sheets (5000) Year 2018 ASSETS 2019 2017 Cash and Mkt Securities Accounts Receivable Inventory $ 600 1,200 $ 930 1,640 3.750 $1,200 1,560 3.150 5.200 CURRENT ASSETS 7.000 6,320 5.910 Prop, Plant, and Equip Other Assets 2,800 600 2,990 690 3,270 710 LONG TERM ASSETS 3.400 3.680 3.980 TOTAL ASSETS 10.400 10.000 2.890 LIABILITIES Notes Payable Current Portion LTD Accounts Payable Accrued Liabilities 1,270 450 4,000 800 1,500 500 3,000 958 1,400 700 2,400 870 CURRENT LIABILITIES 6,600 5.958 5.370 TOTAL LONG TERM DEBT 1.985 2.042 2.560 TOTAL EQUITY 1.813 2.000 1.960 TOTAL DEBT AND EQUITY 10,400 10.000 2.890 Table 4.2 Income Statement for HiQuality Nursery Mallards Creek Income Statements (5000) Year 2019 2018 Net Sales $40,000 $38,000 Cost of Sales Operating Expenses Depreciation 28,000 11,000 350 25,600 11,330 470 EARNING BEFORE INTEREST AND TAXES 650 600 Interest 480 465 EARNINGS BEFORE TAXES Taxes NET INCOME AFTER TAXES Table 4.3 Financial Cash Flow Mallard Creek Mallard Creek Statement of Cash Flows (5000) Year CASH FLOWS FROM OPERATIONS 2019 2018 $ 71 Net Income $ 102 Depreciation Expense Change in Acct. Rec. Change in Inventory Change in Current Liabilities 350 440 - 1450 642 470 -80 -600 588 Net Cash from Operations 449 CASH FLOWS FROM INVESTMENTS Net cash from investments -170 CASH FLOWS FROM FINANCING ACTIVITIES Payment of LTD Payment of dividends Net cash from financing -57 -287 -344 CHANGE IN CASH POSITION -330

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started