Question

Extra info on square from own research Square and PayPal are two of the most popular payment processing platforms for small business owners. While they

Extra info on square from own research

Square and PayPal are two of the most popular payment processing platforms for small business owners. While they both allow you to process payments and charge similar fees, they have key distinctions that will make a difference depending on your business. Square is better suited for in-person and mobile transactions, while PayPal is best suited for e-commerce and online payments. Which of these popular services should you use for your business? We broke them both down to help you decide.

Squares fee for swipe/chip transactions is 2.6% plus 10 cents per transaction while PayPal starts at 2.29% plus 9 cents and goes up depending on your package. Besides the difference in transaction fees, there are other variations in fees to be aware of. Keep in mind that PayPal charges a $20 fee for chargebacks, while Square does not. Additionally, PayPal charges an extra 1.50% for international transactions while Square does not. Finally, PayPal does not refund merchants the transaction fee when a customer issues a return, while Square does return the transaction fee to the merchant.

Regardless, PayPal is the leading company for e-commerce. The company offers more ways for customers to pay, including cryptocurrencies. Plus, customers recognize the PayPal name, which makes it more likely they will follow through with payment online.

PayPals transaction fees are listed as lower for card-present transactions2.29% plus 9 cents compared with $2.6% plus 10 centshowever, PayPal does have more additional fees that are less apparent and harder to account for (such as a $20 chargeback fee and additional fees to process international credit cards).

The first card reader Square gives you is free. After that, each additional card reader is $10. With PayPal, card readers cost $29 and $79 for each additional device. Square offers a tip management tool and both companies offer multiple options for software integration.

Square is a better option for small businesses that focus on in-person transactions. If you plan to receive payments primarily online, PayPal will more likely suit your needs. Square offers business management tools as part of its POS system, while PayPals is simpler. Additionally, PayPal issues more fees than Square, such as a $20 chargeback fee and higher fees for international credit cards. However, there are advantages to using PayPal for an e-commerce store or for online payments. PayPal is able to accept a wider range of payment options (including PayPal) and the additional options may help boost sales.

https://www.forbes.com/advisor/business/software/square-vs-paypal/#:~:text=In%20general%2C%20Square%20is%20a,received%20a%20significantly%20higher%20score.

Square started in 2009 with a simple device that allowed anyone with a cell phone to accept credit card payments. In the meantime, the company has expanded its offerings to include an incredible range of services.

For example, Square now offers an entire suite of software for SMEs, but also payments, online trading, and loans to end customers.

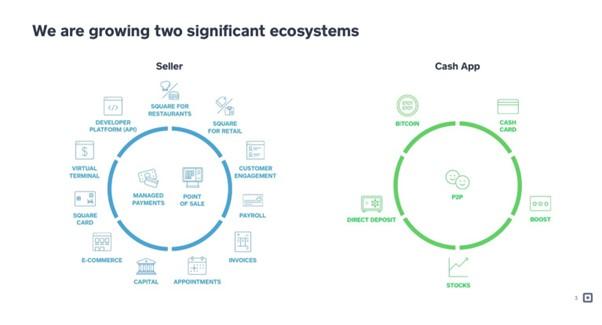

And thats where Square differs from the competition. While the rebundling of other successful fintechs is limited to one category of customers, Square has managed to achieve a dominant position in two ecosystems.

On the one side, theres the Cash App. Squares Cash App has 36 million customers in the US. By comparison, Wells Fargo and Bank of America have 70 and 66 million customers, respectively. Both have existed for over 100 years. Square was founded a bit more than 10 years ago.

The Cash App went through its own unbundling, rebundling cycle. It was developed in a hackathon in 2013 as a simple mobile payment service. Today, the Cash App can be used as a bank account, as a P2P payment option, and to invest in stocks and cryptocurrencies. It also offers a free tax-filing service. At the same time, Square developed an enormous partner network. Cash app users benefit from changing discount deals at fast-food restaurants, delivery services, or ride-hailing companies.

The network effects associated with Cash App have given Square a significant competitive advantage. This has allowed Square to continuously increase the profitability of each customer. The longer customers stay with Square, the more recurring revenue they generate for Square.

On the other side, Square also has a whole suite of software and hardware products for corporate customers, including payment terminals, accounting, appointment, and invoicing software, and much more.

These types of services benefit from a strong lock-in effect. Besides, Square also has a bundle of services specifically for restaurants and one for e-commerce companies. And if that wasnt enough, theres also the possibility to integrate Squares services into your own apps and products using APIs. Developers can also create additional software on Squares own marketplace. Square is expanding its products not only horizontally, but for each ecosystem also vertically and even cross-functionally. Square could use its seller base as an acquisition channel for new Cash App users and vice-versa. Squares partner network enables the creation of a direct bridge between Squares corporate customers and its private customers, potentially disintermediating third parties completely.

And Square is also expanding into completely different industries. Earlier this month, it bought the music streaming service Tidal. The goal is to serve creatives and creators, helping them sell music, merchandise, and tickets. They will also likely integrate Cash App into Tidal. Square is thus bundling financial products with lifestyle services. So it wouldnt be surprising if Square partnered with a video streaming service or bought a ride-hailing provider next. Square could play a role in the lives of its users not just as a bank or financial services provider, but as an indispensable Super app. It has become a prime example of how financial services can be embedded in other industries.

Pick one business that is the dominate design within the case study and link them with

theories listed below ( Ive picked square)

example square uses radical innovation this is evident when square. Square also uses.. in comparison to apple as apple uses incremental innovation In conclusion square in my opinion is the dominant design as

( the work is opinion based and you can do additional research to looking at the square as a business link to a theory)

(not all theories link to the case study but the ones that do link add it to the assignment. You need to have three or more theories linked to the question but try and add as much as possible)

Theories

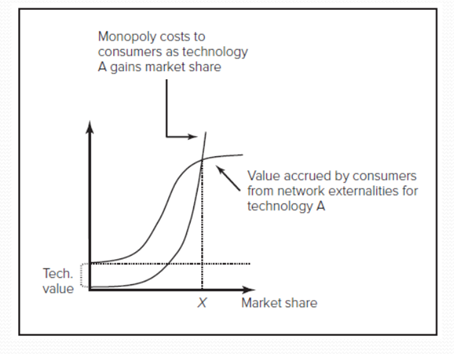

Network externalities a users benefit from using a good increases as the number of other users (installed base) of the same good increases

Network externalities are common in industries that are physically networked (e.g. railroads or telecommunications)

Network externalities also arise when compatibility or complementary goods are important Compatibility-Choosing a computer that uses the Windows operating system and an Intel microprocessor because the Wintel platform has the largest installed base Complementary goods-Additional goods and services that enable or enhance the value of another good. - Many products are only functional or desirable when there is a set of complementary goods available for them (game console & video game)

Complementary goods

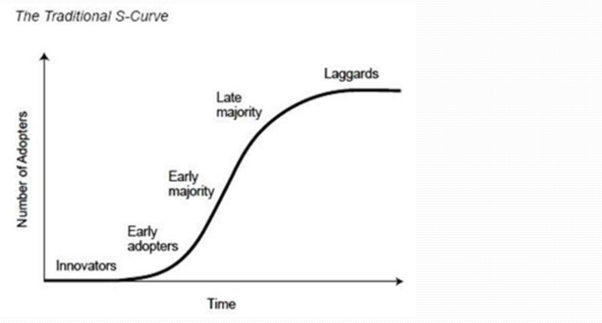

The s-curve

Radical innovations are very new and different from previously existing products and processes.

Incremental innovations may involve only a refinement/minor change from (or adjustment to) existing products or practices.

2. Adjacent innovation

Adjacent innovation is a typical example of a successful expansion. It refers to using existing capabilities (like technology or knowledge) to appeal to a new audience or enter a new market. This provides a competitive advantage to the original product or service that allows it to be differentiated in the market.

To illustrate the concept of adjacent innovation, we can take the example of big companies that buy innovative startups in order to integrate their groundbreaking products and services into their own portfolio.

3. Disruptive innovation

Disruptive innovation refers to the actions taken by a smaller company to shake up an industry by targeting its large, existing competitors overlooked segments.

Over time, the disruptive innovation party will accelerate and start taking over the main segments of the industry. When the adoption of the new innovation by the main segment happens, we speak of disruptive innovation.

Technology clustering

Most significant source of innovation comes from the collaborative networks that leverage resources and capabilities across multiple organizations or individuals

Firms that are located in geographic proximity tend to collaborate in technology clusters

Firms that are proximate thus have an advantage in sharing information that can lead to greater innovation productivity ,that is, agglomeration economies.

Agglomeration economies :The benefits firms reap by locating in close geographical proximity to each other.

Innovation types

Component (modular) innovations entail changes to components but do not significantly affect the overall configuration (design) of the product system. e.g. bicycle gel-filled material for additional cushioning

Architectural innovations entail changing the overall design of the system or the way components interact.

Most architectural innovations necessitate changes in the underlying components.

Monopoly costs -the costs users bear as one company dominates the market -higher prices, lower variety, etc.

Network externality benefits follow an S-curve, while monopoly costs likely to grow exponentially

Network externality benefits and monopoly costs trade off against each other

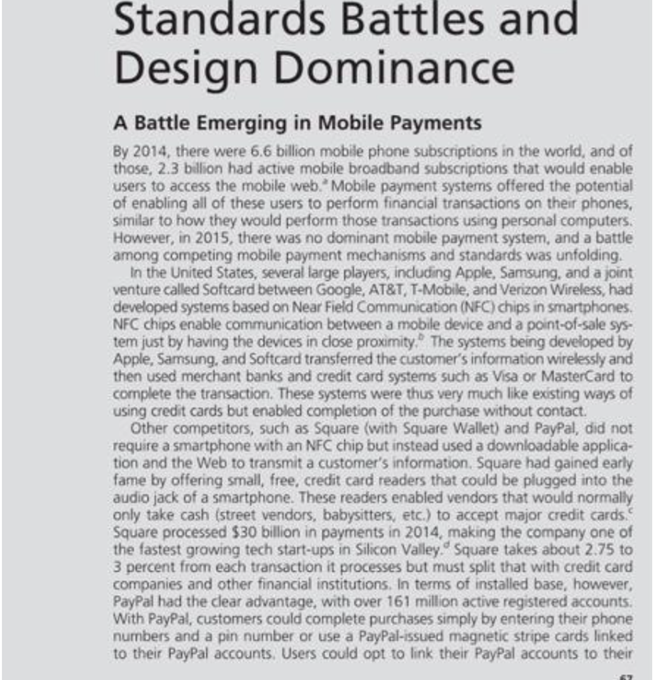

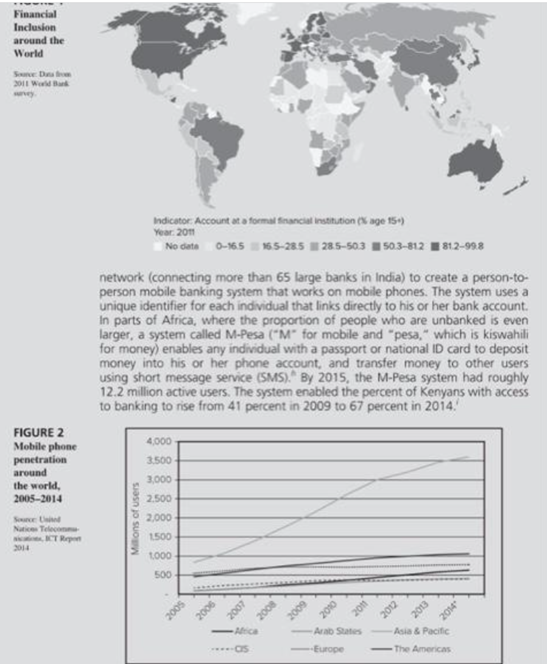

.Your answer should contain evidence of the following: r Knowledge and understanding of the key theoretical concepts related to MGT 3014 Innovation Management - Critical analysis of issues - Evidence of research using secondary sources of information - Application of the relevant theory you learnt from this module to the case study References to relevant academic articles A Accurate use of references and in-text citations Joint application of theories in explaining questions Question 1 Using 'A Battle Emerging in Mobile Payments' case study (Schilling, 2017, p67), what do you think will determine which becomes dominant? Using information in the case study and from you own research, and applying appropriate theories and analytical tools that you learnt from MGT 3014 Innovation Management, discuss the forces that are likely to encourage one of the mobile payment systems to emerge as dominant design. Standards Battles and Design Dominance A Battle Emerging in Mobile Payments By 2014, there were 6.6 billion mobile phone subscriptions in the world, and of those, 2.3 billion had active mobile broadband subscriptions that would enable users to access the mobile web." Mobile payment systems offered the potential of enabling all of these users to perform financial transactions on their phones, similar to how they would perform those transactions using personal computers. However, in 2015, there was no dominant mobile payment system, and a battle among competing mobile payment mechanisms and standards was unfolding. In the United States, several large players, induding Apple, Samsung, and a joint venture called Softcard between Google, AT\&T, T-Mobile, and Verizon Wireless, had developed systems based on Near Field Communication (NFC) chips in smartphones. NFC chips enable communication between a mobile device and a point-of-sale sys. tem just by having the devices in close proximity." The systems being developed by Apple, Samsung, and Softcard transferred the customer's information wirelessly and then used merchant banks and credit card systems such as Visa or MasterCard to complete the transaction. These systems were thus very much like existing ways of using credit cards but enabled completion of the purchase without contact. Other competitors, such as Square (with Square Wallet) and PayPal, did not require a smartphone with an NFC chip but instead used a downloadable application and the Web to transmit a customer's information. Square had gained early fame by offering small, free, credit card readers that could be plugged into the audio jack of a smartphone. These readers enabled vendors that would normally only take cash (street vendors, babysitters, etc.) to accept major credit cards. Square processed $30 billion in payments in 2014, making the company one of the fastest grawing tech start-ups in Silicon Valley. Square takes about 2.75 to 3 percent from each transaction it processes but must split that with credit card companies and other financial institutions. In terms of installed base, however, PayPal had the clear advantage, with over 161 million active registered accounts. With Pay?al, customers could complete purchases simply by entering their phone numbers and a pin number or use a PayPal-issued magnetic stripe cards linked to their PayPal accounts. Users could opt to link their PayPal accounts to their credit cards or directly to their bank accounts. PayPal also owned a service called Venmo that enabled peer-to-peer exchanges with a Facebook-like interface that was growing in popularity as a way to exchange money without carrying cash. Venmo charged a 3 percent fee if the transaction used a major credit card but was free if the consumer used it with a major bank card and debit card. As noted above, some of the systems being developed did not require involvement of the major credit card companies-which potentially meant that billions of dollars in transaction fees might be avoided or captured by a new player. PayPal, and its peer-to-peer system. Venmo, for instance, did not require credit cards. A group of large merchants that induded Wal-Mart, Old Navy, Best Buy, 7-eleven, and more had also developed their own payment system- " Current- C " downloadable application for a smartphone that enabled purchases to be deducted directly from the customer's bank accounts. This would enable the merchants to avoid the 2-4 percent charges that merchants paid on credit card transactionsamounting to billions of dollars in savings for the participating merchants," For consumers, the key dimensions that influenced adoption were convenience (e.g., would the customer have to type in a code at the point of purchase? Was it easily accessible on a device the individual already owned?), risk of fraud (e.9. was the individual's identity and financial information at risk?), and ubiquity (e.g. could the system be used everywhere? Did it enable peer-to-peer transactions?). For merchants, fraud was also a big concern-especially in situations where the transaction was not guaranteed by a third party, and cost (e.9., what were the fixed costs and transaction fees of using the system?). Apple Pay had a significant convenience advantage in that a customer could pay with their fingerprint.' Current-C, by contrast had a serious convenience disadvantage because consumers would have to open the application on their phone and get a QR code that would need to be scanned at the checkout aisle. Both Apple Pay and Current- C had also experienced fraud problems, with multiple reports of hacked accounts emerging by early 2015. In the United States, almost half of all consumers had used their smartphones to make a payment at a merchant location by early 2015. Mobile payments accounted for $52 billion in transactions in 2014 and were expected to be $67 billion in 2015. In other parts of the world, intriguing alternatives for mobile banking were gaining traction even faster. In India and Africa, for example, there are enormous populations of "unbanked" or "underbanked" people (individuals who do not have bank accounts or make limited use of banking services). In these regions, the proportion of people with mobile phones vastly exceeds the proportion of people with credit cards. In Africa, for example, less than 3 percent of the population was estimated to have a credit card, whereas 69 percent of the population was estimated to have mobile phones. Notably, the maximum fxed-line phone penetration ever achieved in Africa was 1.6 percent-reached in 2009 -demonstrating the power of mobile technology to "leapfrog" land-based technology in the developing world. The opportunity, then, of giving such people access to fast and inexpensive funds transfer is enormous. The leading system in India is the Inter-bank Mobile Payment Service developed by National Payments Corporation of india (NPCI). 2 NPCI leveraged its ATM Mdicator Account at a formal financial institution ( $ age 15) Year. 2011 network (connecting more than 65 large banks in India) to create a person-toperson mobile banking system that works on mobile phones. The system uses a unique identifier for each individual that links directly to his or her bank account. In parts of Africa, where the proportion of people who are unbanked is even larger, a system called M-Pesa ("M* for mobile and "pesa," which is kiswahili for money) enables any individual with a passport or national ID card to deposit money into his or her phone account, and transfer money to other users using short message service (SMS)." By 2015, the M-Pesa system had roughly 12. 2 million active users. The system enabled the percent of Kenyans with access to banking to rise from 41 percent in 2009 to 67 percent in 2014 . Industry Dynamics of Technological Innovation By early 2015, it was clear that mobile payments represented a game-changing opportunity that could accelerate e-commerce, smartphone adoption, and the global reach of financial services. However, lack of compatibility between many of the mobile payment systems and uncertainty over what type of mobile payment system would become dominant still posed significant obstacles to consumer and merchant adoption. We are growing two significant ecosystems The Traditional S-Curve Monopoly costs to consumers as technology A gains market share

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started