extra info.:

extra info.:

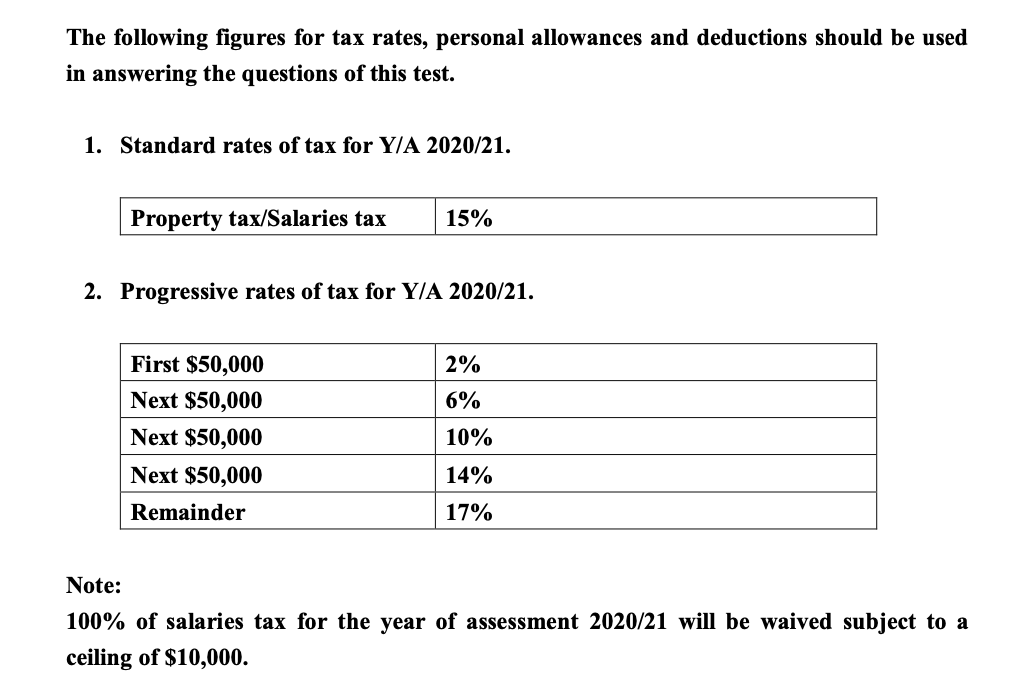

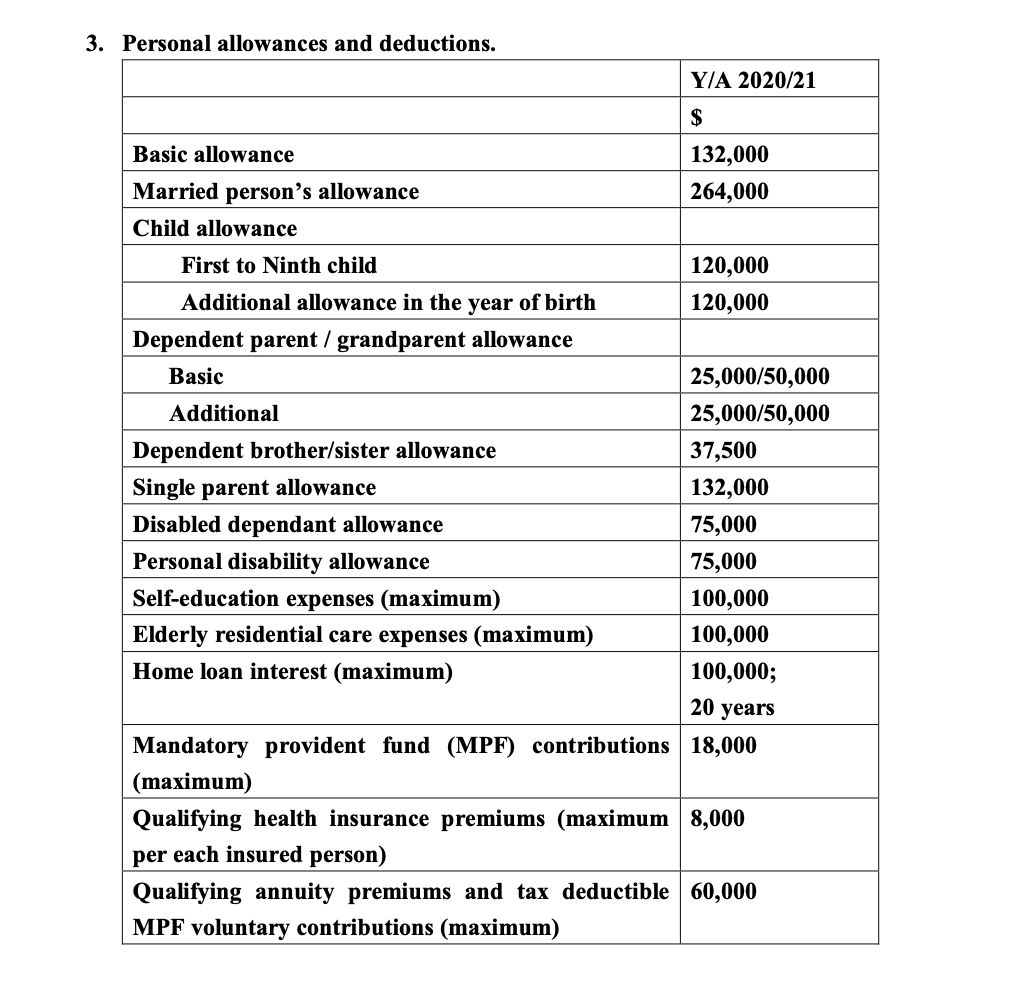

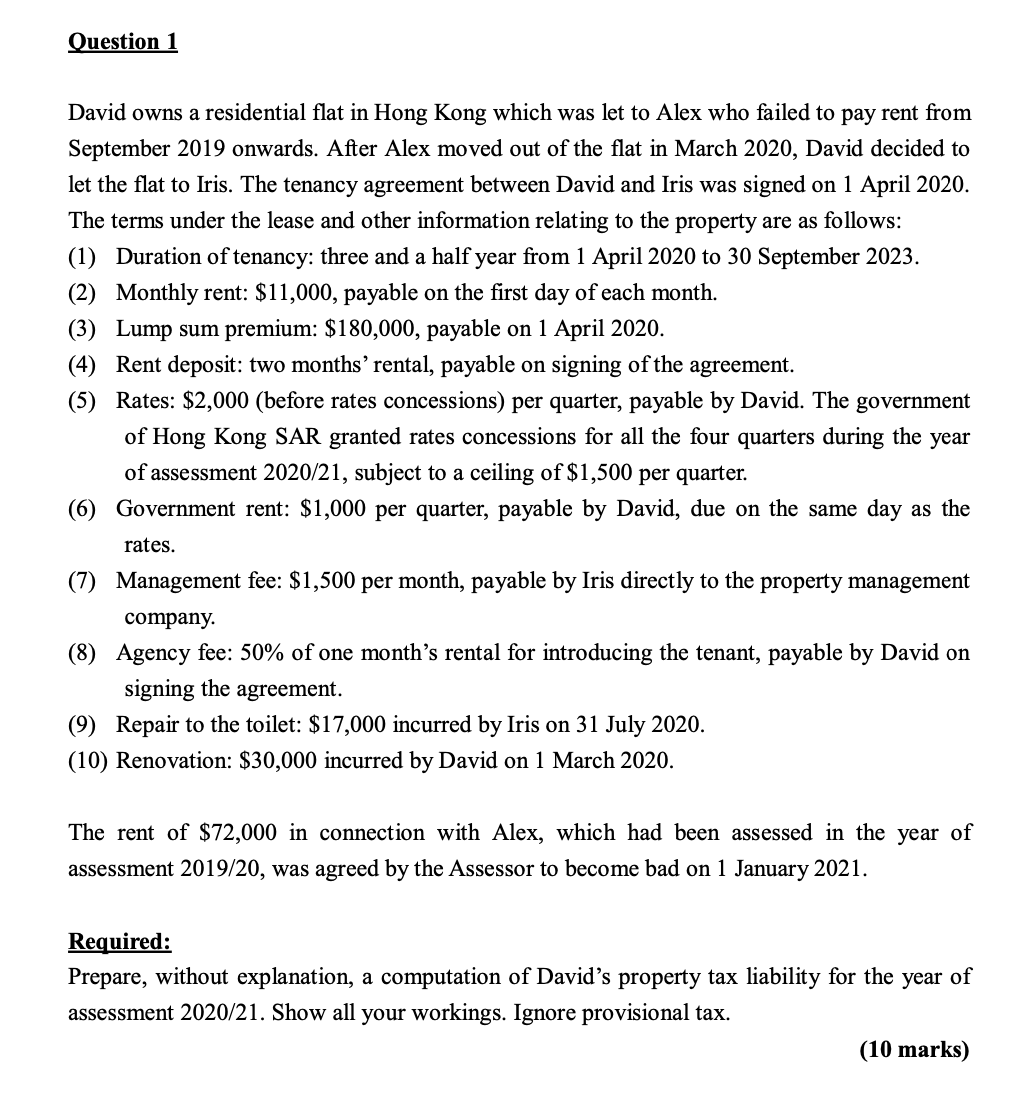

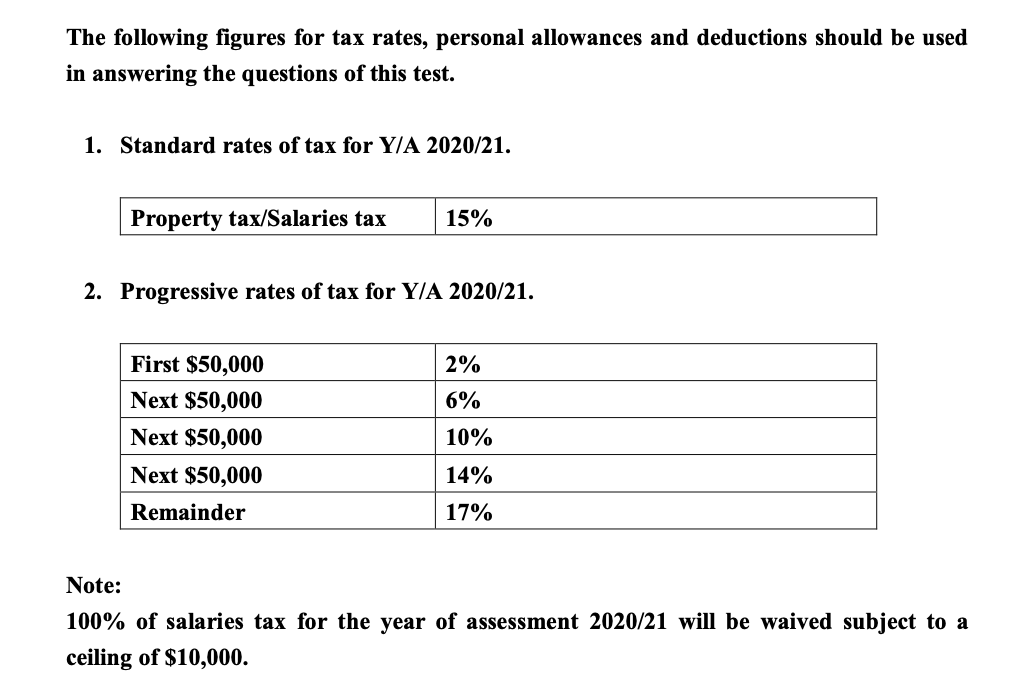

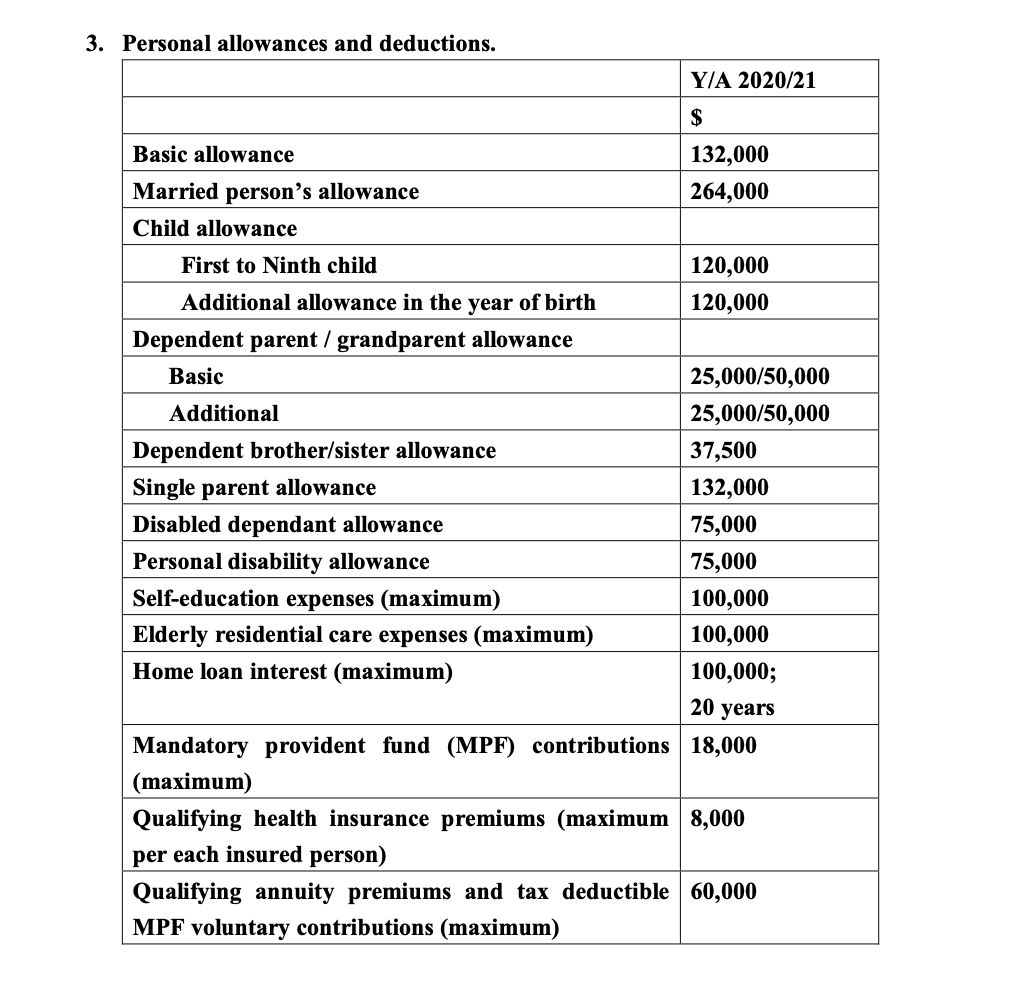

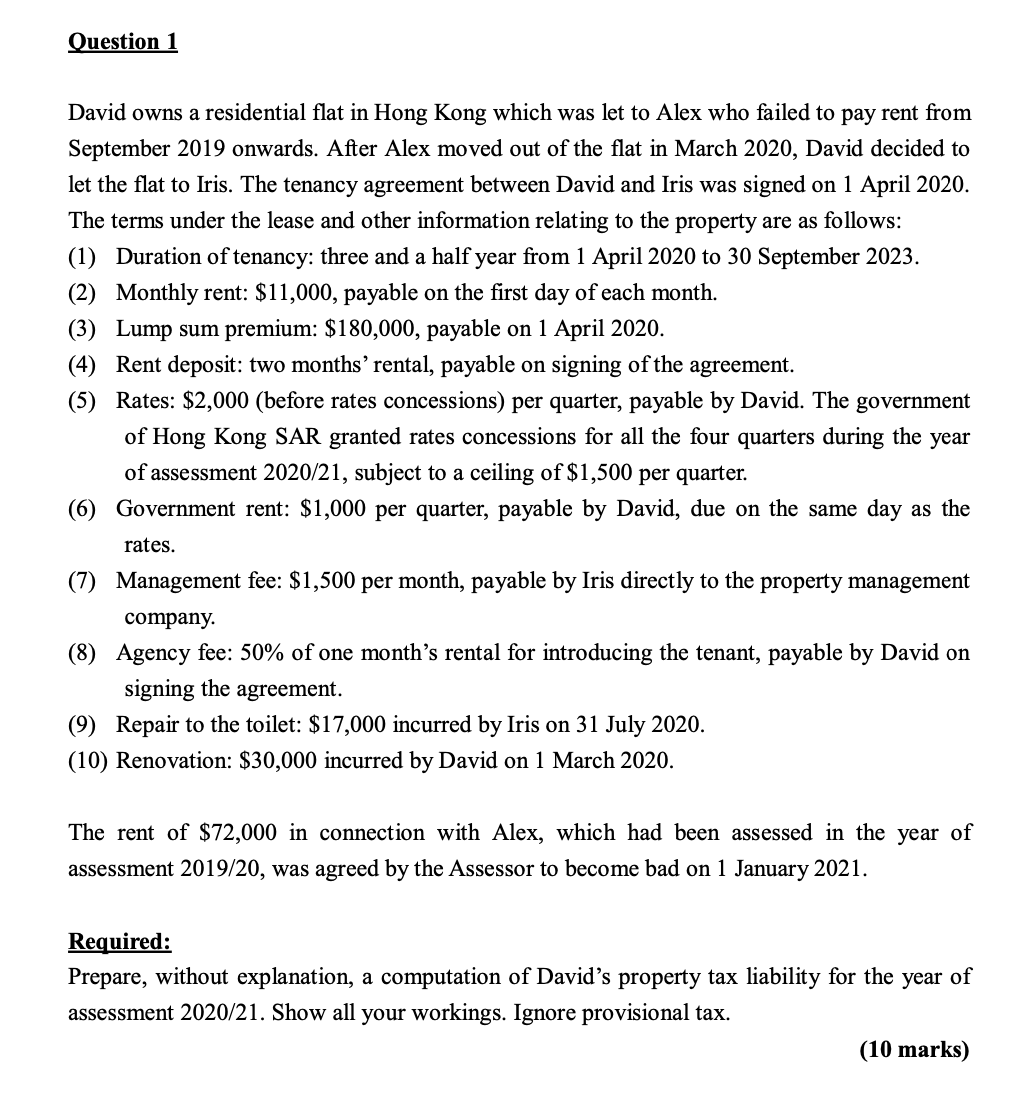

Question 1 David owns a residential flat in Hong Kong which was let to Alex who failed to pay rent from September 2019 onwards. After Alex moved out of the flat in March 2020, David decided to let the flat to Iris. The tenancy agreement between David and Iris was signed on 1 April 2020. The terms under the lease and other information relating to the property are as follows: (1) Duration of tenancy: three and a half year from 1 April 2020 to 30 September 2023. (2) Monthly rent: $11,000, payable on the first day of each month. (3) Lump sum premium: $180,000, payable on 1 April 2020. (4) Rent deposit: two months' rental, payable on signing of the agreement. (5) Rates: $2,000 (before rates concessions) per quarter, payable by David. The government of Hong Kong SAR granted rates concessions for all the four quarters during the year of assessment 2020/21, subject to a ceiling of $1,500 per quarter. (6) Government rent: $1,000 per quarter, payable by David, due on the same day as the rates. (7) Management fee: $1,500 per month, payable by Iris directly to the property management company. (8) Agency fee: 50% of one month's rental for introducing the tenant, payable by David on signing the agreement. (9) Repair to the toilet: $17,000 incurred by Iris on 31 July 2020. (10) Renovation: $30,000 incurred by David on 1 March 2020. The rent of $72,000 in connection with Alex, which had been assessed in the year of assessment 2019/20, was agreed by the Assessor to become bad on 1 January 2021. Required: Prepare, without explanation, a computation of David's property tax liability for the year of assessment 2020/21. Show all your workings. Ignore provisional tax. (10 marks) The following figures for tax rates, personal allowances and deductions should be used in answering the questions of this test. 1. Standard rates of tax for Y/A 2020/21. Property tax/Salaries tax 15% 2. Progressive rates of tax for Y/A 2020/21. 2% 6% First $50,000 Next $50,000 Next $50,000 Next $50,000 Remainder 10% 14% 17% Note: 100% of salaries tax for the year of assessment 2020/21 will be waived subject to a ceiling of $10,000. 3. Personal allowances and deductions. Y/A 2020/21 $ 132,000 264,000 120,000 120,000 Basic allowance Married person's allowance Child allowance First to Ninth child Additional allowance in the year of birth Dependent parent / grandparent allowance Basic Additional Dependent brother/sister allowance Single parent allowance Disabled dependant allowance Personal disability allowance Self-education expenses (maximum) Elderly residential care expenses (maximum) Home loan interest (maximum) 25,000/50,000 25,000/50,000 37,500 132,000 75,000 75,000 100,000 100,000 100,000; 20 years Mandatory provident fund (MPF) contributions 18,000 (maximum) Qualifying health insurance premiums (maximum 8,000 per each insured person) Qualifying annuity premiums and tax deductible 60,000 MPF voluntary contributions (maximum) Question 1 David owns a residential flat in Hong Kong which was let to Alex who failed to pay rent from September 2019 onwards. After Alex moved out of the flat in March 2020, David decided to let the flat to Iris. The tenancy agreement between David and Iris was signed on 1 April 2020. The terms under the lease and other information relating to the property are as follows: (1) Duration of tenancy: three and a half year from 1 April 2020 to 30 September 2023. (2) Monthly rent: $11,000, payable on the first day of each month. (3) Lump sum premium: $180,000, payable on 1 April 2020. (4) Rent deposit: two months' rental, payable on signing of the agreement. (5) Rates: $2,000 (before rates concessions) per quarter, payable by David. The government of Hong Kong SAR granted rates concessions for all the four quarters during the year of assessment 2020/21, subject to a ceiling of $1,500 per quarter. (6) Government rent: $1,000 per quarter, payable by David, due on the same day as the rates. (7) Management fee: $1,500 per month, payable by Iris directly to the property management company. (8) Agency fee: 50% of one month's rental for introducing the tenant, payable by David on signing the agreement. (9) Repair to the toilet: $17,000 incurred by Iris on 31 July 2020. (10) Renovation: $30,000 incurred by David on 1 March 2020. The rent of $72,000 in connection with Alex, which had been assessed in the year of assessment 2019/20, was agreed by the Assessor to become bad on 1 January 2021. Required: Prepare, without explanation, a computation of David's property tax liability for the year of assessment 2020/21. Show all your workings. Ignore provisional tax. (10 marks) The following figures for tax rates, personal allowances and deductions should be used in answering the questions of this test. 1. Standard rates of tax for Y/A 2020/21. Property tax/Salaries tax 15% 2. Progressive rates of tax for Y/A 2020/21. 2% 6% First $50,000 Next $50,000 Next $50,000 Next $50,000 Remainder 10% 14% 17% Note: 100% of salaries tax for the year of assessment 2020/21 will be waived subject to a ceiling of $10,000. 3. Personal allowances and deductions. Y/A 2020/21 $ 132,000 264,000 120,000 120,000 Basic allowance Married person's allowance Child allowance First to Ninth child Additional allowance in the year of birth Dependent parent / grandparent allowance Basic Additional Dependent brother/sister allowance Single parent allowance Disabled dependant allowance Personal disability allowance Self-education expenses (maximum) Elderly residential care expenses (maximum) Home loan interest (maximum) 25,000/50,000 25,000/50,000 37,500 132,000 75,000 75,000 100,000 100,000 100,000; 20 years Mandatory provident fund (MPF) contributions 18,000 (maximum) Qualifying health insurance premiums (maximum 8,000 per each insured person) Qualifying annuity premiums and tax deductible 60,000 MPF voluntary contributions (maximum)

extra info.:

extra info.: