extra info that you might need to know

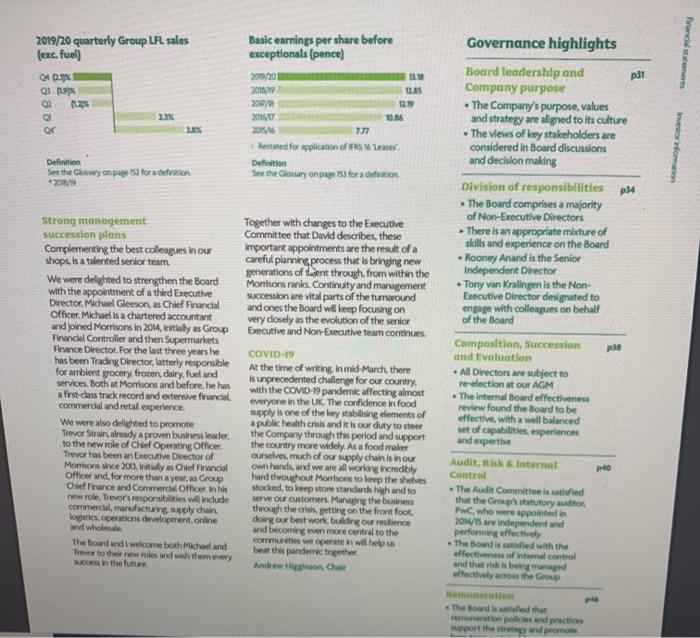

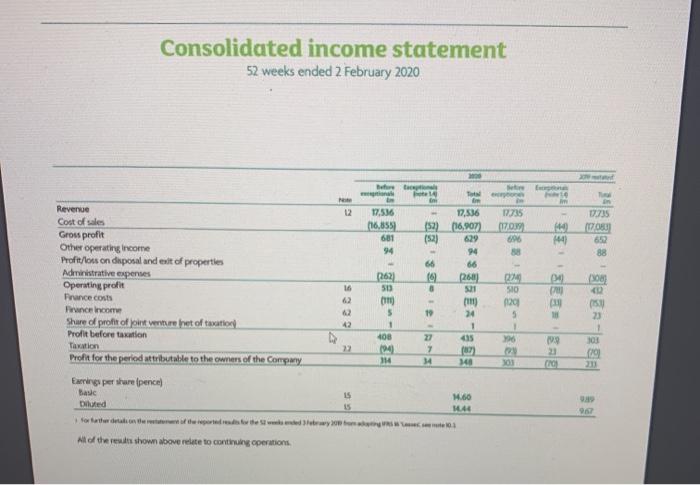

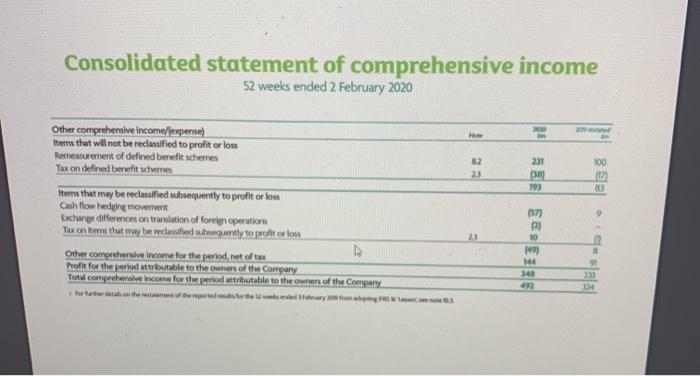

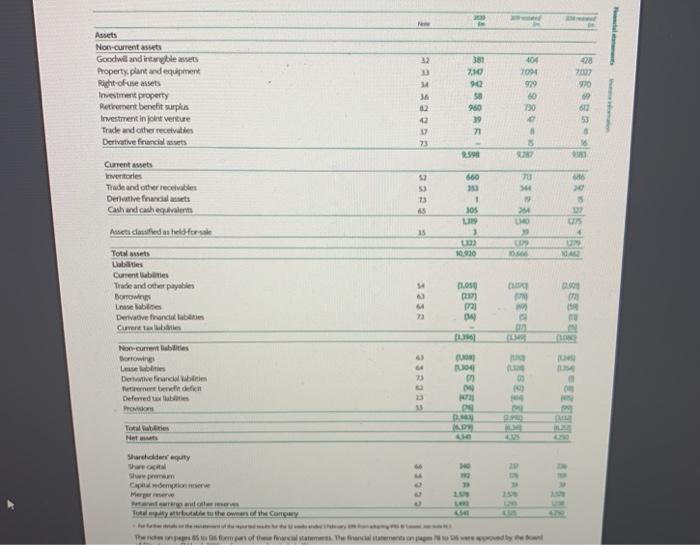

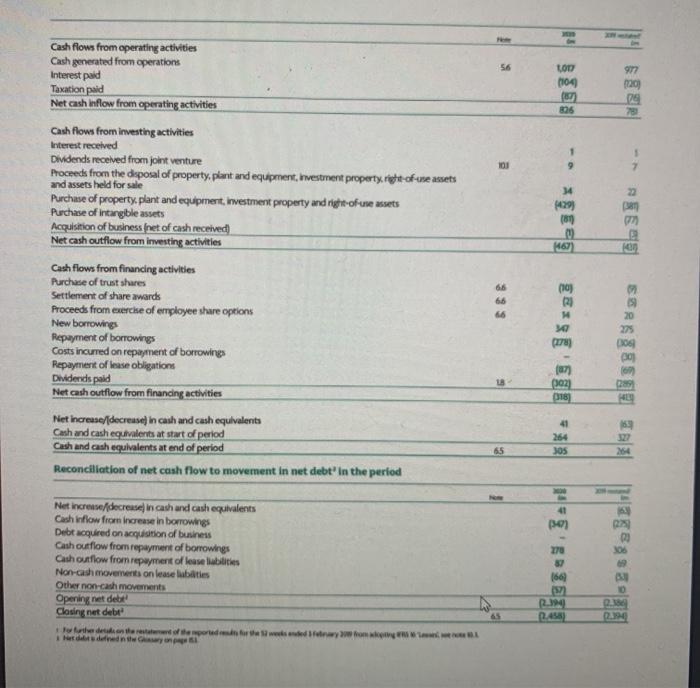

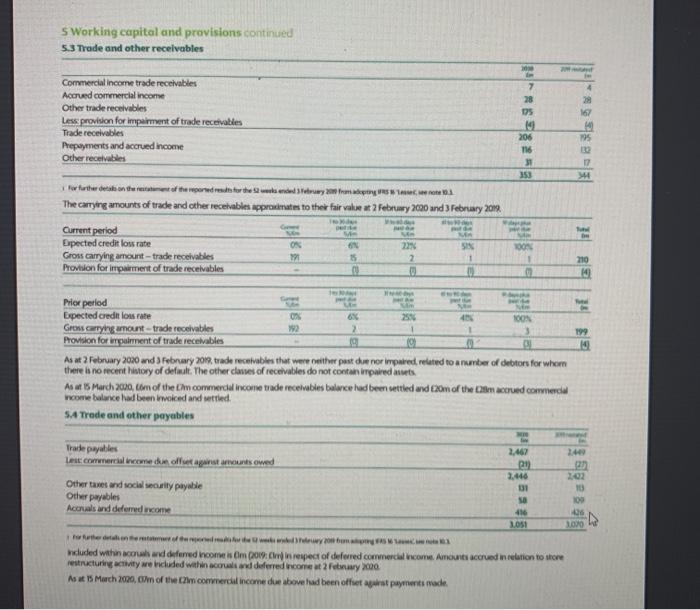

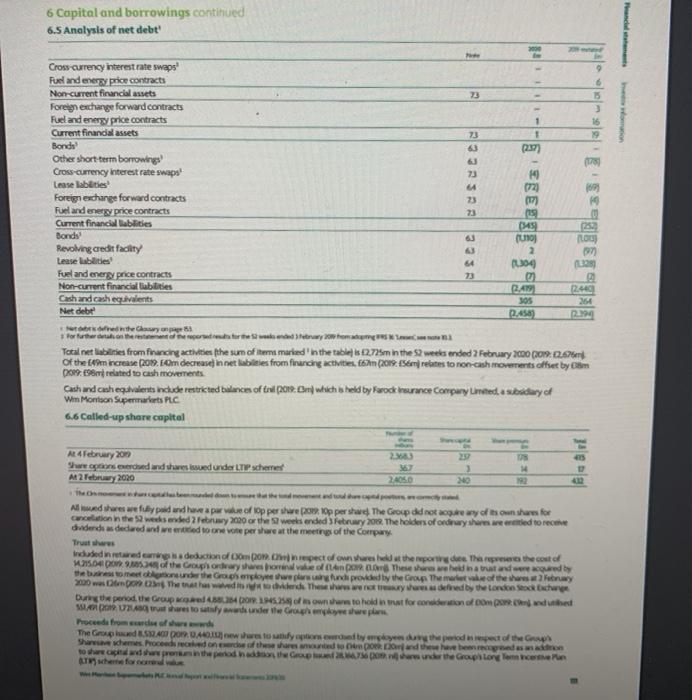

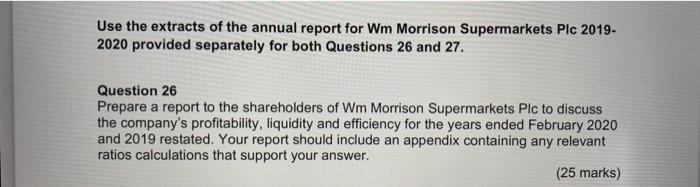

Use the extracts of the annual report for Wm Morrison Supermarkets Plc 2019- 2020 provided separately for both Questions 26 and 27. Question 26 Prepare a report to the shareholders of Wm Morrison Supermarkets Plc to discuss the company's profitability, liquidity and efficiency for the years ended February 2020 and 2019 restated. Your report should include an appendix containing any relevant ratios calculations that support your answer. (25 marks) 2019/20 quarterly Group LFL sales (exc. fuel) calmers 04. Q3 02 Basic earnings per share before exceptionals (pence) 2009 01 2015 285 2007 12:19 2010 101 2015/06 7.77 Restored for aplication of me Definition See the Glossary on page 153 for a definition 23 06 Investor women Definition See the Glory on page 133 fora delo * 2000/ Strong management succession plans Complementing the best colleagues in our shops, is a talented senior team We were delighted to strengthen the Board with the appointment of a third Executive Director Michael Gleeson, as Chief Financial Officer, Michaelis a chartered accountant and joined Morrisons in 2014, initially as Group Financial Controller and then Supermarkets Finance Director. For the last three years he has been Trading Director, latterly responsible for ambient grocery, frozen, dairy fuel and services. Both at Morrisons and before, he has a first class track record and extensive financial commercial and retail experience We were also delighted to promote Trevor Strwy already a proven business leader, to the new role of Chief Operating Officer Trever has been an Executive Director of Morrison since 2013 inay as Chief Financial Officer and, for more than a yew, as Group Chief Finance and Commercial Office in his new role, Trevor's responsibilities will include Commercial, manufacturing supply chain logoties, operation development online and wholesale The board and welcome both Michael and Theo to the new roles and with them every www in the future Together with changes to the Executive Committee that David describes, these important appointments are the result of a careful planning process that is bringing new generations of last through from within the Morrisons ranks. Continuity and management succession are vital parts of the tumaround and ones the Board will keep focusing on very dosely as the evolution of the senior Executive and Non-Executive team continues COVID-19 At the time of writing. In mid-March, there Is unprecedented challenge for our country with the COVID-19 pandem affecting almost everyone in the UK. The confidence in food supply is one of the key stabilling elements of a public health crisis and it is our duty to steer the Company through this period and support the country more widely. As a food make ourselves, much of our supply chain is in our own hands, and we are all worlog incredibly hard throughout Morrison to lep the shelves sted to keep store standardish and to serve our customers. Managing the business through the crisis, getting on the front foot doing our best work, building our resence and becoming even more central to the Cities we operate in wil help us beat this panderric together Andrew Hon Chale Governance highlights Board leadership and P31 Company purpose The Company's purpose, values and strategy are aligned to its culture The views of key stakeholders are considered in Board discussions and decision making Division of responsibilities p14 The Board comprises a majority of Non-Executive Directors There is an appropriate mixture of skills and experience on the Board Rooney Anand is the Senior Independent Director Tony van Kralingen is the Non- Executive Director designated to engage with colleagues on behalf of the Board Composition, Succession pis and Evaluation All Directors are subject to re-election at Our AGM The Internal Board effectiveness review found the Board to be effective, with a well balanced set of capabilities, experiences and expertise Audit, tisk & Internal Control The Audit Committee sed that the Group statutory auditor PwC, who were appointed 2011 are independent and performing effectively The Board is tied with the effectiveness of internal control and that is being managed effectively across the Group Remuneration The Board is able that remention pond practices support the way and promote PO Consolidated income statement 52 weeks ended 2 February 2020 here 14 im 12 17.735 1.735 17,536 (16,855 601 94 696 144) 17.536 (52) (16,907 (52) 629 94 66 66 1260) 21 692 88 04 16 62 Revenue Cost of sales Grow profit Other operating income Profit/ou on diposal and exit of properties Administrative expenses Operating profit France costs Pince income Shure of profit of joint venture fret of watery Profit before taxation Taxation Profit for the period attributable to the owners of the Company Earnings per stare pench) Basic Diluted 262) 50 (1) 5 1 408 104 114 510 120 5 19 24 1 as 1 50 23 1 101 (29 211 19.9 7 34 Bu 340 3 IS M.60 103 All of the results shown above relate to continuing operations Consolidated statement of comprehensive income 52 weeks ended 2 February 2020 231 82 23 les 8 193 Other comprehensive income/expense) Iterns that will not be reclassified to profit or los Remexsurement of defined benefit schemes Tax on defined benefit schemes Items that may be reclassified subsequently to profit or low Cash flow hedging movement Exchange differences on translation of foreign operations Tox on kes that may be refiend subsequently to profit or low Other comprehensive Income for the period, net of tux Profit for the period attributable to the owners of the Company Total comprehensive income for the period attributable to the owner of the Company 157 9 23 10 9 144 340 492 asialal 134 32 28 Assets Non current assets Goodwil and intable assets Property, plant and equipment Right-oute assets Investment property Retirement benefit surplus Investment in verture Trade and other receive Derivative francia 34 36 381 7. 90 50 960 39 72 104 7094 929 60 30 90 59 60 53 73 5 2:59 73 45 660 353 + sos UN 3 5 UO 35 Currentes Inventories Trade and other reces Derative financial Cash and catch equivalent Aset datafied as held forske Total Labies Current Trade and other pay Brown Lebi Derivative financial labies Cartas 10930 14 050 0227 21 0.00 07 1920 4 Non-current les Borowie seb Derwendenti Peberwendetin Deferred to be room 75 0 Tabs Shorty Share www Capital demption Mere COO Toy the owner the Cry 56 LOT 1104 (87) 806 977 020 29 e 9 2 34 9429 (89 M M6 On Cash flows from operating activities Cash generated from operations Interest paid Taxation paid Net cash Inflow from operating activities Cash flows from investing activities Interest received Dividends received from joint venture Proceeds from the disposal of property, plant and equipment, Investment property right-of-use assets and assets held for sale Purchase of property, plant and equipment, investment property and rightofuse assets Purchase of intangble assets Acquisition of business net of cash received) Net cash outflow from investing activities Cash flows from financing activities Purchase of trust stures Settlement of share awarck Proceeds from exercke of employee share options New borrowings Repayment of borrowings Costs incurred on repayment of borrowings Repayment of lease obligations Dividends pald Net cash outflow from financing activities Net increase/(decrease in cash and cash equivalents Cash and cash equivalents at start of period Cash and cash equivalents at end of period Reconciliation of net cash flow to movement in net debt" in the period 66 66 66 (10) 29 14 (178) 20 275 DOS 00 6 (27) 0302) 018 41 65 JOS M 301 270 Net incro/decrease in cash and cash equivalents Cash flow from increase in borrowings Debt acquired on acquisition of business Cash outflow from repayment of borrowings Cash outflow from repayment of lease liabilities Non-cash movements on lease boties Other non-cash movements Opening net dette Clasing net debt 7429881 19 1662 45 0.48 s Working capital and provisions continued 5.3 Trade and other receivables 4 7 28 DS 167 Commercial income trade receivables Accrued commercial income Other trade receivables Less provision for impairment of trade receivables Trade receivables Pepayments and accrued income Other recevables 195 206 116 31 350 17 4 for the ended overy from The carrying amounts of trade and other receivables approximates to the fair value at 2 February 2000 and 3 February 2012 ON Current period Expected credit low rate Gross carrying amount - trade receivables Provilon for impairment of trade receivables 22% 2 OON 15 SIN 1 JU 210 10 199 10 Prior period Expected credit loss rate SOON Gross carrying amount - trade receivables 2 Provision for pulment of trade receivables 19 19 As at 2 February 2010 and 3 February 2019. trade receivables that were either post de nor impared related to a number of debtors for whom there is no recent history of default. The other classes of receivables do not contan impaired amets. As at 5 March 2010, tom of the commercial income trade recewables balance had been settled and 20m of the Cole accrued commerc come balance had been worked and settled SA Trade and other poyables 140 trade payables Le corneral income offre against amounts owed Other taxes and social security payable Other payables Accruals and deferred come 2,467 21 2.446 so 416 3.051 10 100 06 ncluded with cod deferred income is Em 2009: Clin respect of deferred commercial income Amount accrued in relation to store restructuring activity we cluded within cousand deferred income Fury 2000 Asut 5 March 2020, Cm of the commercial income due above lad been offert payments made 6 Capital and borrowings continued 6.5 Analysis of net debt 2 Cross currency interest rate swaps 9 Fuel and energy price contracts 6 Non-current financial assets Foreign exchange forward contracts 3 Fuel and energy price contracts 16 Current financial assets 73 1 19 Bonds 63 (237) Other short-term borrowing! 63 17 Cross currency interest rate swaps! 73 19 Lease Babies 64 172) Foreign exchange forward contracts 23 (17) Fuel and energy price contracts Current financial abilities (345 Bonds (O) ro Revolving credit facility 2 Lease abities (304 Fuel and energy price contracts 0 Non-current financial abilities 24 2440 Cash and cash equivalents BOS 264 Net debt 2.45 12.90 thewy For further details on the worth www from Total net labies from facing activities the sum of the marked in the table is 2.775m in the S2 weeks ended ? February 2000 019.2.6% Of the Am increase (2019. Om decrease in net labies from firing activities. 66 (2019 Selates to non-cash movements offer by Cm 18. Em related to cash movements Cash and cash equivalents include restricted balance of Crd (2019. Cry which is held by Farock rewrance Company Limited a subdiary of Wim Montson Supermarkets PLC 6.6 Called-up share capital Ev. Isibaas: 3 o ulala o 63 64 es AL 4 February 2009 Sheeded and share issued under LTP scheme At 2 Feb 2020 2.4050 240 And there we fully paid und have a pure of op per shure 01. Op pershwe The Group did not gey of town for canction in the weekended Feb 2030 or the week ended February 2018. The holders of ordwysherited to rece dhedendas dedered and we nied to one e per set the meeting of the Company Truthers Indated neared is deduction of X (2018.pect of sweet the reported there the cost of 25.04 pow. of the Groups ordery one of these three tratadered by the best to meet under the Grouchergewe orange provided by the Group Thement of the the way 2000 wes on the that has to be there is sched by the London och Dung period the Grouped DO 1945.25 of owners to hold for considerion of computed 1. Uharesto nad under the Grohem The Groped ... por new here to pretendon the period spect of the Shares hemes. Proceedsrece de of the Weed to compor dhe have been redan to share and share Therefore Use the extracts of the annual report for Wm Morrison Supermarkets Plc 2019- 2020 provided separately for both Questions 26 and 27. Question 26 Prepare a report to the shareholders of Wm Morrison Supermarkets Plc to discuss the company's profitability, liquidity and efficiency for the years ended February 2020 and 2019 restated. Your report should include an appendix containing any relevant ratios calculations that support your answer. (25 marks) 2019/20 quarterly Group LFL sales (exc. fuel) calmers 04. Q3 02 Basic earnings per share before exceptionals (pence) 2009 01 2015 285 2007 12:19 2010 101 2015/06 7.77 Restored for aplication of me Definition See the Glossary on page 153 for a definition 23 06 Investor women Definition See the Glory on page 133 fora delo * 2000/ Strong management succession plans Complementing the best colleagues in our shops, is a talented senior team We were delighted to strengthen the Board with the appointment of a third Executive Director Michael Gleeson, as Chief Financial Officer, Michaelis a chartered accountant and joined Morrisons in 2014, initially as Group Financial Controller and then Supermarkets Finance Director. For the last three years he has been Trading Director, latterly responsible for ambient grocery, frozen, dairy fuel and services. Both at Morrisons and before, he has a first class track record and extensive financial commercial and retail experience We were also delighted to promote Trevor Strwy already a proven business leader, to the new role of Chief Operating Officer Trever has been an Executive Director of Morrison since 2013 inay as Chief Financial Officer and, for more than a yew, as Group Chief Finance and Commercial Office in his new role, Trevor's responsibilities will include Commercial, manufacturing supply chain logoties, operation development online and wholesale The board and welcome both Michael and Theo to the new roles and with them every www in the future Together with changes to the Executive Committee that David describes, these important appointments are the result of a careful planning process that is bringing new generations of last through from within the Morrisons ranks. Continuity and management succession are vital parts of the tumaround and ones the Board will keep focusing on very dosely as the evolution of the senior Executive and Non-Executive team continues COVID-19 At the time of writing. In mid-March, there Is unprecedented challenge for our country with the COVID-19 pandem affecting almost everyone in the UK. The confidence in food supply is one of the key stabilling elements of a public health crisis and it is our duty to steer the Company through this period and support the country more widely. As a food make ourselves, much of our supply chain is in our own hands, and we are all worlog incredibly hard throughout Morrison to lep the shelves sted to keep store standardish and to serve our customers. Managing the business through the crisis, getting on the front foot doing our best work, building our resence and becoming even more central to the Cities we operate in wil help us beat this panderric together Andrew Hon Chale Governance highlights Board leadership and P31 Company purpose The Company's purpose, values and strategy are aligned to its culture The views of key stakeholders are considered in Board discussions and decision making Division of responsibilities p14 The Board comprises a majority of Non-Executive Directors There is an appropriate mixture of skills and experience on the Board Rooney Anand is the Senior Independent Director Tony van Kralingen is the Non- Executive Director designated to engage with colleagues on behalf of the Board Composition, Succession pis and Evaluation All Directors are subject to re-election at Our AGM The Internal Board effectiveness review found the Board to be effective, with a well balanced set of capabilities, experiences and expertise Audit, tisk & Internal Control The Audit Committee sed that the Group statutory auditor PwC, who were appointed 2011 are independent and performing effectively The Board is tied with the effectiveness of internal control and that is being managed effectively across the Group Remuneration The Board is able that remention pond practices support the way and promote PO Consolidated income statement 52 weeks ended 2 February 2020 here 14 im 12 17.735 1.735 17,536 (16,855 601 94 696 144) 17.536 (52) (16,907 (52) 629 94 66 66 1260) 21 692 88 04 16 62 Revenue Cost of sales Grow profit Other operating income Profit/ou on diposal and exit of properties Administrative expenses Operating profit France costs Pince income Shure of profit of joint venture fret of watery Profit before taxation Taxation Profit for the period attributable to the owners of the Company Earnings per stare pench) Basic Diluted 262) 50 (1) 5 1 408 104 114 510 120 5 19 24 1 as 1 50 23 1 101 (29 211 19.9 7 34 Bu 340 3 IS M.60 103 All of the results shown above relate to continuing operations Consolidated statement of comprehensive income 52 weeks ended 2 February 2020 231 82 23 les 8 193 Other comprehensive income/expense) Iterns that will not be reclassified to profit or los Remexsurement of defined benefit schemes Tax on defined benefit schemes Items that may be reclassified subsequently to profit or low Cash flow hedging movement Exchange differences on translation of foreign operations Tox on kes that may be refiend subsequently to profit or low Other comprehensive Income for the period, net of tux Profit for the period attributable to the owners of the Company Total comprehensive income for the period attributable to the owner of the Company 157 9 23 10 9 144 340 492 asialal 134 32 28 Assets Non current assets Goodwil and intable assets Property, plant and equipment Right-oute assets Investment property Retirement benefit surplus Investment in verture Trade and other receive Derivative francia 34 36 381 7. 90 50 960 39 72 104 7094 929 60 30 90 59 60 53 73 5 2:59 73 45 660 353 + sos UN 3 5 UO 35 Currentes Inventories Trade and other reces Derative financial Cash and catch equivalent Aset datafied as held forske Total Labies Current Trade and other pay Brown Lebi Derivative financial labies Cartas 10930 14 050 0227 21 0.00 07 1920 4 Non-current les Borowie seb Derwendenti Peberwendetin Deferred to be room 75 0 Tabs Shorty Share www Capital demption Mere COO Toy the owner the Cry 56 LOT 1104 (87) 806 977 020 29 e 9 2 34 9429 (89 M M6 On Cash flows from operating activities Cash generated from operations Interest paid Taxation paid Net cash Inflow from operating activities Cash flows from investing activities Interest received Dividends received from joint venture Proceeds from the disposal of property, plant and equipment, Investment property right-of-use assets and assets held for sale Purchase of property, plant and equipment, investment property and rightofuse assets Purchase of intangble assets Acquisition of business net of cash received) Net cash outflow from investing activities Cash flows from financing activities Purchase of trust stures Settlement of share awarck Proceeds from exercke of employee share options New borrowings Repayment of borrowings Costs incurred on repayment of borrowings Repayment of lease obligations Dividends pald Net cash outflow from financing activities Net increase/(decrease in cash and cash equivalents Cash and cash equivalents at start of period Cash and cash equivalents at end of period Reconciliation of net cash flow to movement in net debt" in the period 66 66 66 (10) 29 14 (178) 20 275 DOS 00 6 (27) 0302) 018 41 65 JOS M 301 270 Net incro/decrease in cash and cash equivalents Cash flow from increase in borrowings Debt acquired on acquisition of business Cash outflow from repayment of borrowings Cash outflow from repayment of lease liabilities Non-cash movements on lease boties Other non-cash movements Opening net dette Clasing net debt 7429881 19 1662 45 0.48 s Working capital and provisions continued 5.3 Trade and other receivables 4 7 28 DS 167 Commercial income trade receivables Accrued commercial income Other trade receivables Less provision for impairment of trade receivables Trade receivables Pepayments and accrued income Other recevables 195 206 116 31 350 17 4 for the ended overy from The carrying amounts of trade and other receivables approximates to the fair value at 2 February 2000 and 3 February 2012 ON Current period Expected credit low rate Gross carrying amount - trade receivables Provilon for impairment of trade receivables 22% 2 OON 15 SIN 1 JU 210 10 199 10 Prior period Expected credit loss rate SOON Gross carrying amount - trade receivables 2 Provision for pulment of trade receivables 19 19 As at 2 February 2010 and 3 February 2019. trade receivables that were either post de nor impared related to a number of debtors for whom there is no recent history of default. The other classes of receivables do not contan impaired amets. As at 5 March 2010, tom of the commercial income trade recewables balance had been settled and 20m of the Cole accrued commerc come balance had been worked and settled SA Trade and other poyables 140 trade payables Le corneral income offre against amounts owed Other taxes and social security payable Other payables Accruals and deferred come 2,467 21 2.446 so 416 3.051 10 100 06 ncluded with cod deferred income is Em 2009: Clin respect of deferred commercial income Amount accrued in relation to store restructuring activity we cluded within cousand deferred income Fury 2000 Asut 5 March 2020, Cm of the commercial income due above lad been offert payments made 6 Capital and borrowings continued 6.5 Analysis of net debt 2 Cross currency interest rate swaps 9 Fuel and energy price contracts 6 Non-current financial assets Foreign exchange forward contracts 3 Fuel and energy price contracts 16 Current financial assets 73 1 19 Bonds 63 (237) Other short-term borrowing! 63 17 Cross currency interest rate swaps! 73 19 Lease Babies 64 172) Foreign exchange forward contracts 23 (17) Fuel and energy price contracts Current financial abilities (345 Bonds (O) ro Revolving credit facility 2 Lease abities (304 Fuel and energy price contracts 0 Non-current financial abilities 24 2440 Cash and cash equivalents BOS 264 Net debt 2.45 12.90 thewy For further details on the worth www from Total net labies from facing activities the sum of the marked in the table is 2.775m in the S2 weeks ended ? February 2000 019.2.6% Of the Am increase (2019. Om decrease in net labies from firing activities. 66 (2019 Selates to non-cash movements offer by Cm 18. Em related to cash movements Cash and cash equivalents include restricted balance of Crd (2019. Cry which is held by Farock rewrance Company Limited a subdiary of Wim Montson Supermarkets PLC 6.6 Called-up share capital Ev. Isibaas: 3 o ulala o 63 64 es AL 4 February 2009 Sheeded and share issued under LTP scheme At 2 Feb 2020 2.4050 240 And there we fully paid und have a pure of op per shure 01. Op pershwe The Group did not gey of town for canction in the weekended Feb 2030 or the week ended February 2018. The holders of ordwysherited to rece dhedendas dedered and we nied to one e per set the meeting of the Company Truthers Indated neared is deduction of X (2018.pect of sweet the reported there the cost of 25.04 pow. of the Groups ordery one of these three tratadered by the best to meet under the Grouchergewe orange provided by the Group Thement of the the way 2000 wes on the that has to be there is sched by the London och Dung period the Grouped DO 1945.25 of owners to hold for considerion of computed 1. Uharesto nad under the Grohem The Groped ... por new here to pretendon the period spect of the Shares hemes. Proceedsrece de of the Weed to compor dhe have been redan to share and share Therefore

extra info that you might need to know

extra info that you might need to know