Question

Extract A-Recession and depreciation of the roubleIn 2015 and the first half of 2016, the Russian economy has been in a deep and painful recession

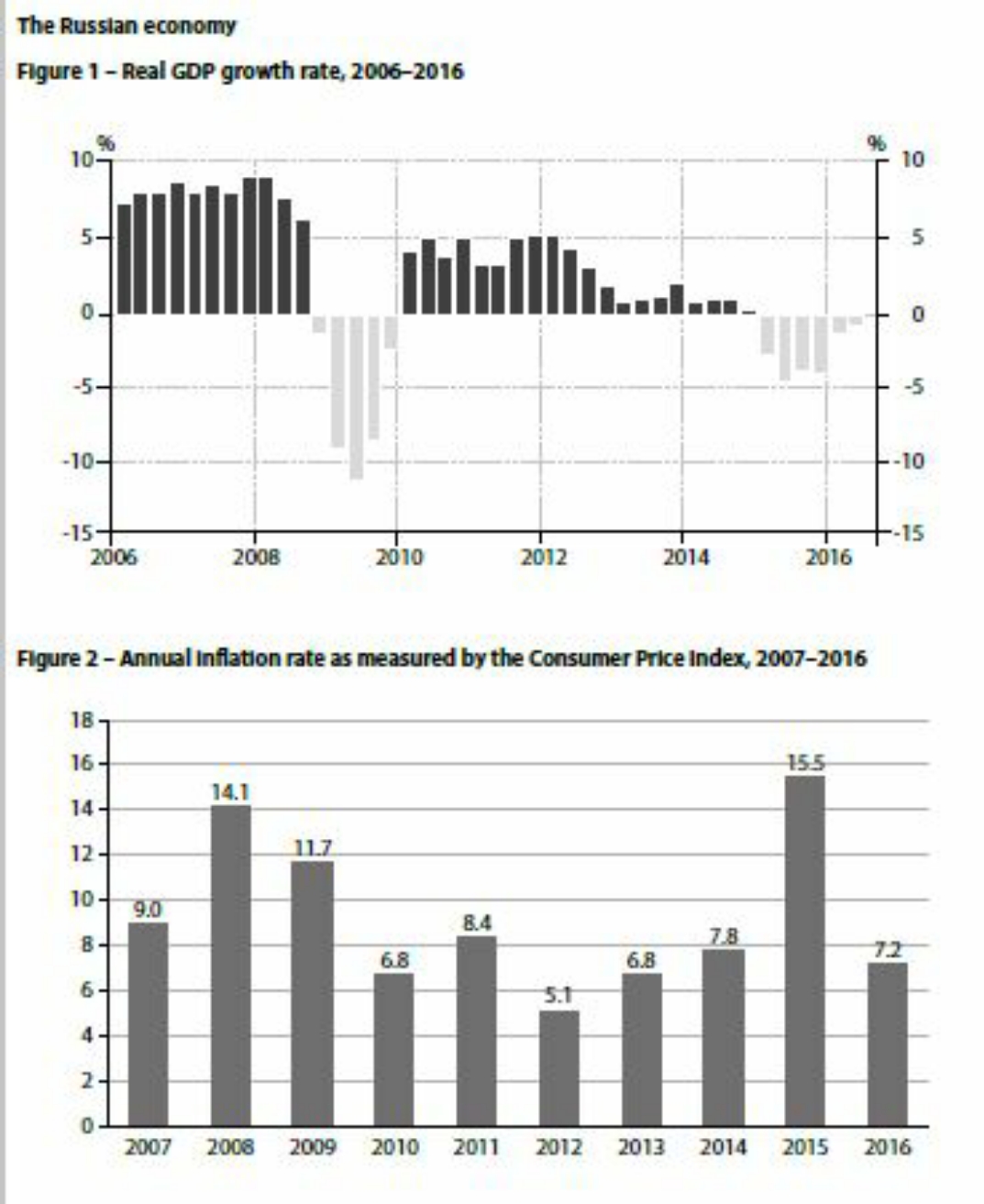

Extract A-Recession and depreciation of the roubleIn 2015 and the first half of 2016, the Russian economy has been in a deep and painful recession although the pace of economic decline is slowing. Real GDP fell by 1.2% in the first quarter of 2016, following a 3.7% fall in 2015. Russia has suffered from a combination of low oil prices and economic sanctions. The low oil prices have resulted in reduced export earnings. Further, the sanctions imposed on Russia over its role in the crisis inUkraine have severely reduced foreign direct investment (FDI) into the country. Sanctions have also made it harder for Russian firms to obtain finance from Europe and America.The Russian currency, the rouble, depreciated sharply against the dollar in 2015 and by a further 5.8% in the first eight months of 2016. This caused an increase in the rate of inflation in 2015, while nominal earnings only rose by 6.8%. A Russian ban on most food imports from Europe and America pushed prices even higher. As a result of this, millions of Russians have fallen into poverty since 2014.The rouble depreciation benefited the tradable sectors of the economy, such as agriculture, chemicals, leather, and rubber production. Worsening terms of trade in the first half of 2016 resulted in a reduction in the current account surplus to 3.06 of GDP from 7.1% of GDP in the same period in 2015).Extract B Dependence on oil and natural gasRussia is the world's largest producer of crude oil and the second-largest producer of natural gas. They contribute more than 40% of Russia's tax revenues.Russia's economic growth is very dependent on energy exports, making up 70% of its export earnings. Russia and Europe are interdependent in terms of energy. The EuropeanUnion obtains around 30% of its oil and gas from Russia. Russia is dependent on Europe as the biggest market for its oil and natural gas.The Russian Government offered special tax incentives to energy companies prepared to invest in regions such as the Arctic Ocean that are difficult to exploit. Despite sanctions announced in March 2014, the transnational energy company Total agreed to develop energy resources in partnership with Lukoil, Russia's largest oil company. However, Total stopped its involvement in September 2014, when additional sanctions were announced.Indeed, virtually all involvement in Russian energy projects by European and American companies has ceased following the sanctions. Questions to be answered :-(a) With reference to Figure 2 and Extract A, calculate the change in real earnings in 2015. You are advised to show your working.. (b) Explain what is meant by the phrase 'worsening terms of trade' (Extract A, line 15). (c) With reference to the information provided, examine the likely impact of a fall in foreign direct investment on Russia's balance of payments accounts. (d) With reference to Extract A, analyse the likely effect of the recession on income inequality in Russia. IIlustrate your answer with a Lorenz curve diagram. (e) With reference to the information provided, discuss the problems of the dependence on oil and natural gas for the Russian economy.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started