Answered step by step

Verified Expert Solution

Question

1 Approved Answer

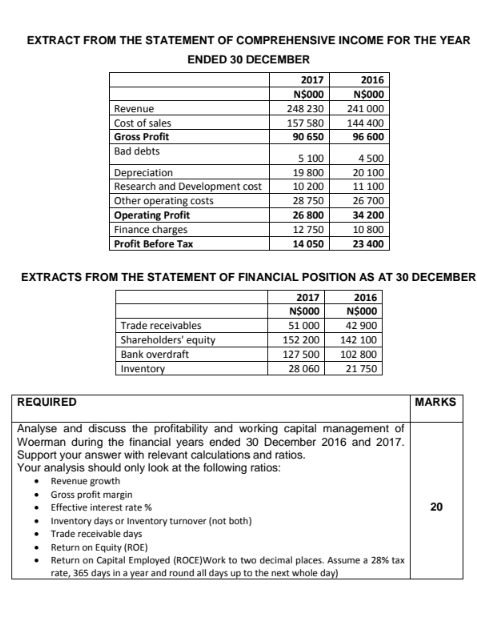

EXTRACT FROM THE STATEMENT OF COMPREHENSIVE INCOME FOR THE YEAR ENDED 30 DECEMBER 2017 2016 N$000 N$000 Revenue 248 230 241 000 Cost of sales

EXTRACT FROM THE STATEMENT OF COMPREHENSIVE INCOME FOR THE YEAR ENDED 30 DECEMBER 2017 2016 N$000 N$000 Revenue 248 230 241 000 Cost of sales 157 580 144 400 Gross Profit 90 650 96 600 Bad debts 5 100 4 500 Depreciation 19 800 20 100 Research and Development cost 10 200 11 100 28 750 26 700 Other operating costs Operating Profit Finance charges 26 800 34 200 12 750 10 800 Profit Before Tax 14 050 23 400 EXTRACTS FROM THE STATEMENT OF FINANCIAL POSITION AS AT 30 DECEMBER 2017 2016 N$000 N$000 Trade receivables 51 000 42 900 Shareholders' equity 152 200 142 100 127 500 102 800 Bank overdraft Inventory 28 060 21 750 REQUIRED MARKS Analyse and discuss the profitability and working capital management of Woerman during the financial years ended 30 December 2016 and 2017. Support your answer with relevant calculations and ratios. Your analysis should only look at the following ratios: Revenue growth Gross profit margin Effective interest rate % 20 Inventory days or Inventory turnover (not both) Trade receivable days Return on Equity (ROE) Return on Capital Employed (ROCE)Work to two decimal places. Assume a 28% tax rate, 365 days in a year and round all days up to the next whole day)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started