Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Extract: Should you ditch your fixed rate mortgage early to avoid mortgage prison? By Lucy Dean Australian Financial Review 10 March 2023 Assume a

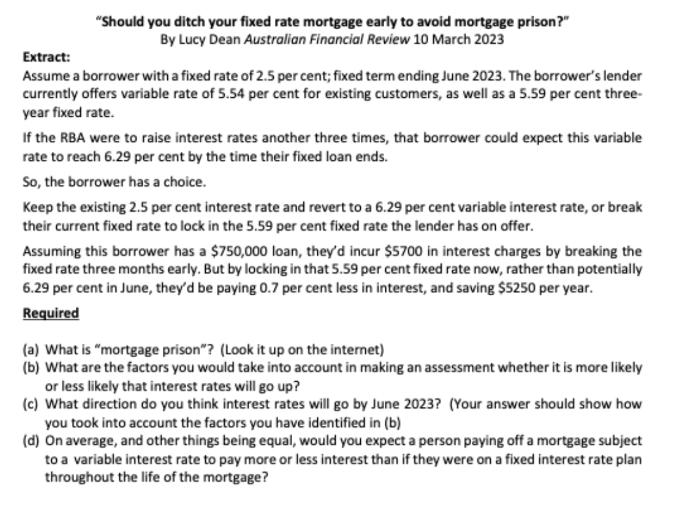

Extract: "Should you ditch your fixed rate mortgage early to avoid mortgage prison?" By Lucy Dean Australian Financial Review 10 March 2023 Assume a borrower with a fixed rate of 2.5 per cent; fixed term ending June 2023. The borrower's lender currently offers variable rate of 5.54 per cent for existing customers, as well as a 5.59 per cent three- year fixed rate. If the RBA were to raise interest rates another three times, that borrower could expect this variable rate to reach 6.29 per cent by the time their fixed loan ends. So, the borrower has a choice. Keep the existing 2.5 per cent interest rate and revert to a 6.29 per cent variable interest rate, or break their current fixed rate to lock in the 5.59 per cent fixed rate the lender has on offer. Assuming this borrower has a $750,000 loan, they'd incur $5700 in interest charges by breaking the fixed rate three months early. But by locking in that 5.59 per cent fixed rate now, rather than potentially 6.29 per cent in June, they'd be paying 0.7 per cent less in interest, and saving $5250 per year. Required (a) What is "mortgage prison"? (Look it up on the internet) (b) What are the factors you would take into account in making an assessment whether it is more likely or less likely that interest rates will go up? (c) What direction do you think interest rates will go by June 2023? (Your answer should show how you took into account the factors you have identified in (b) (d) On average, and other things being equal, would you expect a person paying off a mortgage subject to a variable interest rate to pay more or less interest than if they were on a fixed interest rate plan throughout the life of the mortgage?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer a Mortgage prison refers to a situation where a borrower feels trapped or constrained by the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started