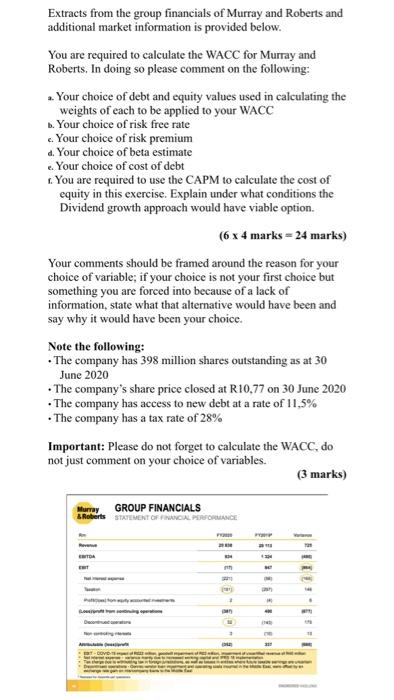

Extracts from the group financials of Murray and Roberts and additional market information is provided below. You are required to calculate the WACC for Murray and Roberts. In doing so please comment on the following: .. Your choice of debt and equity values used in calculating the weights of each to be applied to your WACC . Your choice of risk free rate c. Your choice of risk premium d. Your choice of beta estimate . Your choice of cost of debt 1. You are required to use the CAPM to calculate the cost of equity in this exercise. Explain under what conditions the Dividend growth approach would have viable option. (6 x 4 marks = 24 marks) Your comments should be framed around the reason for your choice of variable: if your choice is not your first choice but something you are forced into because of a lack of information, state what that alternative would have been and say why it would have been your choice. Note the following: The company has 398 million shares outstanding as at 30 June 2020 The company's share price closed at R10,77 on 30 June 2020 . The company has access to new debt at a rate of 11,5% The company has a tax rate of 28% Important: Please do not forget to calculate the WACC, do not just comment on your choice of variables. (3 marks) GROUP FINANCIALS Roberts STATEMENT OFFICIAL PERFORMANCE + Extracts from the group financials of Murray and Roberts and additional market information is provided below. You are required to calculate the WACC for Murray and Roberts. In doing so please comment on the following: .. Your choice of debt and equity values used in calculating the weights of each to be applied to your WACC . Your choice of risk free rate c. Your choice of risk premium d. Your choice of beta estimate . Your choice of cost of debt 1. You are required to use the CAPM to calculate the cost of equity in this exercise. Explain under what conditions the Dividend growth approach would have viable option. (6 x 4 marks = 24 marks) Your comments should be framed around the reason for your choice of variable: if your choice is not your first choice but something you are forced into because of a lack of information, state what that alternative would have been and say why it would have been your choice. Note the following: The company has 398 million shares outstanding as at 30 June 2020 The company's share price closed at R10,77 on 30 June 2020 . The company has access to new debt at a rate of 11,5% The company has a tax rate of 28% Important: Please do not forget to calculate the WACC, do not just comment on your choice of variables. (3 marks) GROUP FINANCIALS Roberts STATEMENT OFFICIAL PERFORMANCE +