Answered step by step

Verified Expert Solution

Question

1 Approved Answer

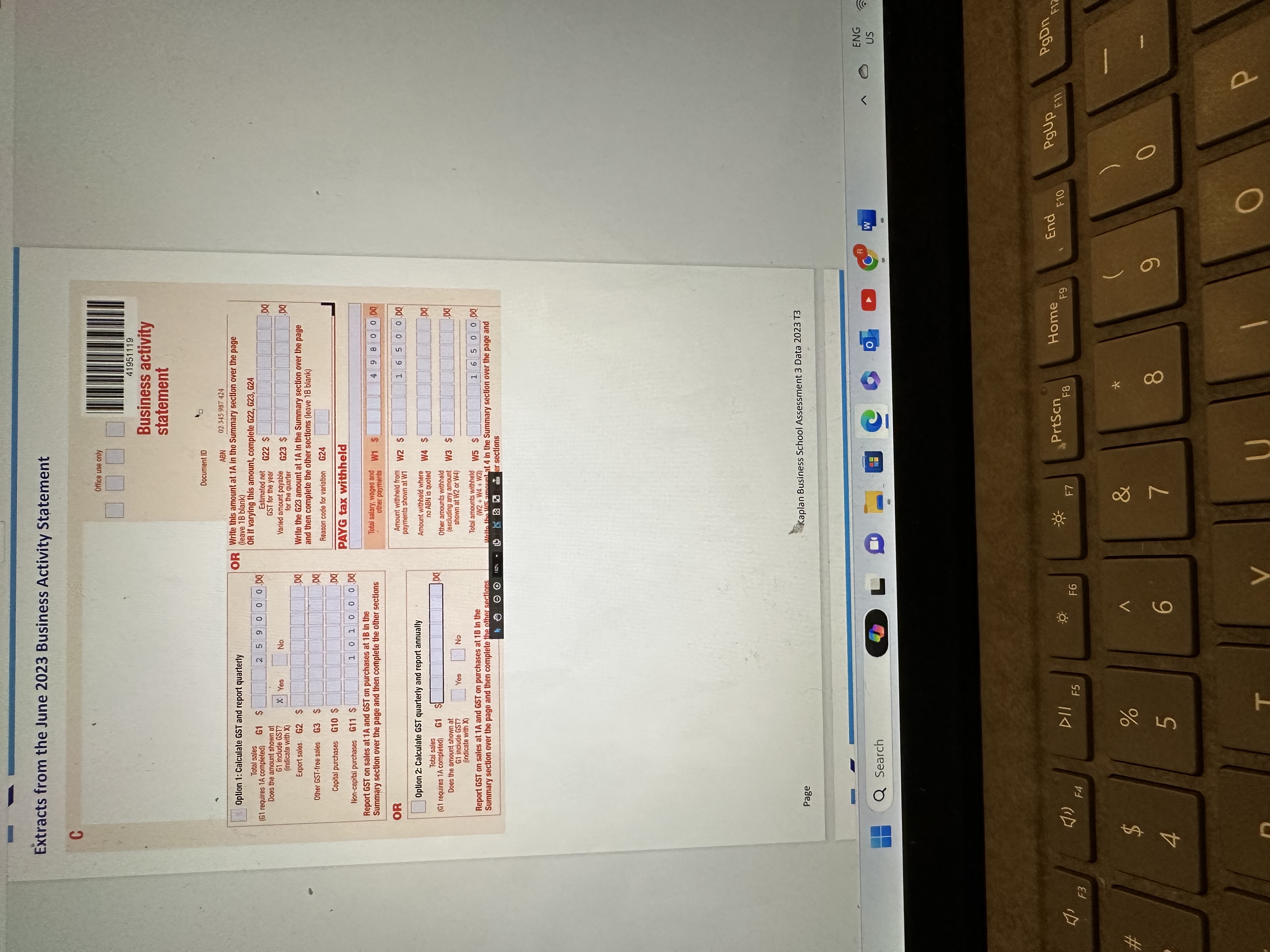

Extracts from the June 2023 Business Activity Statement C Option 1: Calculate GST and report quarterly Total sales (G1 requires 1A completed) G1 $

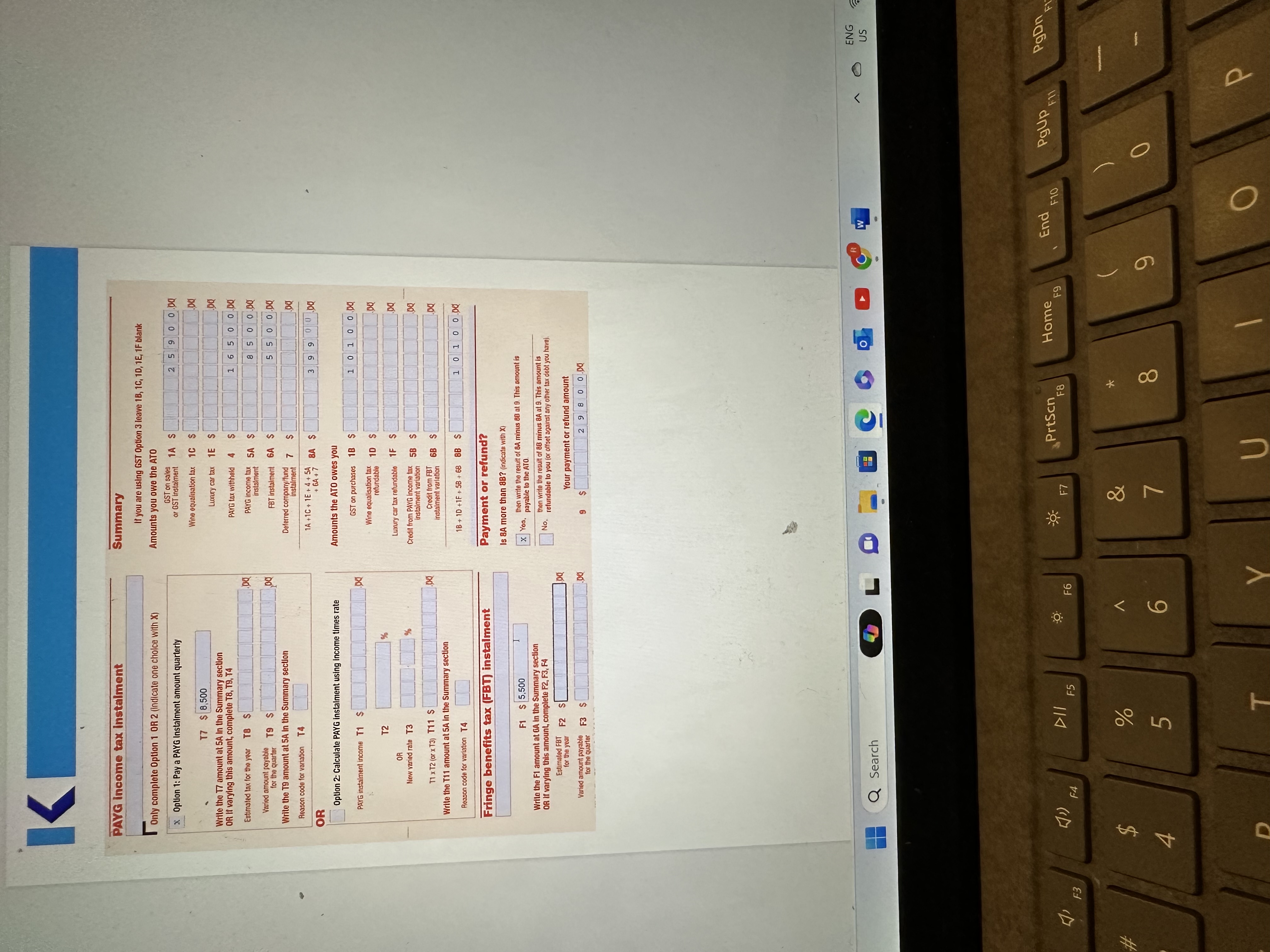

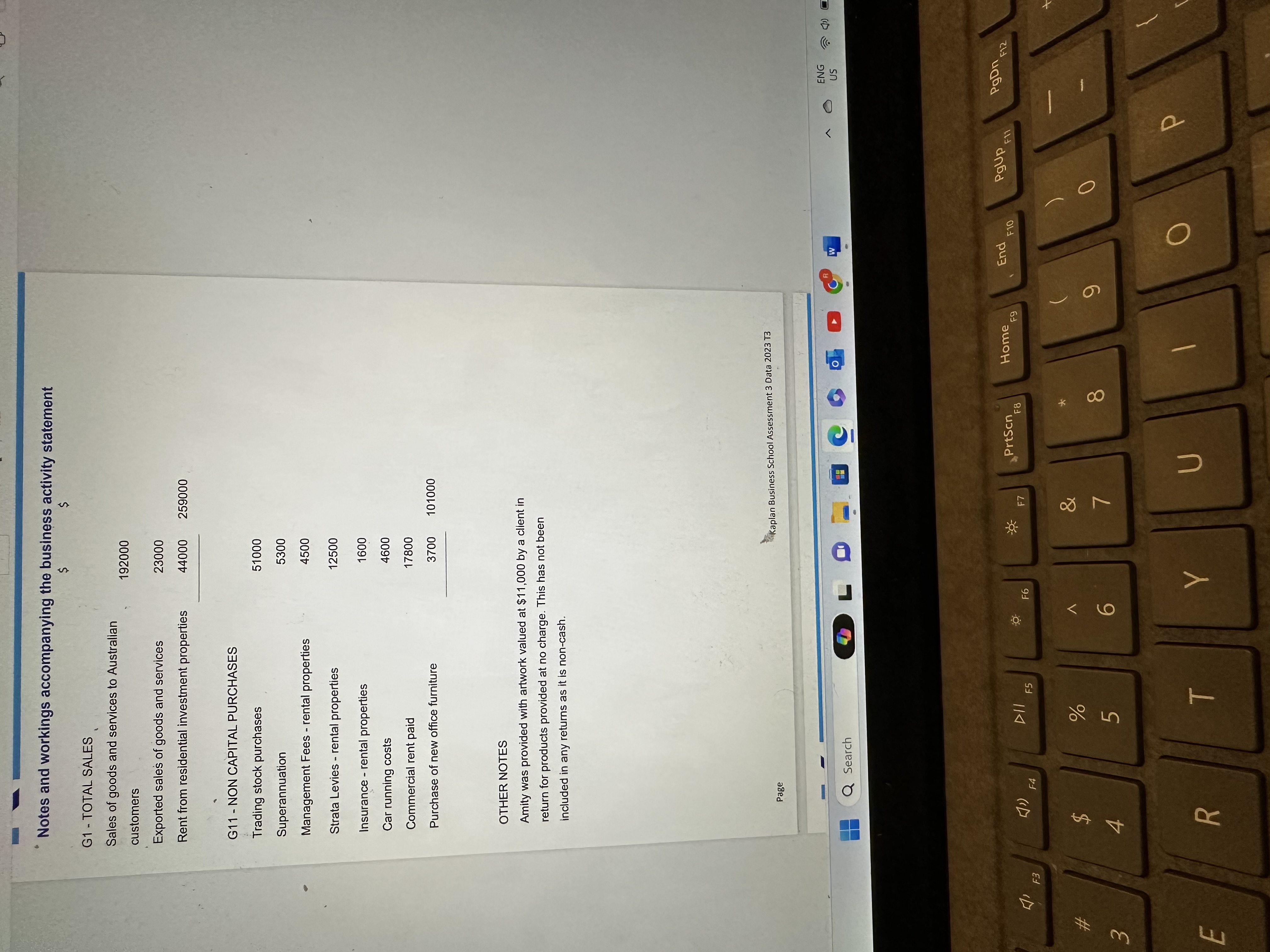

Extracts from the June 2023 Business Activity Statement C Option 1: Calculate GST and report quarterly Total sales (G1 requires 1A completed) G1 $ 2 5 90 Does the amount shown at G1 indude GST? X Yos No HC 0.00 (indicate with X) Export sales G2 $ Other GST-free sales G3 $ Copital purchases G10 $ Non-capital purchases G11 $ .00 .00 mmm38 Da 1 0 1 0 0 0.00 Report GST on sales at 1A and GST on purchases at 1B in the Summary section over the page and then complete the other sections OR Option 2: Calculate GST quarterly and report annually Office use only 41951119 Business activity statement Document ID ABN 02 345 987 424 OR Write this amount at 1A in the Summary section over the page (leave 1B blank) OR if varying this amount, complete G22, G23, G24 Total sales (01 requires 1A completed) G1 $ .00 Does the amount shown at G1 include GST? Yos No (indicate with X) Report GST on sales at 1A and GST on purchases at 1B in the Summary section over the page and then complete the other sections Page Q Search F3 F4 DII F5 $ 4 % 5 C H L 96 Estimated net G22 $ GST for the year Varied amount payable G23 $ for the quarter Write the G23 amount at 1A In the Summary section over the page and then complete the other sections (leave 18 blank) Reason code for variation G24 PAYG tax withheld pa pa Total salary, wages and other payments W1 S 49 8 0 0.00 Amount withheld from payments shown at W1 W2 $ 1 6 5 00.00 Amount withhold where no ABN is quoted Other amounts withheld (excluding any amount W3 $ shown at W2 or W4) W4 $ 00 .00 Total amounts withheld W5 $ 1 65 0 0.00 (W2+ W4+ W3) Walte the WS amount at 4 in the Summary section over the page and er sections Kaplan Business School Assessment 3 Data 2023 T3 ENG W US PrtScn Home End PgUp PgDn F6 F7 F8 F9 F10 F11 & 7 8* 9 0 F12 F3 K PAYG income tax instalment Only complete Option 1 OR 2 (indicate one choice with X) x Option 1: Pay a PAYG Instalment amount quarterly T7 $8,500 Write the T7 amount at 5A In the Summary section OR If varying this amount, complete T8, T9, T4 Estimated tax for the year T8 $ Varied amount payable T9 $ for the quarter Write the T9 amount at 5A In the Summary section Reason code for variation T4 OR Option 2: Calculate PAYG instalment using income times rate Summary If you are using GST Option 3 leave 1B, 1C, 1D, 1E, 1F blank Amounts you owe the ATO OST on sales or GST instalment 1A S 259 0 0.00 Wine equalisation tax 1C $ Da Luorury car tax 1E S .DQ S 1 65 0 000 00 pa gg PAYG tax withheld 4 PAYG income tax 5A $ instalment FBT instalment GA $ 8 500.00 5 5 0 0.00 Deferred company/fund $ instalment 1A+1C + 1E+4+5A + GA + 7 BA $ 399 00 DQ Amounts the ATO owes you PAYG instalment income T1 $ T2 OR Now varied rate T3 T1 x T2 (or x T3) T11 S Write the T11 amount at SA in the Summary section Reason code for variation T4 DA refundable GST on purchases 1B $ Wine equalisation tax 1D S 1 0 1 0 0.00 .00 % % Luxury car tax refundable 1F S Credit from PAYG income tax DQ 5B $ DQ instalment variation .00 g Creart from FBT instalment variation 6B $ 00 1B+1D+1F5B+ 68 8B S 1 0 1 0 0.00 Fringe benefits tax (FBT) instalment F1 $ 5,500 Write the F1 amount at 6A in the Summary section OR If varying this amount, complete F2, F3, F4 Estimated FBT F2 S for the year .00 Payment or refund? Is 8A more than 8B? (indicate with X) X Yos, No. then write the result of 8A minus 88 at 9. This amount is payable to the ATO. then write the result of 88 minus 8A at 9. This amount is refundable to you (or offset against any other tax debt you have). Your payment or refund amount Varied amount payable F3 $ for the quarter Search F4 DII F5 $ 4 5 do T > 6 .00 9 $ 2980 0.00 R ENG W US PrtScn Home End PgUp F6 F7 F8 F9 F10 29 & Y U 8 9 0 O F11 PgDn P FL 3 # Notes and workings accompanying the business activity statement $ $ G1 TOTAL SALES Sales of goods and services to Australian 192000 customers Exported sales of goods and services 23000 Rent from residential investment properties 44000 259000 G11-NON CAPITAL PURCHASES Trading stock purchases 51000 Superannuation 5300 Management Fees - rental properties 4500 Strata Levies - rental properties 12500 Insurance - rental properties 1600 Car running costs 4600 Commercial rent paid 17800 Purchase of new office furniture 3700 101000 OTHER NOTES Amity was provided with artwork valued at $11,000 by a client in return for products provided at no charge. This has not been included in any returns as it is non-cash. Page F4 F3 67 Search L DII F5 55 % Kaplan Business School Assessment 3 Data 2023 T3 R ENG W US -X- PrtScn Home End PgUp PgDn F6 F7 F8 F9 F10 F11 F12 96 E R T Y 7 U 8 9 O P -

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started